Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paolo, Inc. (the lessor) entered into a sales-type lease with another company on January 1, 2016. The lease was for five years with $40,000

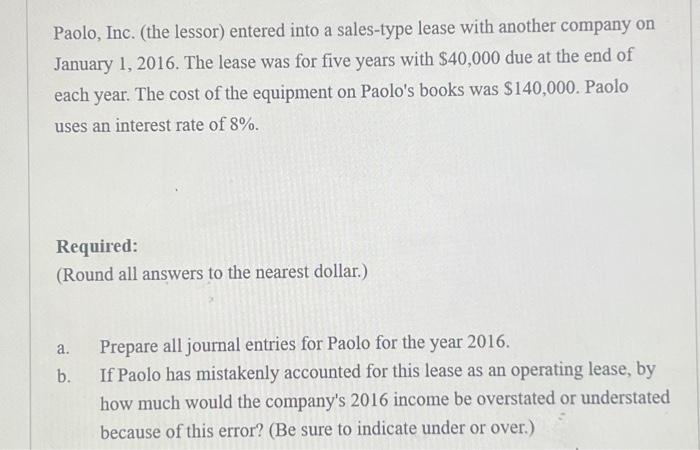

Paolo, Inc. (the lessor) entered into a sales-type lease with another company on January 1, 2016. The lease was for five years with $40,000 due at the end of each year. The cost of the equipment on Paolo's books was $140,000. Paolo uses an interest rate of 8%. Required: (Round all answers to the nearest dollar.) a. Prepare all journal entries for Paolo for the year 2016. b. If Paolo has mistakenly accounted for this lease as an operating lease, by how much would the company's 2016 income be overstated or understated because of this error? (Be sure to indicate under or over.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal entries for Paolo Inc for the year 2016 1 January 1 2016 Lease Receivable Debit 140000 Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started