Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pappa Razal Limited is a South African company and its current reporting period ends on 31 December 2020. On 1 August 2020, the entity purchased

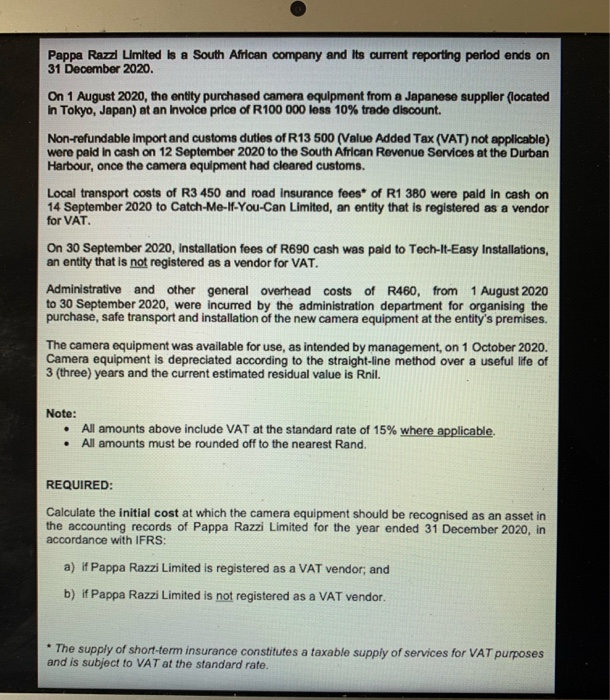

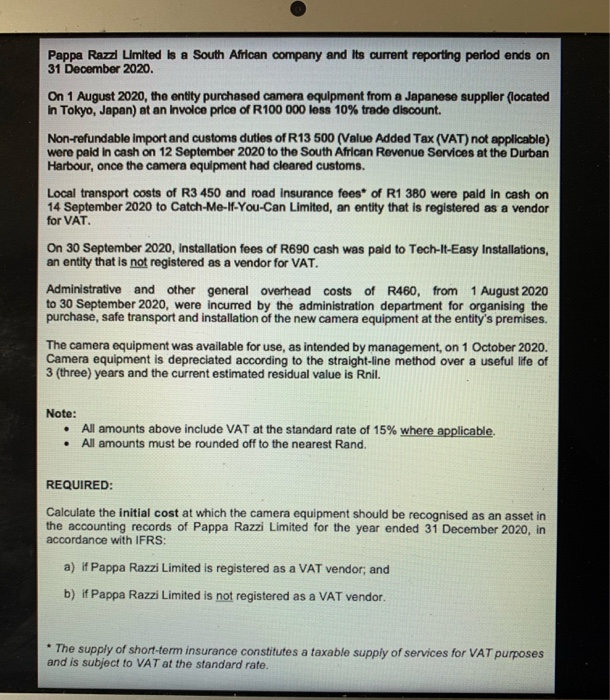

Pappa Razal Limited is a South African company and its current reporting period ends on 31 December 2020. On 1 August 2020, the entity purchased camera equipment from a Japanese supplier (located in Tokyo, Japan) at an Invoice price of R100 000 less 10% trade discount. Non-refundable import and customs duties of R13 500 (Value Added Tax (VAT) not applicable) were paid in cash on 12 September 2020 to the South African Revenue Services at the Durban Harbour, once the camera equipment had cleared customs. Local transport costs of R3 450 and road Insurance fees of R1 380 were paid in cash on 14 September 2020 to Catch-Me-If-You-Can Limited, an entity that is registered as a vendor for VAT On 30 September 2020, Installation fees of R690 cash was paid to Tech-It-Easy Installations, an entity that is not registered as a vendor for VAT. Administrative and other general overhead costs of R460, from 1 August 2020 to 30 September 2020, were incurred by the administration department for organising the purchase, safe transport and installation of the new camera equipment at the entity's premises. The camera equipment was available for use, as intended by management, on 1 October 2020. Camera equipment is depreciated according to the straight-line method over a useful life of 3 (three) years and the current estimated residual value is Rnil. Note: All amounts above include VAT at the standard rate of 15% where applicable. All amounts must be rounded off to the nearest Rand. REQUIRED: Calculate the initial cost at which the camera equipment should be recognised as an asset in the accounting records of Pappa Razzi Limited for the year ended 31 December 2020, in accordance with IFRS: a) i Pappa Razzi Limited is registered as a VAT vendor; and b) if Pappa Razzi Limited is not registered as a VAT vendor. The supply of short-term insurance constitutes a taxable supply of services for VAT purposes and is subject to VAT at the standard rate

Pappa Razal Limited is a South African company and its current reporting period ends on 31 December 2020. On 1 August 2020, the entity purchased camera equipment from a Japanese supplier (located in Tokyo, Japan) at an Invoice price of R100 000 less 10% trade discount. Non-refundable import and customs duties of R13 500 (Value Added Tax (VAT) not applicable) were paid in cash on 12 September 2020 to the South African Revenue Services at the Durban Harbour, once the camera equipment had cleared customs. Local transport costs of R3 450 and road Insurance fees of R1 380 were paid in cash on 14 September 2020 to Catch-Me-If-You-Can Limited, an entity that is registered as a vendor for VAT On 30 September 2020, Installation fees of R690 cash was paid to Tech-It-Easy Installations, an entity that is not registered as a vendor for VAT. Administrative and other general overhead costs of R460, from 1 August 2020 to 30 September 2020, were incurred by the administration department for organising the purchase, safe transport and installation of the new camera equipment at the entity's premises. The camera equipment was available for use, as intended by management, on 1 October 2020. Camera equipment is depreciated according to the straight-line method over a useful life of 3 (three) years and the current estimated residual value is Rnil. Note: All amounts above include VAT at the standard rate of 15% where applicable. All amounts must be rounded off to the nearest Rand. REQUIRED: Calculate the initial cost at which the camera equipment should be recognised as an asset in the accounting records of Pappa Razzi Limited for the year ended 31 December 2020, in accordance with IFRS: a) i Pappa Razzi Limited is registered as a VAT vendor; and b) if Pappa Razzi Limited is not registered as a VAT vendor. The supply of short-term insurance constitutes a taxable supply of services for VAT purposes and is subject to VAT at the standard rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started