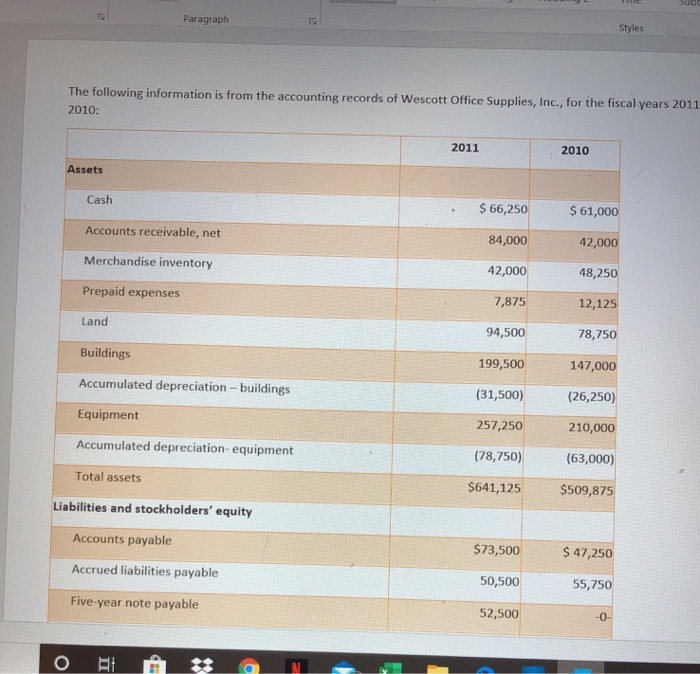

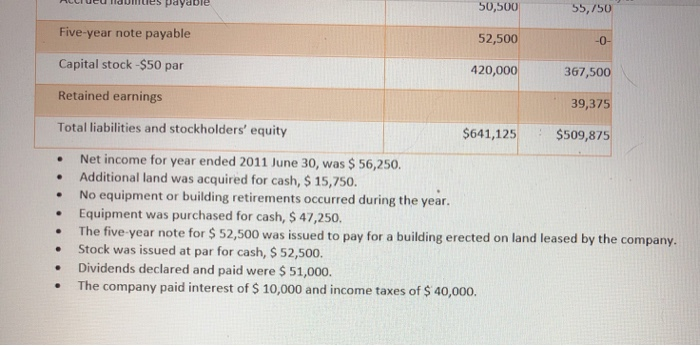

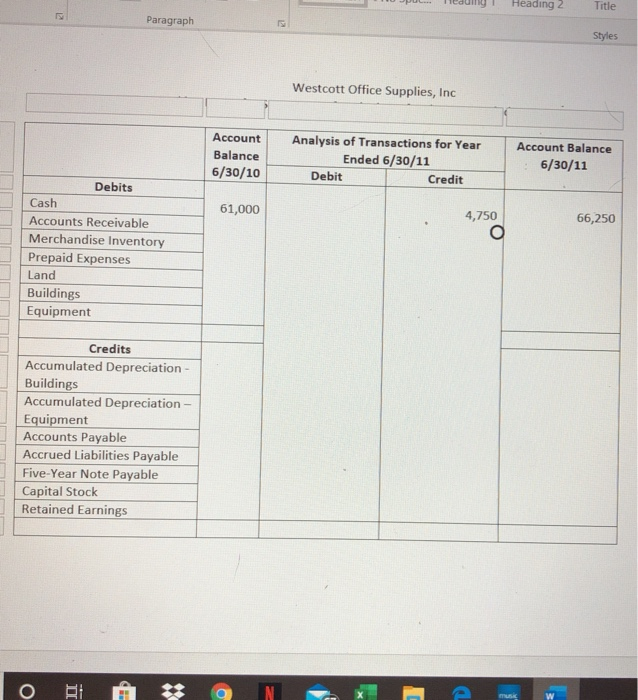

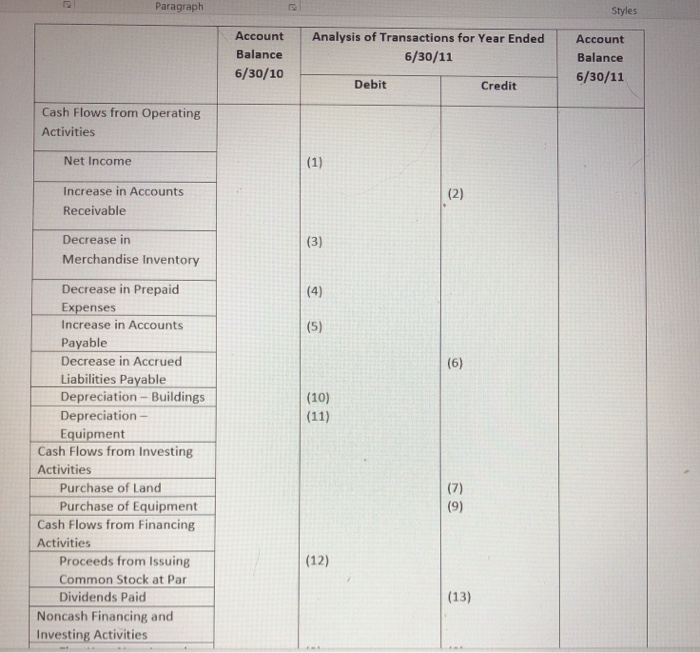

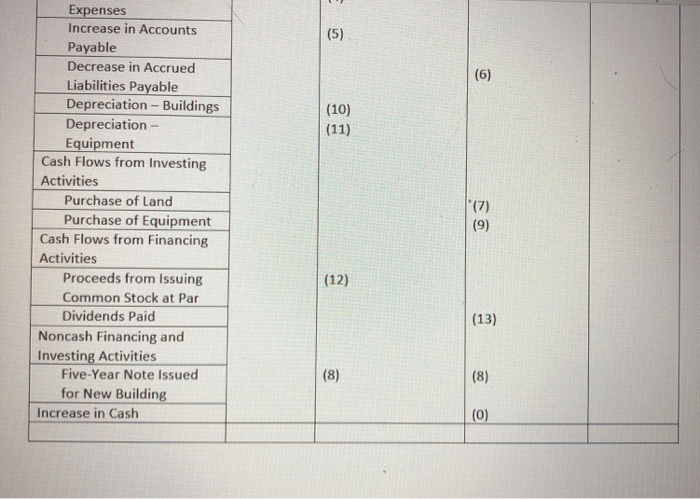

Paragraph Styles The following information is from the accounting records of Wescott Office Supplies, Inc., for the fiscal years 2011 2010: 2011 2010 Assets Cash $ 66,250 $ 61,000 Accounts receivable, net 84,000 42,000 Merchandise inventory 42,000 48,250 Prepaid expenses 7,875 12,125 Land 94,500 78,750 Buildings 199,500 147,000 Accumulated depreciation - buildings (26,250) (31,500) 257,250 Equipment 210,000 Accumulated depreciation equipment (78,750) (63,000) Total assets $641,125 $509,875 Liabilities and stockholders' equity Accounts payable $73,500 $ 47,250 Accrued liabilities payable 50,500 55,750 Five-year note payable 52,500 o AA ** Alieu d es payable 50,500 55,750 Five-year note payable 52,500 -0- Capital stock -$50 par 420,000 367,500 Retained earnings 39,375 Total liabilities and stockholders' equity $641,125 $509,875 Net income for year ended 2011 June 30, was $ 56,250. Additional land was acquired for cash, $ 15,750. No equipment or building retirements occurred during the year. Equipment was purchased for cash, $ 47,250. The five-year note for $ 52,500 was issued to pay for a building erected on land leased by the company. Stock was issued at par for cash, $ 52,500. Dividends declared and paid were $ 51,000. The company paid interest of $ 10,000 and income taxes of $ 40,000. Juc... Tiedumiy Heading 2 Title Paragraph Styles Westcott Office Supplies, Inc Account Balance 6/30/10 Analysis of Transactions for Year Ended 6/30/11 Debit Credit Account Balance : 6/30/11 61,000 4,750 66,250 Debits Cash Accounts Receivable Merchandise Inventory Prepaid Expenses Land Buildings Equipment Credits Accumulated Depreciation - Buildings Accumulated Depreciation Equipment Accounts Payable Accrued Liabilities Payable Five-Year Note Payable Capital Stock Retained Earnings O BI ** 9 Paragraph Styles Account Balance 6/30/10 Analysis of Transactions for Year Ended 6/30/11 Account Balance 6/30/11 Debit Credit Cash Flows from Operating Activities Net Income Increase in Accounts Receivable Decrease in Merchandise Inventory Decrease in Prepaid Expenses Increase in Accounts Payable Decrease in Accrued Liabilities Payable Depreciation - Buildings Depreciation - Equipment Cash Flows from Investing Activities Purchase of Land Purchase of Equipment Cash Flows from Financing Activities Proceeds from Issuing Common Stock at Par Dividends Paid Noncash Financing and Investing Activities (12) (13) Expenses Increase in Accounts Payable Decrease in Accrued Liabilities Payable Depreciation - Buildings Depreciation - Equipment Cash Flows from Investing Activities Purchase of Land Purchase of Equipment Cash Flows from Financing Activities Proceeds from Issuing Common Stock at Par Dividends Paid Noncash Financing and Investing Activities Five-Year Note Issued for New Building Increase in Cash (12)