Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paragraph Styles Sommer's repairs ltd, has excess funds. One use for these funds is an acquisition. A potential target is Leon Housing (LH), they operate

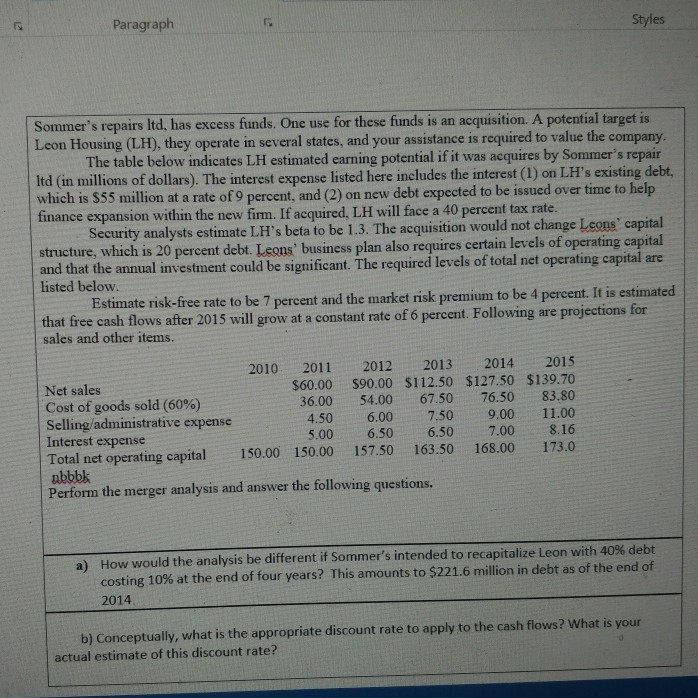

Paragraph Styles Sommer's repairs ltd, has excess funds. One use for these funds is an acquisition. A potential target is Leon Housing (LH), they operate in several states, and your assistance is required to value the company. The table below indicates LH estimated earning potential if it was acquires by Sommer's repair Itd (in millions of dollars). The interest expense listed here includes the interest (1) on LH's existing debt, which is $55 million at a rate of 9 percent, and (2) on new debt expected to be issued over time to help finance expansion within the new firm. If acquired, LH will face a 40 percent tax rate. Security analysts estimate LH's beta to be 1.3. The acquisition would not change Leons' capital structure, which is 20 percent debt. Leons' business plan also requires certain levels of operating capital and that the annual investment could be significant. The required levels of total net operating capital are listed below. Estimate risk-free rate to be 7 percent and the market risk premium to be 4 percent. It is estimated that free cash flows after 2015 will grow at a constant rate of 6 percent. Following are projections for sales and other items. 2010 2011 2012 2013 2014 2015 Net sales $60.00 $90.00 $112.50 $127.50 $139.70 Cost of goods sold (60%) 36.00 54.00 67.50 76.50 83.80 Selling/administrative expense 4.50 6.00 7.50 9.00 11.00 Interest expense 5.00 6.50 6.50 7.00 8.16 Total net operating capital 150.00 150.00 157.50 163.50 168.00 173.0 abbbk Perform the merger analysis and answer the following questions. a) How would the analysis be different it Sommer's intended to recapitalize Leon with 40% debt costing 10% at the end of four years? This amounts to $221.6 million in debt as of the end of 2014 b) Conceptually, what is the appropriate discount rate to apply to the cash flows? What is your actual estimate of this discount rate? Paragraph Styles Sommer's repairs ltd, has excess funds. One use for these funds is an acquisition. A potential target is Leon Housing (LH), they operate in several states, and your assistance is required to value the company. The table below indicates LH estimated earning potential if it was acquires by Sommer's repair Itd (in millions of dollars). The interest expense listed here includes the interest (1) on LH's existing debt, which is $55 million at a rate of 9 percent, and (2) on new debt expected to be issued over time to help finance expansion within the new firm. If acquired, LH will face a 40 percent tax rate. Security analysts estimate LH's beta to be 1.3. The acquisition would not change Leons' capital structure, which is 20 percent debt. Leons' business plan also requires certain levels of operating capital and that the annual investment could be significant. The required levels of total net operating capital are listed below. Estimate risk-free rate to be 7 percent and the market risk premium to be 4 percent. It is estimated that free cash flows after 2015 will grow at a constant rate of 6 percent. Following are projections for sales and other items. 2010 2011 2012 2013 2014 2015 Net sales $60.00 $90.00 $112.50 $127.50 $139.70 Cost of goods sold (60%) 36.00 54.00 67.50 76.50 83.80 Selling/administrative expense 4.50 6.00 7.50 9.00 11.00 Interest expense 5.00 6.50 6.50 7.00 8.16 Total net operating capital 150.00 150.00 157.50 163.50 168.00 173.0 abbbk Perform the merger analysis and answer the following questions. a) How would the analysis be different it Sommer's intended to recapitalize Leon with 40% debt costing 10% at the end of four years? This amounts to $221.6 million in debt as of the end of 2014 b) Conceptually, what is the appropriate discount rate to apply to the cash flows? What is your actual estimate of this discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started