Question

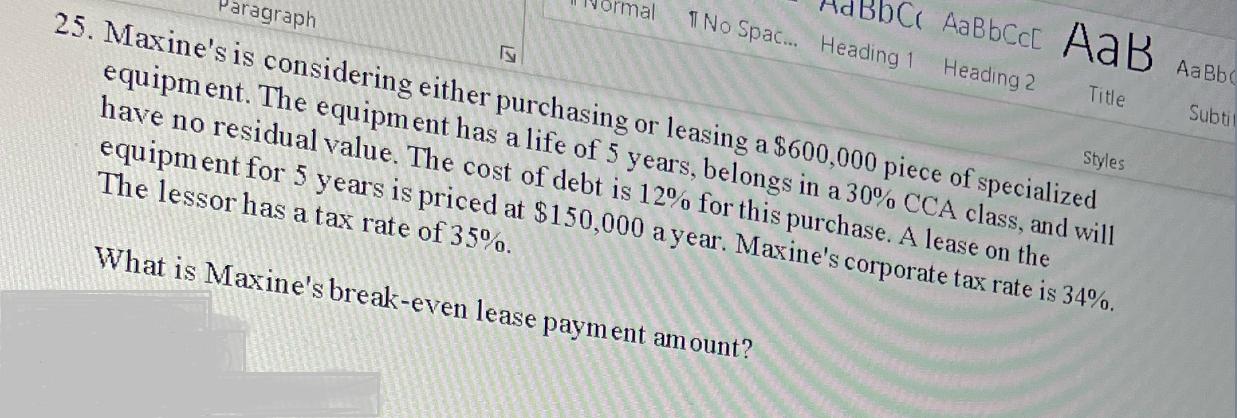

Paragraph 25. Maxine's is considering either purchasing or leasing a $600,000 piece of specialized equipment. The equipment has a life of 5 years, belongs

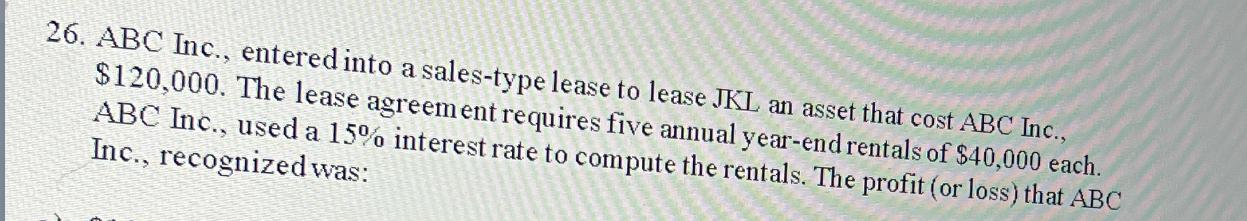

Paragraph 25. Maxine's is considering either purchasing or leasing a $600,000 piece of specialized equipment. The equipment has a life of 5 years, belongs in a 30% CCA class, and will have no residual value. The cost of debt is 12% for this purchase. A lease on the equipment for 5 years is priced at $150,000 a year. Maxine's corporate tax rate is 34%. The lessor has a tax rate of 35%. What is Maxine's break-even lease payment amount? ormal AaBbcc AaB Aa Bbc Title Subtil TNo Spac... Heading 1 Heading 2 Styles 26. ABC Inc., entered into a sales-type lease to lease JKL an asset that cost ABC Inc., $120,000. The lease agreement requires five annual year-end rentals of $40,000 each. ABC Inc., used a 15% interest rate to compute the rentals. The profit (or loss) that ABC Inc., recognized was:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Modeling

Authors: Simon Benninga

4th Edition

0262027283, 9780262027281

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App