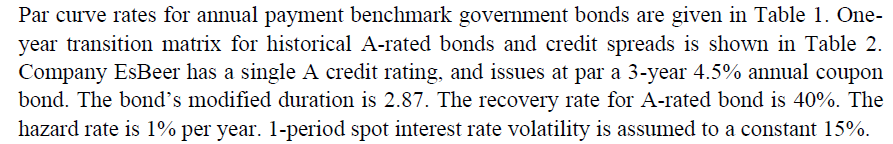

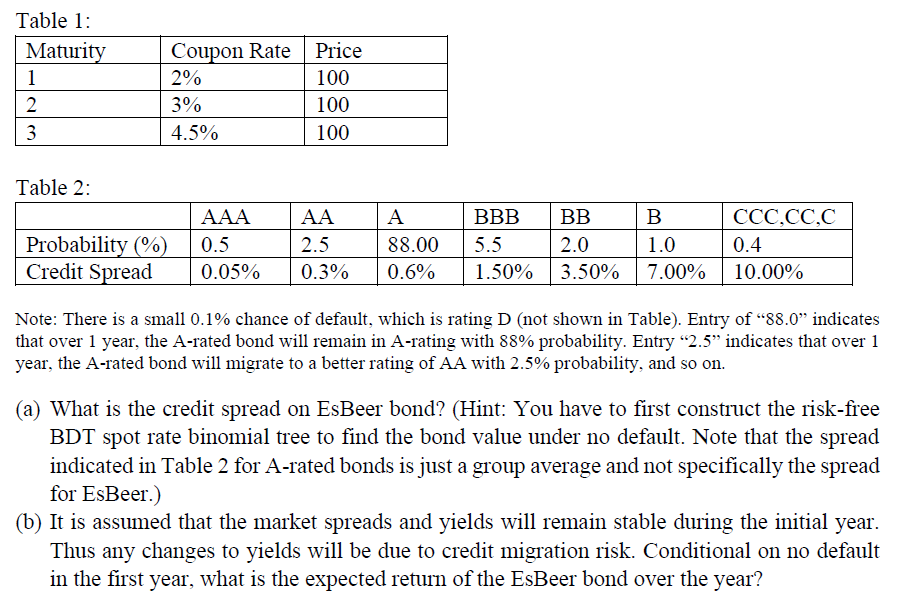

Par curve rates for annual payment benchmark government bonds are given in Table 1. One- year transition matrix for historical A-rated bonds and credit spreads is shown in Table 2. Company EsBeer has a single A credit rating, and issues at par a 3-year 4.5% annual coupon bond. The bond's modified duration is 2.87. The recovery rate for A-rated bond is 40%. The hazard rate is 1% per year. 1-period spot interest rate volatility is assumed to a constant 15%. Table 1: Maturity 1 2 3 Coupon Rate Price 2% 100 100 4.5% 100 3% Table 2: CCC.CC,C Probability (%) Credit Spread AAA 0.5 0.05% AA 2.5 0.3% A 88.00 0.6% BBB BB 5.5 2.0 1.50% 3.50% B 1.0 0.4 7.00% 10.00% Note: There is a small 0.1% chance of default, which is rating D (not shown in Table). Entry of 88.0 indicates that over 1 year, the A-rated bond will remain in A-rating with 88% probability. Entry "2.5" indicates that over 1 year, the A-rated bond will migrate to a better rating of AA with 2.5% probability, and so on. (a) What is the credit spread on EsBeer bond? (Hint: You have to first construct the risk-free BDT spot rate binomial tree to find the bond value under no default. Note that the spread indicated in Table 2 for A-rated bonds is just a group average and not specifically the spread for EsBeer.) (b) It is assumed that the market spreads and yields will remain stable during the initial year. Thus any changes to yields will be due to credit migration risk. Conditional on no default in the first year, what is the expected return of the EsBeer bond over the year? Par curve rates for annual payment benchmark government bonds are given in Table 1. One- year transition matrix for historical A-rated bonds and credit spreads is shown in Table 2. Company EsBeer has a single A credit rating, and issues at par a 3-year 4.5% annual coupon bond. The bond's modified duration is 2.87. The recovery rate for A-rated bond is 40%. The hazard rate is 1% per year. 1-period spot interest rate volatility is assumed to a constant 15%. Table 1: Maturity 1 2 3 Coupon Rate Price 2% 100 100 4.5% 100 3% Table 2: CCC.CC,C Probability (%) Credit Spread AAA 0.5 0.05% AA 2.5 0.3% A 88.00 0.6% BBB BB 5.5 2.0 1.50% 3.50% B 1.0 0.4 7.00% 10.00% Note: There is a small 0.1% chance of default, which is rating D (not shown in Table). Entry of 88.0 indicates that over 1 year, the A-rated bond will remain in A-rating with 88% probability. Entry "2.5" indicates that over 1 year, the A-rated bond will migrate to a better rating of AA with 2.5% probability, and so on. (a) What is the credit spread on EsBeer bond? (Hint: You have to first construct the risk-free BDT spot rate binomial tree to find the bond value under no default. Note that the spread indicated in Table 2 for A-rated bonds is just a group average and not specifically the spread for EsBeer.) (b) It is assumed that the market spreads and yields will remain stable during the initial year. Thus any changes to yields will be due to credit migration risk. Conditional on no default in the first year, what is the expected return of the EsBeer bond over the year