Par Inc owns 72.85% of Sub Corp. On January 1, Year 3, Sub purchased $110,876 face value of Par's 8.79% bonds for $92,036. On

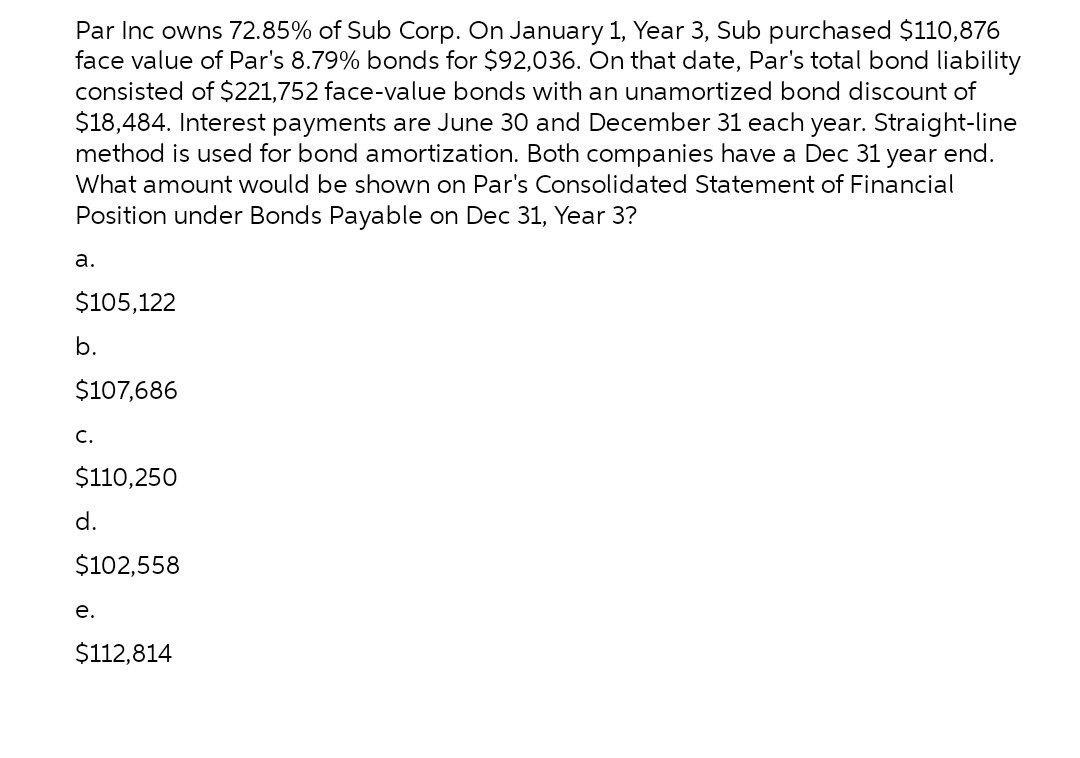

Par Inc owns 72.85% of Sub Corp. On January 1, Year 3, Sub purchased $110,876 face value of Par's 8.79% bonds for $92,036. On that date, Par's total bond liability consisted of $221,752 face-value bonds with an unamortized bond discount of $18,484. Interest payments are June 30 and December 31 each year. Straight-line method is used for bond amortization. Both companies have a Dec 31 year end. What amount would be shown on Par's Consolidated Statement of Financial Position under Bonds Payable on Dec 31, Year 3? a. $105,122 b. $107,686 C. $110,250 d. $102,558 e. $112,814

Step by Step Solution

3.59 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The answer is B On Pars Consolidated Statement of Financial Position the Bonds Payable would be show...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started