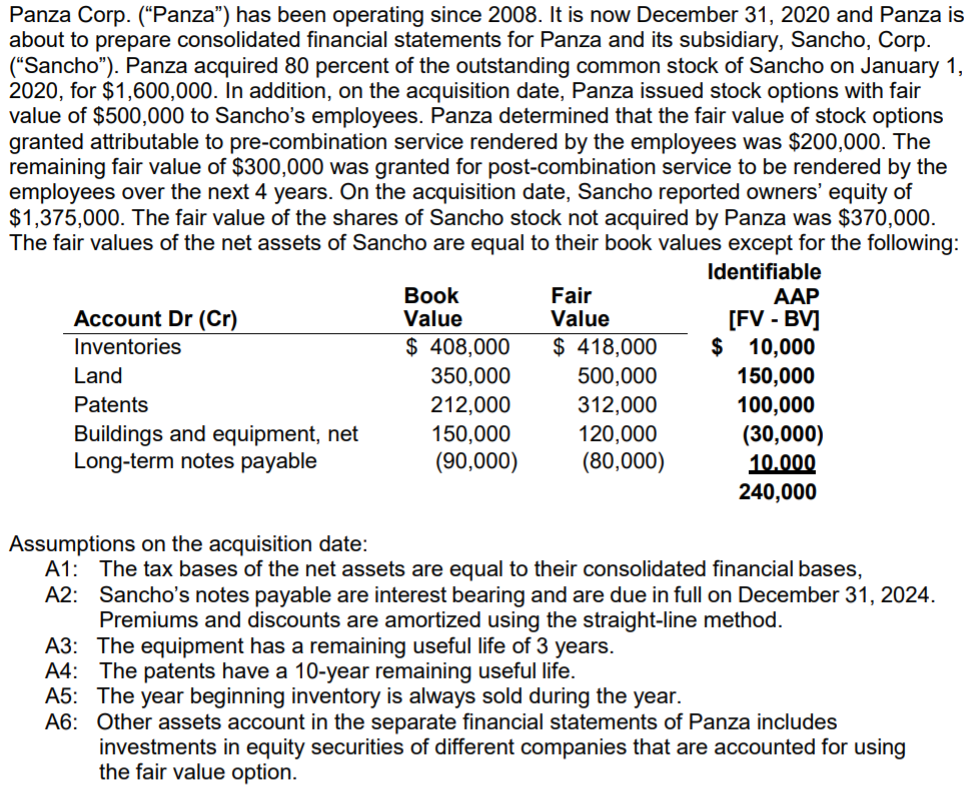

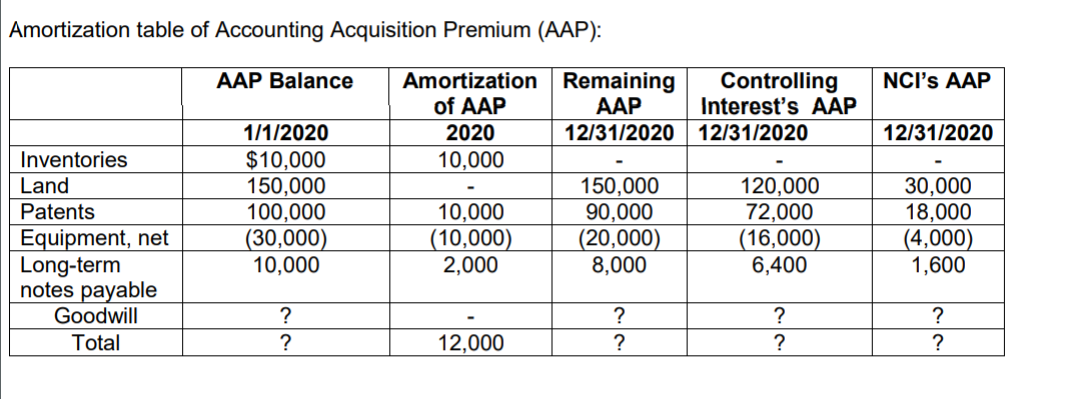

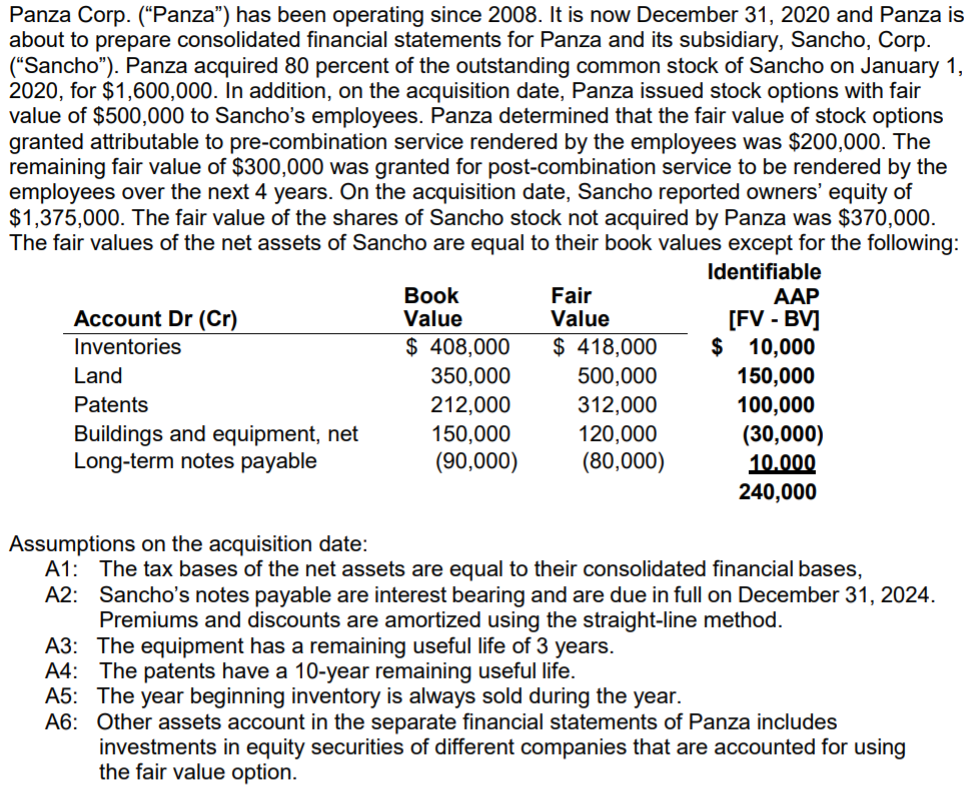

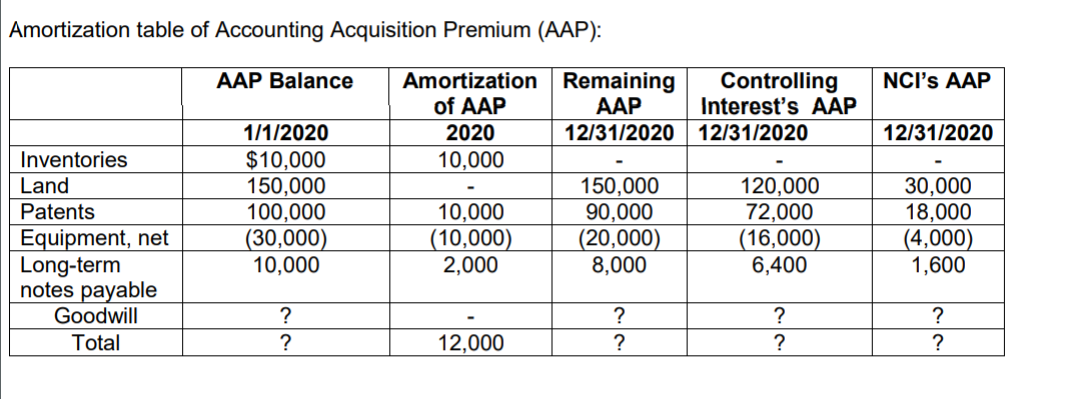

Panza Corp. ("Panza") has been operating since 2008. It is now December 31, 2020 and Panza is about to prepare consolidated financial statements for Panza and its subsidiary, Sancho, Corp. ("Sancho"). Panza acquired 80 percent of the outstanding common stock of Sancho on January 1, 2020, for $1,600,000. In addition, on the acquisition date, Panza issued stock options with fair value of $500,000 to Sancho's employees. Panza determined that the fair value of stock options granted attributable to pre-combination service rendered by the employees was $200,000. The remaining fair value of $300,000 was granted for post-combination service to be rendered by the employees over the next 4 years. On the acquisition date, Sancho reported owners' equity of $1,375,000. The fair value of the shares of Sancho stock not acquired by Panza was $370,000. The fair values of the net assets of Sancho are equal to their book values except for the following: Identifiable Book Fair AAP Account Dr (Cr) Value Value [FV - BV] Inventories $ 408,000 $ 418,000 $ 10,000 Land 350,000 500,000 150,000 Patents 212,000 312,000 100,000 Buildings and equipment, net 150,000 120,000 (30,000) Long-term notes payable (90,000) (80,000) 10.000 240,000 Assumptions on the acquisition date: A1: The tax bases of the net assets are equal to their consolidated financial bases, A2: Sancho's notes payable are interest bearing and are due in full on December 31, 2024. Premiums and discounts are amortized using the straight-line method. A3: The equipment has a remaining useful life of 3 years. A4: The patents have a 10-year remaining useful life. A5: The year beginning inventory is always sold during the year. A6: Other assets account in the separate financial statements of Panza includes investments in equity securities of different companies that are accounted for using the fair value option. Amortization table of Accounting Acquisition Premium (AAP): AAP Balance NCI's AAP 12/31/2020 Inventories Land Patents Equipment, net Long-term notes payable Goodwill Total 1/1/2020 $10,000 150,000 100,000 (30,000) 10,000 Amortization Remaining Controlling of AAP Interest's AAP 2020 12/31/2020 12/31/2020 10,000 150,000 120,000 10,000 90,000 72,000 (10,000) (20,000) (16,000) 2,000 8,000 6,400 30,000 18,000 (4,000) 1,600 ? ? ? ? ? ? ? ? 12,000 Panza Corp. ("Panza") has been operating since 2008. It is now December 31, 2020 and Panza is about to prepare consolidated financial statements for Panza and its subsidiary, Sancho, Corp. ("Sancho"). Panza acquired 80 percent of the outstanding common stock of Sancho on January 1, 2020, for $1,600,000. In addition, on the acquisition date, Panza issued stock options with fair value of $500,000 to Sancho's employees. Panza determined that the fair value of stock options granted attributable to pre-combination service rendered by the employees was $200,000. The remaining fair value of $300,000 was granted for post-combination service to be rendered by the employees over the next 4 years. On the acquisition date, Sancho reported owners' equity of $1,375,000. The fair value of the shares of Sancho stock not acquired by Panza was $370,000. The fair values of the net assets of Sancho are equal to their book values except for the following: Identifiable Book Fair AAP Account Dr (Cr) Value Value [FV - BV] Inventories $ 408,000 $ 418,000 $ 10,000 Land 350,000 500,000 150,000 Patents 212,000 312,000 100,000 Buildings and equipment, net 150,000 120,000 (30,000) Long-term notes payable (90,000) (80,000) 10.000 240,000 Assumptions on the acquisition date: A1: The tax bases of the net assets are equal to their consolidated financial bases, A2: Sancho's notes payable are interest bearing and are due in full on December 31, 2024. Premiums and discounts are amortized using the straight-line method. A3: The equipment has a remaining useful life of 3 years. A4: The patents have a 10-year remaining useful life. A5: The year beginning inventory is always sold during the year. A6: Other assets account in the separate financial statements of Panza includes investments in equity securities of different companies that are accounted for using the fair value option. Amortization table of Accounting Acquisition Premium (AAP): AAP Balance NCI's AAP 12/31/2020 Inventories Land Patents Equipment, net Long-term notes payable Goodwill Total 1/1/2020 $10,000 150,000 100,000 (30,000) 10,000 Amortization Remaining Controlling of AAP Interest's AAP 2020 12/31/2020 12/31/2020 10,000 150,000 120,000 10,000 90,000 72,000 (10,000) (20,000) (16,000) 2,000 8,000 6,400 30,000 18,000 (4,000) 1,600 ? ? ? ? ? ? ? ? 12,000