Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Papermark Ltd completed the following inventory transactions in the month of May. At the beginning of May, Papermark Ltd's ledger showed Cash $3,500 and

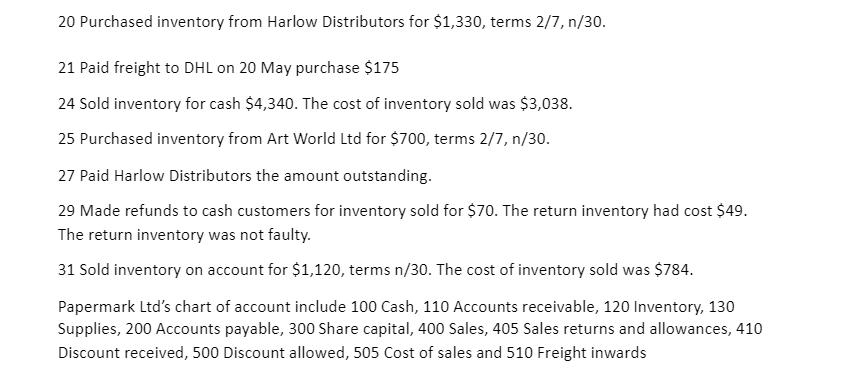

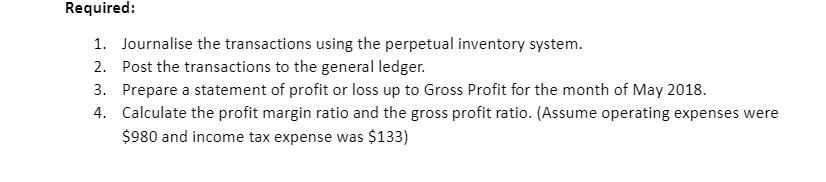

Papermark Ltd completed the following inventory transactions in the month of May. At the beginning of May, Papermark Ltd's ledger showed Cash $3,500 and Share Capital $3,500. May 2 Sold inventory on account for $3,150, terms 2/7, n/30. The cost of inventory sold was $2,100. 3 Purchased inventory on account from Pen & Paper Wholesale Supply for $4,200, terms 2/7, n/30. 5 Returned inventory and received credit from Pen & Paper Wholesale Supply for $140. 9 Received amounts owing from customers invoiced for sales of $3,150 on 2 May. 10 Paid Pen & Paper Wholesale Supply the amount owing. 11 Purchased supplies for cash $630 12 Purchased inventory for cash $1,680. 15 Returned goods and received a refund for poor-quality inventory from supplier on cash purchase $161. 20 Purchased inventory from Harlow Distributors for $1,330, terms 2/7, n/30. 21 Paid freight to DHL on 20 May purchase $175 24 Sold inventory for cash $4,340. The cost of inventory sold was $3,038. 25 Purchased inventory from Art World Ltd for $700, terms 2/7, n/30. 27 Paid Harlow Distributors the amount outstanding. 29 Made refunds to cash customers for inventory sold for $70. The return inventory had cost $49. The return inventory was not faulty. 31 Sold inventory on account for $1,120, terms n/30. The cost of inventory sold was $784. Papermark Ltd's chart of account include 100 Cash, 110 Accounts receivable, 120 Inventory, 130 Supplies, 200 Accounts payable, 300 Share capital, 400 Sales, 405 Sales returns and allowances, 410 Discount received, 500 Discount allowed, 505 Cost of sales and 510 Freight inwards Required: 1. Journalise the transactions using the perpetual inventory system. 2. Post the transactions to the general ledger. 3. Prepare a statement of profit or loss up to Gross Profit for the month of May 2018. 4. Calculate the profit margin ratio and the gross profit ratio. (Assume operating expenses were $980 and income tax expense was $133)

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started