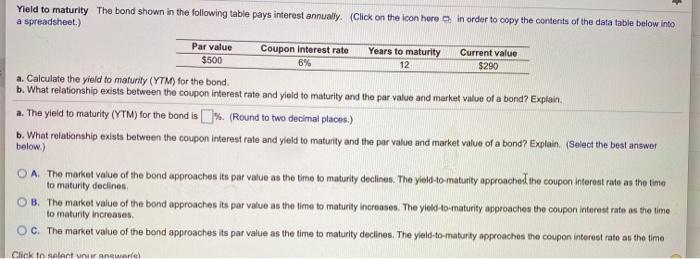

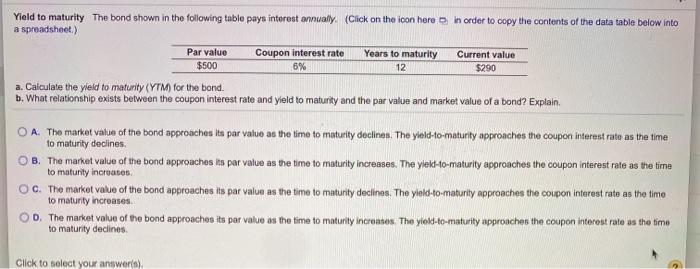

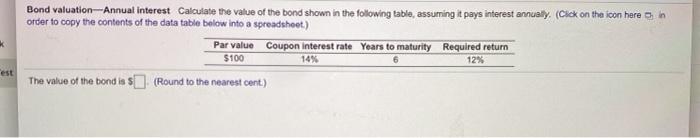

Par value Yield to maturity The bond shown in the following table pays interest annually. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Coupon Interest rate Years to maturity Current value $500 6% 12 $290 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is (%. (Round to two decimal places.) b. What relationship exists between the coupon interest rate and yield to maturity and the per value and market value of a bond? Explain. (Select the best answer below) O A The market value of the bond approaches its par vnue as the time to maturity declines. The yield-to maturity approached the coupon Interest rate as the time to maturity declines OB. The market value of the bond approaches its par value as the time to maturity increases. The yield-to-maturity approaches the coupon interest rate as the time to maturity increases OC. The market value of the bond approaches its par value as the time to maturity declines. The yield-to-maturity approaches the coupon interest rate as the time Click to slant un answare Yield to maturity The bond shown in the following table pays interest annually. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Par value Coupon interest rate Years to maturity $500 6% 12 $290 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain Current value A. The market value of the bord approaches its par value as the time to maturity declines. The yield-to-maturity approaches the coupon interest rate as the time to maturity declines. B. The market value of the bond approaches its par value as the time to maturity increases. The ylekd-to-maturity approaches the coupon interest rate as the time to maturity increases OC. The market value of the bond approaches its par value as the time to maturity declines. The yield-to-maturity approaches the coupon interest rate as the time OD. The market value of the bond approaches its par value as the time to maturity increases. The yield-to-maturity approaches the coupon interest rate as the time to maturity declines to maturity increases Click to select your answers) * Bond valuation--Annual interest Calculate the value of the bond shown in the following table, assuming it pays interest annually. (Click on the foon heren order to copy the contents of the data table below into a spreadsheet.) Par value Coupon Interest rate Years to maturity Required return $100 12% The value of the bond is sd (Round to the nearest cent.) 14% est