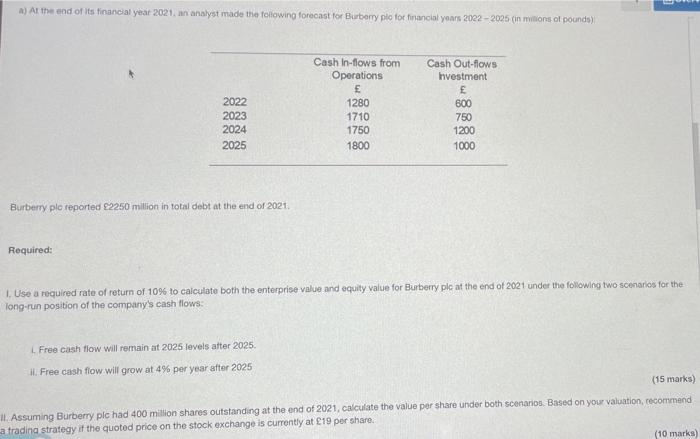

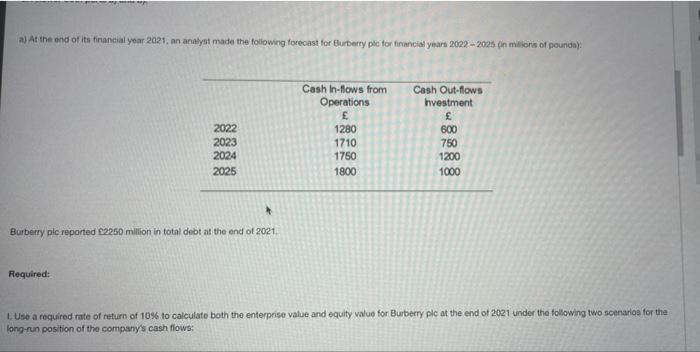

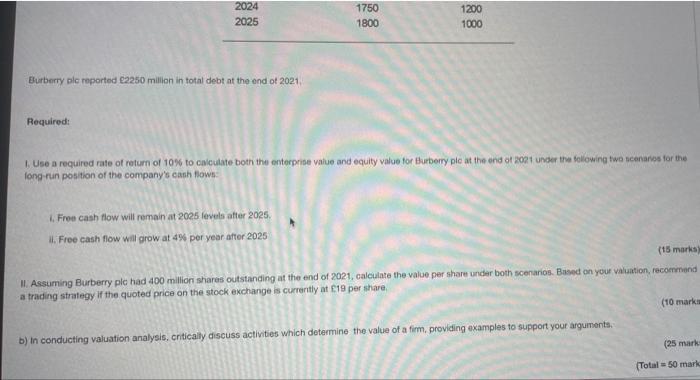

par a) At the end of its financial year 2021, an analyst made the following forecast for Burberry plo for financial years 2022-2025 (in millions of pounds) Cash In-flows from Operations Cash Out-flowS Investment 2022 1280 600 2023 1710 750 2024 1750 1200 2025 1800 1000 Burberry plc reported 2250 million in total debt at the end of 2021. Required: 1. Use a required rate of return of 10% to calculate both the enterprise value and equity value for Burberry plo at the end of 2021 under the following two scenarios for the long-run position of the company's cash flows: L. Free cash flow will remain at 2025 levels after 2025. il. Free cash flow will grow at 4% per year after 2025 (15 marks) II. Assuming Burberry pic had 400 million shares outstanding at the end of 2021, calculate the value per share under both scenarios. Based on your valuation, recommend a trading strategy if the quoted price on the stock exchange is currently at 19 per share. (10 marks) a) At the end of its financial year 2021, an analyst made the following forecast for Burberry pic for financial years 2022-2025 (in millions of pounds): Cash In-flows from Operations Cash Out-flows hvestment 2022 1280 600 2023 1710 750 2024 1750 1200 2025 1800 1000 * Burberry pic reported 2250 million in total debt at the end of 2021. Required: L. Use a required rate of return of 10% to calculate both the enterprise value and equity value for Burberry pic at the end of 2021 under the following two scenarios for the long-run position of the company's cash flows: 2024 1750 1200 2025 1800 1000 Burberry pic reported 2250 million in total debt at the end of 2021. Required: 1. Use a required rate of return of 10% to calculate both the enterprise value and equity value for Burberry pic at the end of 2021 under the following two scenarios for the long-run position of the company's cash flows: i. Free cash flow will remain at 2025 levels after 2025. il. Free cash flow will grow at 4% per year after 2025 (15 marks) II. Assuming Burberry plc had 400 million shares outstanding at the end of 2021, calculate the value per share under both scenarios. Based on your valuation, recommend a trading strategy if the quoted price on the stock exchange is currently at 19 per share. (10 marka b) In conducting valuation analysis, critically discuss activities which determine the value of a firm, providing examples to support your arguments. (25 marks (Total 50 mark