Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paradiso PLC is a tanning company incorporated in Japan and with a branch in Croatia, its main market. Full processing of the raw materials

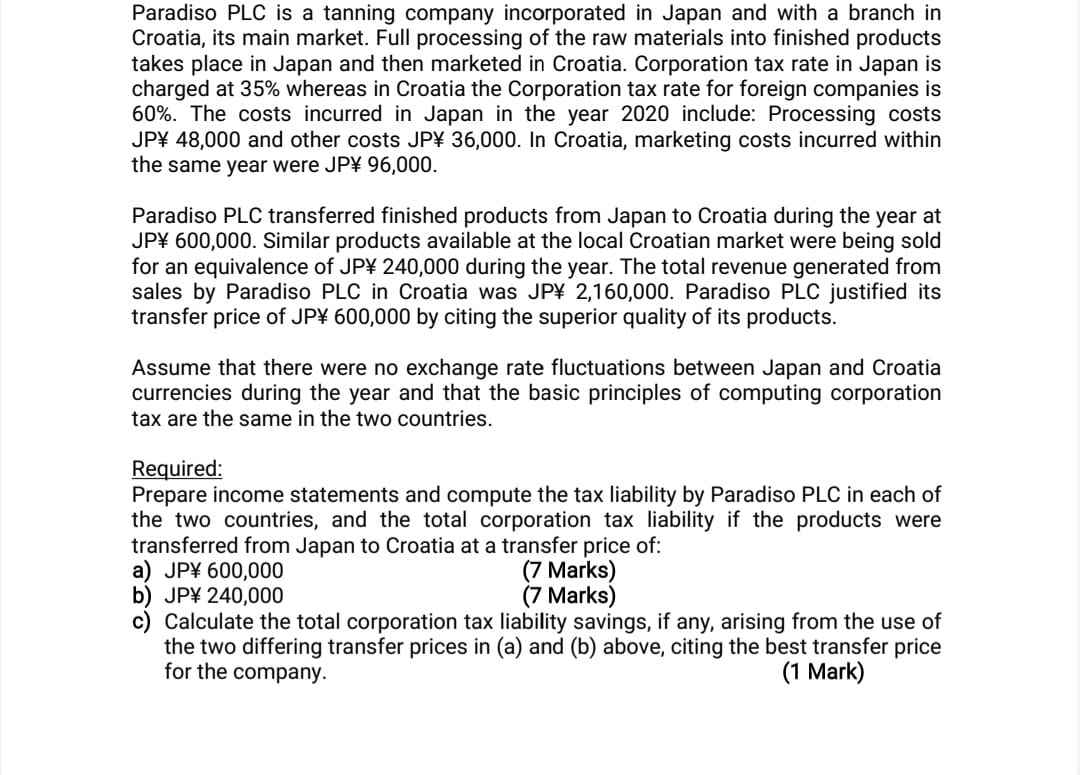

Paradiso PLC is a tanning company incorporated in Japan and with a branch in Croatia, its main market. Full processing of the raw materials into finished products takes place in Japan and then marketed in Croatia. Corporation tax rate in Japan is charged at 35% whereas in Croatia the Corporation tax rate for foreign companies is 60%. The costs incurred in Japan in the year 2020 include: Processing costs JP 48,000 and other costs JP 36,000. In Croatia, marketing costs incurred within the same year were JP 96,000. Paradiso PLC transferred finished products from Japan to Croatia during the year at JP 600,000. Similar products available at the local Croatian market were being sold for an equivalence of JP 240,000 during the year. The total revenue generated from sales by Paradiso PLC in Croatia was JP 2,160,000. Paradiso PLC justified its transfer price of JP 600,000 by citing the superior quality of its products. Assume that there were no exchange rate fluctuations between Japan and Croatia currencies during the year and that the basic principles of computing corporation tax are the same in the two countries. Required: Prepare income statements and compute the tax liability by Paradiso PLC in each of the two countries, and the total corporation tax liability if the products were transferred from Japan to Croatia at a transfer price of: a) JP 600,000 b) JP 240,000 (7 Marks) (7 Marks) c) Calculate the total corporation tax liability savings, if any, arising from the use of the two differing transfer prices in (a) and (b) above, citing the best transfer price for the company. (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Therefore the best transfer price for Paradiso PLC is J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started