Question

Parent Company purchased a controlling interest in the stock of Subsidiary Company on 1/1/x1. Book values and fair value of the net assets of

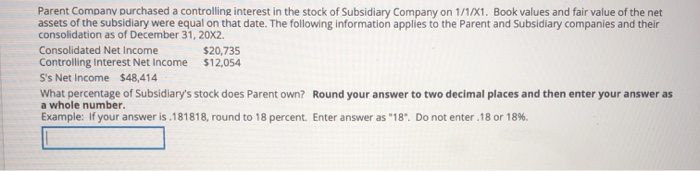

Parent Company purchased a controlling interest in the stock of Subsidiary Company on 1/1/x1. Book values and fair value of the net assets of the subsidiary were equal on that date. The following information applies to the Parent and Subsidiary companies and their consolidation as of December 31, 20X2. Consolidated Net Income $20,735 Controlling Interest Net Income $12,054 S's Net Income $48,414 What percentage of Subsidiary's stock does Parent own? Round your answer to two decimal places and then enter your answer as a whole number. Example: If your answer is .181818, round to 18 percent. Enter answer as "18". Do not enter .18 or 18%.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

12054 Controlling interest net in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra C. Jeter, Paul Chaney

5th Edition

1118022297, 9781118214169, 9781118022290, 1118214161, 978-1118098615

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App