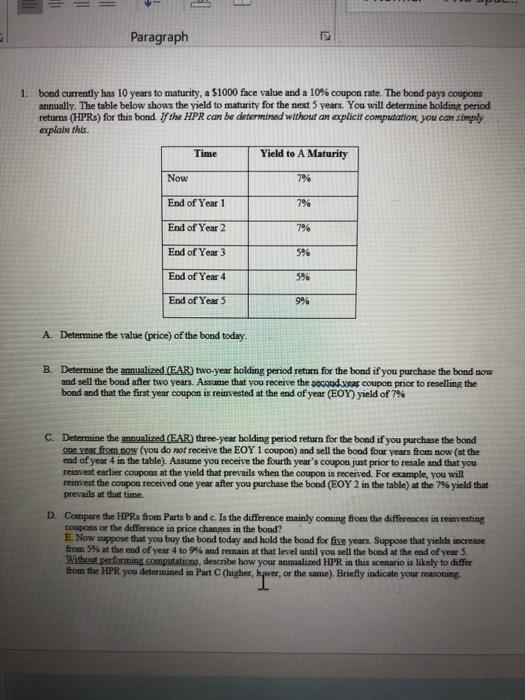

= | Paragraph Kl 1. bond currently has 10 years to maturity, a $1000 face value and a 10% coupon rate. The bond pays coupons annually. The table below shows the yield to maturity for the next 5 years. You will determine holding period returns (HPR) for this bond if the HPR can be determined without an explicit computation you can simply explain this Time Yield to A Maturity Now 7% End of Year 1 7% End of Year 2 7% End of Year 3 5% End of Year 4 5% End of Years 9% A Determine the value (price) of the bond today. B. Determine the manualized (EAR) two-year holding period return for the bond if you purchase the bond now and sell the bond after two years. Assume that you receive the second year coupon prior to reselling the bond and that the first year coupon is reinvested at the end of year (EOY) yield of 7% Determine the annualized (EAR) three-year holding period return for the bond if you purchase the bond One Year from now (you do not receive the EOY 1 coupon) and sell the bond four years from now (at the end of year 4 in the table). Assume you receive the fourth year's coupon just prior to resale and that you reinvest earlier coupons at the yield that prevails when the coupon is received. For example, you will reinvest the coupon received one year after you purchase the bond (EOY 2 in the table) at the 7% yield that prevails at that time. D. Compare the HPR from Parts and e Is the difference mainly coming from the difference in reinvesting coupons or the difference in price changes in the bond? E. Now suppose that you buy the bood today and hold the bond for five years. Suppose that yields increase from 5% at the end of year 4 to 9% and remain at that level until you sell the bond at the end of years Without performing computations, describe how your annualized HPR in this scenario is likely to differ from the HPR you determined in Part (higher, Iwer, or the same). Briefly indicate your reasoning = | Paragraph Kl 1. bond currently has 10 years to maturity, a $1000 face value and a 10% coupon rate. The bond pays coupons annually. The table below shows the yield to maturity for the next 5 years. You will determine holding period returns (HPR) for this bond if the HPR can be determined without an explicit computation you can simply explain this Time Yield to A Maturity Now 7% End of Year 1 7% End of Year 2 7% End of Year 3 5% End of Year 4 5% End of Years 9% A Determine the value (price) of the bond today. B. Determine the manualized (EAR) two-year holding period return for the bond if you purchase the bond now and sell the bond after two years. Assume that you receive the second year coupon prior to reselling the bond and that the first year coupon is reinvested at the end of year (EOY) yield of 7% Determine the annualized (EAR) three-year holding period return for the bond if you purchase the bond One Year from now (you do not receive the EOY 1 coupon) and sell the bond four years from now (at the end of year 4 in the table). Assume you receive the fourth year's coupon just prior to resale and that you reinvest earlier coupons at the yield that prevails when the coupon is received. For example, you will reinvest the coupon received one year after you purchase the bond (EOY 2 in the table) at the 7% yield that prevails at that time. D. Compare the HPR from Parts and e Is the difference mainly coming from the difference in reinvesting coupons or the difference in price changes in the bond? E. Now suppose that you buy the bood today and hold the bond for five years. Suppose that yields increase from 5% at the end of year 4 to 9% and remain at that level until you sell the bond at the end of years Without performing computations, describe how your annualized HPR in this scenario is likely to differ from the HPR you determined in Part (higher, Iwer, or the same). Briefly indicate your reasoning