Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parent Pte Ltd (Parent), a company incorporated in Singapore, is preparing its consolidated financial statements for the financial year ended 31 December 2021. It

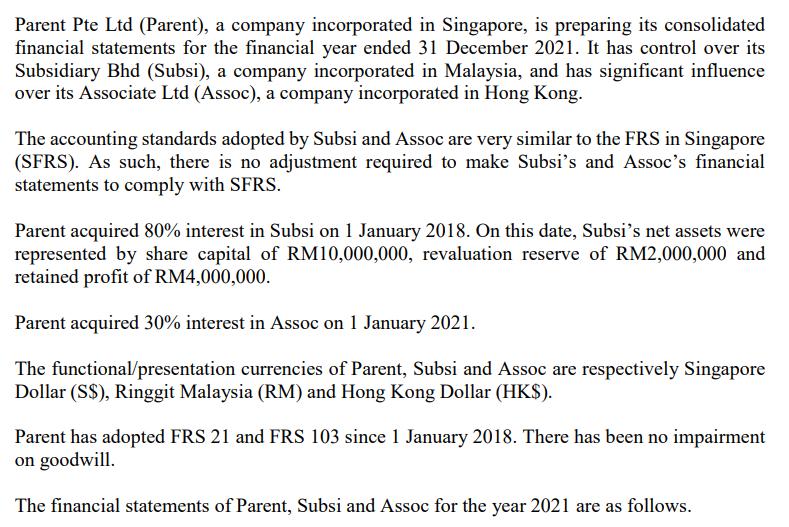

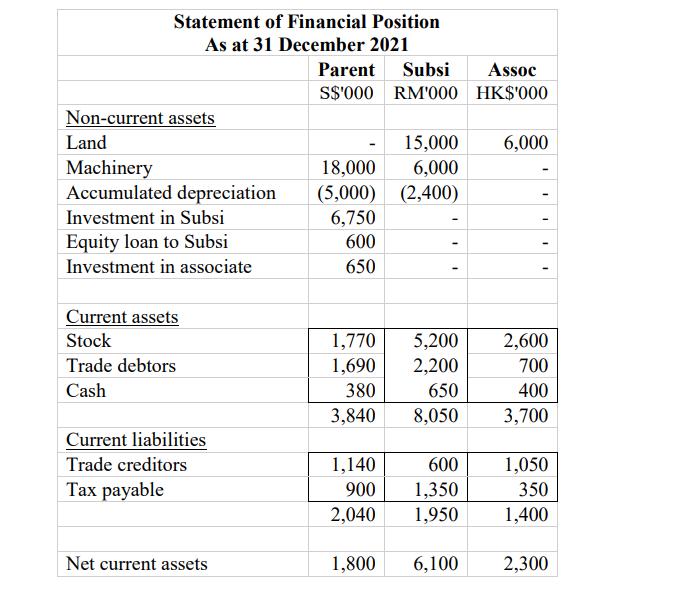

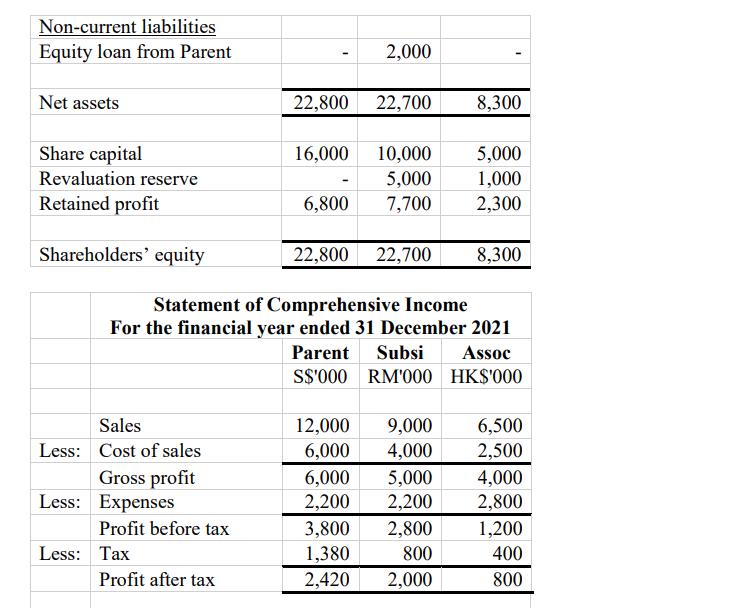

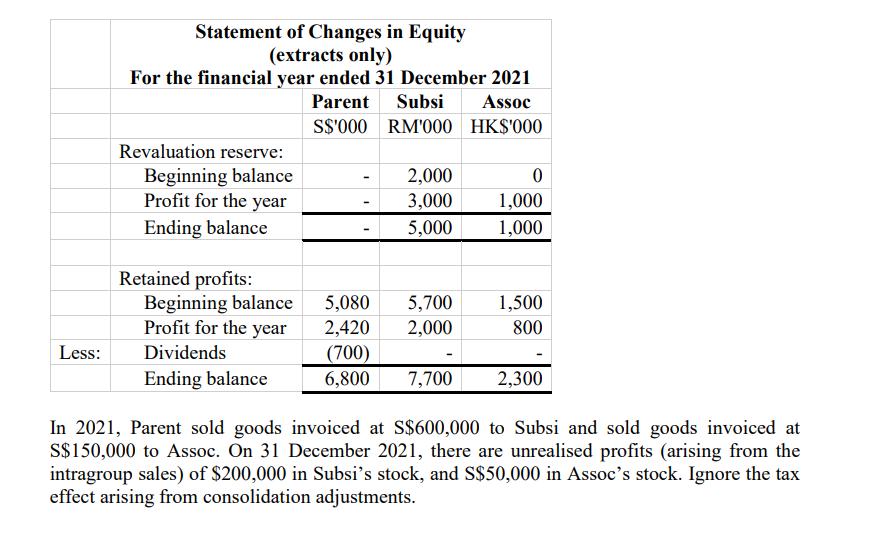

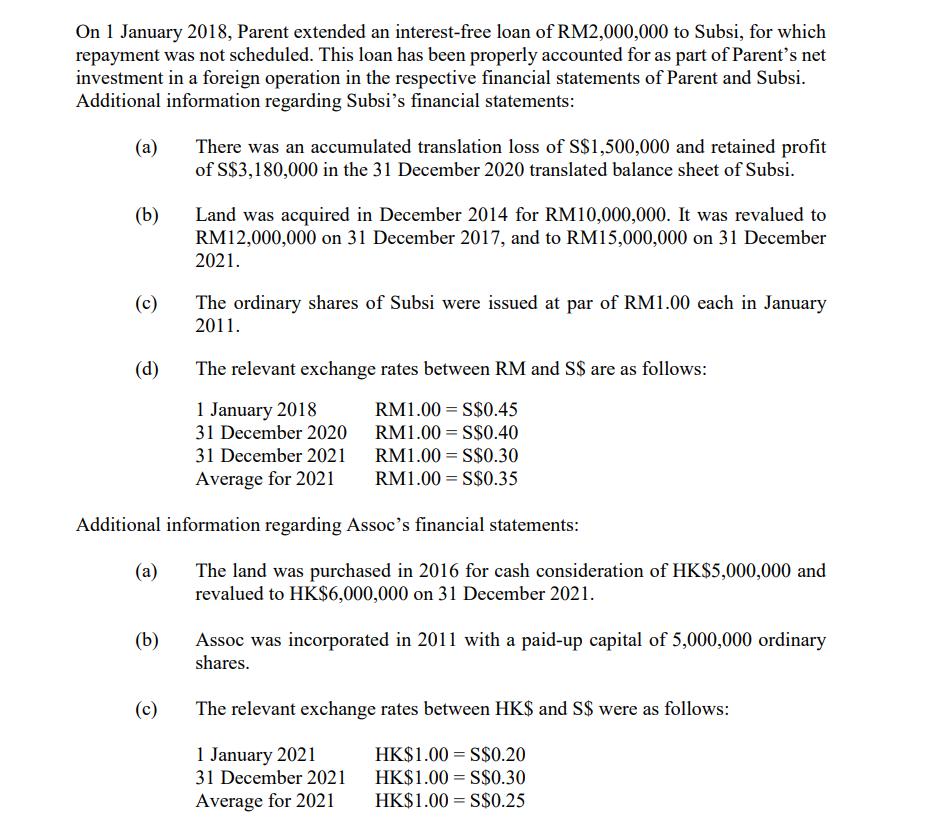

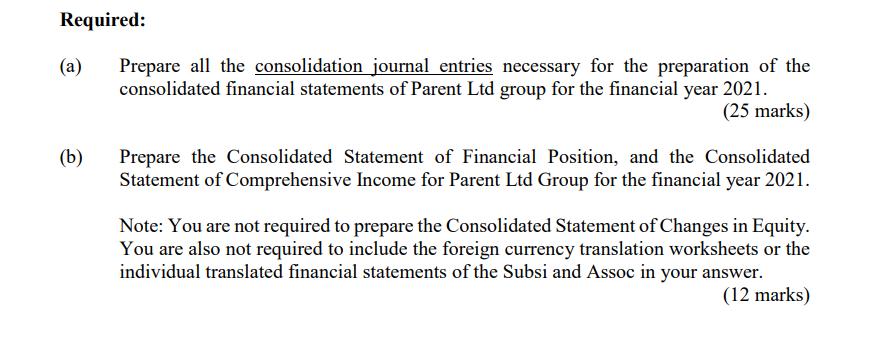

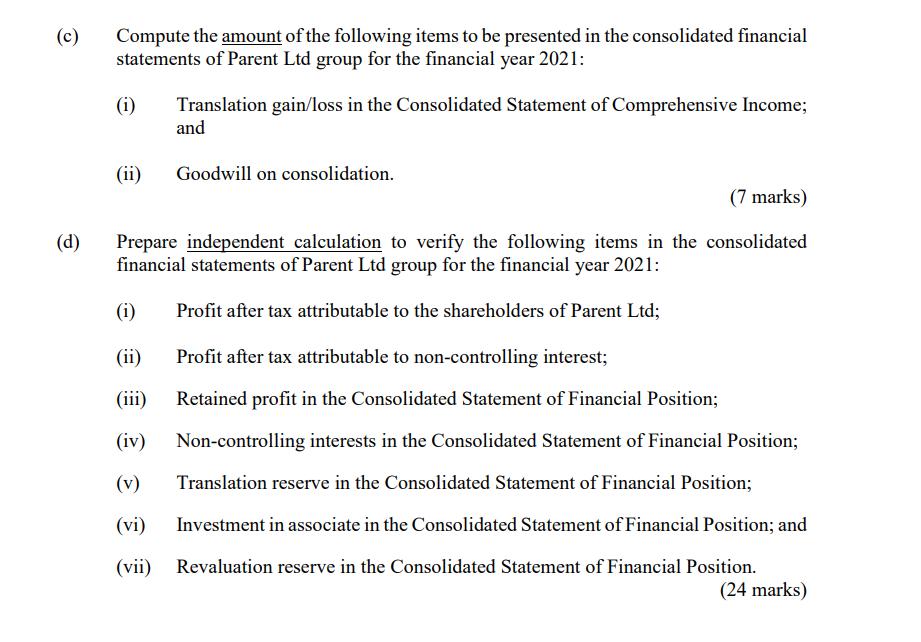

Parent Pte Ltd (Parent), a company incorporated in Singapore, is preparing its consolidated financial statements for the financial year ended 31 December 2021. It has control over its Subsidiary Bhd (Subsi), a company incorporated in Malaysia, and has significant influence over its Associate Ltd (Assoc), a company incorporated in Hong Kong. The accounting standards adopted by Subsi and Assoc are very similar to the FRS in Singapore (SFRS). As such, there is no adjustment required to make Subsi's and Assoc's financial statements to comply with SFRS. Parent acquired 80% interest in Subsi on 1 January 2018. On this date, Subsi's net assets were represented by share capital of RM10,000,000, revaluation reserve of RM2,000,000 and retained profit of RM4,000,000. Parent acquired 30% interest in Assoc on 1 January 2021. The functional/presentation currencies of Parent, Subsi and Assoc are respectively Singapore Dollar (S$), Ringgit Malaysia (RM) and Hong Kong Dollar (HK$). Parent has adopted FRS 21 and FRS 103 since 1 January 2018. There has been no impairment on goodwill. The financial statements of Parent, Subsi and Assoc for the year 2021 are as follows. Statement of Financial Position As at 31 December 2021 Non-current assets Land Machinery Accumulated depreciation Investment in Subsi Equity loan to Subsi Investment in associate Current assets Stock Trade debtors Cash Current liabilities Trade creditors Tax payable Net current assets Parent Subsi Assoc S$'000 RM'000 HK$'000 15,000 18,000 6,000 (5,000) (2,400) 6,750 600 650 - 1,140 900 2,040 6,000 600 1,350 1,950 - 1,770 5,200 2,600 1,690 2,200 700 380 650 400 3,840 8,050 3,700 - 1,050 350 1,400 1,800 6,100 2,300 Non-current liabilities Equity loan from Parent Net assets Share capital Revaluation reserve Retained profit Shareholders' equity Sales Less: Cost of sales Gross profit Less: Expenses Profit before tax Less: Tax Profit after tax 22,800 22,700 16,000 6,800 2,000 Statement of Comprehensive Income For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 22,800 22,700 10,000 5,000 7,700 6,000 2,200 12,000 9,000 6,000 4,000 3,800 1,380 2,420 8,300 5,000 2,200 2,800 800 2,000 5,000 1,000 2,300 8,300 6,500 2,500 4,000 2,800 1,200 400 800 Less: Statement of Changes in Equity (extracts only) For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 Revaluation reserve: Beginning balance Profit for the year Ending balance Retained profits: Beginning balance Profit for the year Dividends Ending balance - 2,000 3,000 5,000 5,080 2,420 (700) 6,800 7,700 5,700 2,000 0 1,000 1,000 1,500 800 2,300 In 2021, Parent sold goods invoiced at S$600,000 to Subsi and sold goods invoiced at S$150,000 to Assoc. On 31 December 2021, there are unrealised profits (arising from the intragroup sales) of $200,000 in Subsi's stock, and S$50,000 in Assoc's stock. Ignore the tax effect arising from consolidation adjustments. On 1 January 2018, Parent extended an interest-free loan of RM2,000,000 to Subsi, for which repayment was not scheduled. This loan has been properly accounted for as part of Parent's net investment in a foreign operation in the respective financial statements of Parent and Subsi. Additional information regarding Subsi's financial statements: (a) (b) (d) (b) There was an accumulated translation loss of S$1,500,000 and retained profit of S$3,180,000 in the 31 December 2020 translated balance sheet of Subsi. (c) Land was acquired in December 2014 for RM10,000,000. It was revalued to RM12,000,000 on 31 December 2017, and to RM15,000,000 on 31 December 2021. The ordinary shares of Subsi were issued at par of RM1.00 each in January 2011. The relevant exchange rates between RM and S$ are as follows: RM1.00 = S$0.45 RM1.00 S$0.40 RM1.00 = S$0.30 RM1.00 S$0.35 Additional information regarding Assoc's financial statements: (a) 1 January 2018 31 December 2020 31 December 2021 Average for 2021 The land was purchased in 2016 for cash consideration of HK$5,000,000 and revalued to HK$6,000,000 on 31 December 2021. Assoc was incorporated in 2011 with a paid-up capital of 5,000,000 ordinary shares. The relevant exchange rates between HK$ and S$ were as follows: 1 January 2021 31 December 2021 Average for 2021 HK$1.00 S$0.20 HK$1.00 S$0.30 HK$1.00 = S$0.25 Required: (a) (b) Prepare all the consolidation journal entries necessary for the preparation of the consolidated financial statements of Parent Ltd group for the financial year 2021. (25 marks) Prepare the Consolidated Statement of Financial Position, and the Consolidated Statement of Comprehensive Income for Parent Ltd Group for the financial year 2021. Note: You are not required to prepare the Consolidated Statement of Changes in Equity. You are also not required to include the foreign currency translation worksheets or the individual translated financial statements of the Subsi and Assoc in your answer. (12 marks) (c) (d) Compute the amount of the following items to be presented in the consolidated financial statements of Parent Ltd group for the financial year 2021: (i) (ii) Translation gain/loss in the Consolidated Statement of Comprehensive Income; and Goodwill on consolidation. (7 marks) Prepare independent calculation to verify the following items in the consolidated financial statements of Parent Ltd group for the financial year 2021: Profit after tax attributable to the shareholders of Parent Ltd; (i) (ii) Profit after tax attributable to non-controlling interest; (iii) Retained profit in the Consolidated Statement of Financial Position; (iv) Non-controlling interests in the Consolidated Statement of Financial Position; Translation reserve in the Consolidated Statement of Financial Position; (v) (vi) Investment in associate in the Consolidated Statement of Financial Position; and (vii) Revaluation reserve in the Consolidated Statement of Financial Position. (24 marks) Parent Pte Ltd (Parent), a company incorporated in Singapore, is preparing its consolidated financial statements for the financial year ended 31 December 2021. It has control over its Subsidiary Bhd (Subsi), a company incorporated in Malaysia, and has significant influence over its Associate Ltd (Assoc), a company incorporated in Hong Kong. The accounting standards adopted by Subsi and Assoc are very similar to the FRS in Singapore (SFRS). As such, there is no adjustment required to make Subsi's and Assoc's financial statements to comply with SFRS. Parent acquired 80% interest in Subsi on 1 January 2018. On this date, Subsi's net assets were represented by share capital of RM10,000,000, revaluation reserve of RM2,000,000 and retained profit of RM4,000,000. Parent acquired 30% interest in Assoc on 1 January 2021. The functional/presentation currencies of Parent, Subsi and Assoc are respectively Singapore Dollar (S$), Ringgit Malaysia (RM) and Hong Kong Dollar (HK$). Parent has adopted FRS 21 and FRS 103 since 1 January 2018. There has been no impairment on goodwill. The financial statements of Parent, Subsi and Assoc for the year 2021 are as follows. Statement of Financial Position As at 31 December 2021 Non-current assets Land Machinery Accumulated depreciation Investment in Subsi Equity loan to Subsi Investment in associate Current assets Stock Trade debtors Cash Current liabilities Trade creditors Tax payable Net current assets Parent Subsi Assoc S$'000 RM'000 HK$'000 15,000 18,000 6,000 (5,000) (2,400) 6,750 600 650 - 1,140 900 2,040 6,000 600 1,350 1,950 - 1,770 5,200 2,600 1,690 2,200 700 380 650 400 3,840 8,050 3,700 - 1,050 350 1,400 1,800 6,100 2,300 Non-current liabilities Equity loan from Parent Net assets Share capital Revaluation reserve Retained profit Shareholders' equity Sales Less: Cost of sales Gross profit Less: Expenses Profit before tax Less: Tax Profit after tax 22,800 22,700 16,000 6,800 2,000 Statement of Comprehensive Income For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 22,800 22,700 10,000 5,000 7,700 6,000 2,200 12,000 9,000 6,000 4,000 3,800 1,380 2,420 8,300 5,000 2,200 2,800 800 2,000 5,000 1,000 2,300 8,300 6,500 2,500 4,000 2,800 1,200 400 800 Less: Statement of Changes in Equity (extracts only) For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 Revaluation reserve: Beginning balance Profit for the year Ending balance Retained profits: Beginning balance Profit for the year Dividends Ending balance - 2,000 3,000 5,000 5,080 2,420 (700) 6,800 7,700 5,700 2,000 0 1,000 1,000 1,500 800 2,300 In 2021, Parent sold goods invoiced at S$600,000 to Subsi and sold goods invoiced at S$150,000 to Assoc. On 31 December 2021, there are unrealised profits (arising from the intragroup sales) of $200,000 in Subsi's stock, and S$50,000 in Assoc's stock. Ignore the tax effect arising from consolidation adjustments. On 1 January 2018, Parent extended an interest-free loan of RM2,000,000 to Subsi, for which repayment was not scheduled. This loan has been properly accounted for as part of Parent's net investment in a foreign operation in the respective financial statements of Parent and Subsi. Additional information regarding Subsi's financial statements: (a) (b) (d) (b) There was an accumulated translation loss of S$1,500,000 and retained profit of S$3,180,000 in the 31 December 2020 translated balance sheet of Subsi. (c) Land was acquired in December 2014 for RM10,000,000. It was revalued to RM12,000,000 on 31 December 2017, and to RM15,000,000 on 31 December 2021. The ordinary shares of Subsi were issued at par of RM1.00 each in January 2011. The relevant exchange rates between RM and S$ are as follows: RM1.00 = S$0.45 RM1.00 S$0.40 RM1.00 = S$0.30 RM1.00 S$0.35 Additional information regarding Assoc's financial statements: (a) 1 January 2018 31 December 2020 31 December 2021 Average for 2021 The land was purchased in 2016 for cash consideration of HK$5,000,000 and revalued to HK$6,000,000 on 31 December 2021. Assoc was incorporated in 2011 with a paid-up capital of 5,000,000 ordinary shares. The relevant exchange rates between HK$ and S$ were as follows: 1 January 2021 31 December 2021 Average for 2021 HK$1.00 S$0.20 HK$1.00 S$0.30 HK$1.00 = S$0.25 Required: (a) (b) Prepare all the consolidation journal entries necessary for the preparation of the consolidated financial statements of Parent Ltd group for the financial year 2021. (25 marks) Prepare the Consolidated Statement of Financial Position, and the Consolidated Statement of Comprehensive Income for Parent Ltd Group for the financial year 2021. Note: You are not required to prepare the Consolidated Statement of Changes in Equity. You are also not required to include the foreign currency translation worksheets or the individual translated financial statements of the Subsi and Assoc in your answer. (12 marks) (c) (d) Compute the amount of the following items to be presented in the consolidated financial statements of Parent Ltd group for the financial year 2021: (i) (ii) Translation gain/loss in the Consolidated Statement of Comprehensive Income; and Goodwill on consolidation. (7 marks) Prepare independent calculation to verify the following items in the consolidated financial statements of Parent Ltd group for the financial year 2021: Profit after tax attributable to the shareholders of Parent Ltd; (i) (ii) Profit after tax attributable to non-controlling interest; (iii) Retained profit in the Consolidated Statement of Financial Position; (iv) Non-controlling interests in the Consolidated Statement of Financial Position; Translation reserve in the Consolidated Statement of Financial Position; (v) (vi) Investment in associate in the Consolidated Statement of Financial Position; and (vii) Revaluation reserve in the Consolidated Statement of Financial Position. (24 marks) Parent Pte Ltd (Parent), a company incorporated in Singapore, is preparing its consolidated financial statements for the financial year ended 31 December 2021. It has control over its Subsidiary Bhd (Subsi), a company incorporated in Malaysia, and has significant influence over its Associate Ltd (Assoc), a company incorporated in Hong Kong. The accounting standards adopted by Subsi and Assoc are very similar to the FRS in Singapore (SFRS). As such, there is no adjustment required to make Subsi's and Assoc's financial statements to comply with SFRS. Parent acquired 80% interest in Subsi on 1 January 2018. On this date, Subsi's net assets were represented by share capital of RM10,000,000, revaluation reserve of RM2,000,000 and retained profit of RM4,000,000. Parent acquired 30% interest in Assoc on 1 January 2021. The functional/presentation currencies of Parent, Subsi and Assoc are respectively Singapore Dollar (S$), Ringgit Malaysia (RM) and Hong Kong Dollar (HK$). Parent has adopted FRS 21 and FRS 103 since 1 January 2018. There has been no impairment on goodwill. The financial statements of Parent, Subsi and Assoc for the year 2021 are as follows. Statement of Financial Position As at 31 December 2021 Non-current assets Land Machinery Accumulated depreciation Investment in Subsi Equity loan to Subsi Investment in associate Current assets Stock Trade debtors Cash Current liabilities Trade creditors Tax payable Net current assets Parent Subsi Assoc S$'000 RM'000 HK$'000 15,000 18,000 6,000 (5,000) (2,400) 6,750 600 650 - 1,140 900 2,040 6,000 600 1,350 1,950 - 1,770 5,200 2,600 1,690 2,200 700 380 650 400 3,840 8,050 3,700 - 1,050 350 1,400 1,800 6,100 2,300 Non-current liabilities Equity loan from Parent Net assets Share capital Revaluation reserve Retained profit Shareholders' equity Sales Less: Cost of sales Gross profit Less: Expenses Profit before tax Less: Tax Profit after tax 22,800 22,700 16,000 6,800 2,000 Statement of Comprehensive Income For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 22,800 22,700 10,000 5,000 7,700 6,000 2,200 12,000 9,000 6,000 4,000 3,800 1,380 2,420 8,300 5,000 2,200 2,800 800 2,000 5,000 1,000 2,300 8,300 6,500 2,500 4,000 2,800 1,200 400 800 Less: Statement of Changes in Equity (extracts only) For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 Revaluation reserve: Beginning balance Profit for the year Ending balance Retained profits: Beginning balance Profit for the year Dividends Ending balance - 2,000 3,000 5,000 5,080 2,420 (700) 6,800 7,700 5,700 2,000 0 1,000 1,000 1,500 800 2,300 In 2021, Parent sold goods invoiced at S$600,000 to Subsi and sold goods invoiced at S$150,000 to Assoc. On 31 December 2021, there are unrealised profits (arising from the intragroup sales) of $200,000 in Subsi's stock, and S$50,000 in Assoc's stock. Ignore the tax effect arising from consolidation adjustments. On 1 January 2018, Parent extended an interest-free loan of RM2,000,000 to Subsi, for which repayment was not scheduled. This loan has been properly accounted for as part of Parent's net investment in a foreign operation in the respective financial statements of Parent and Subsi. Additional information regarding Subsi's financial statements: (a) (b) (d) (b) There was an accumulated translation loss of S$1,500,000 and retained profit of S$3,180,000 in the 31 December 2020 translated balance sheet of Subsi. (c) Land was acquired in December 2014 for RM10,000,000. It was revalued to RM12,000,000 on 31 December 2017, and to RM15,000,000 on 31 December 2021. The ordinary shares of Subsi were issued at par of RM1.00 each in January 2011. The relevant exchange rates between RM and S$ are as follows: RM1.00 = S$0.45 RM1.00 S$0.40 RM1.00 = S$0.30 RM1.00 S$0.35 Additional information regarding Assoc's financial statements: (a) 1 January 2018 31 December 2020 31 December 2021 Average for 2021 The land was purchased in 2016 for cash consideration of HK$5,000,000 and revalued to HK$6,000,000 on 31 December 2021. Assoc was incorporated in 2011 with a paid-up capital of 5,000,000 ordinary shares. The relevant exchange rates between HK$ and S$ were as follows: 1 January 2021 31 December 2021 Average for 2021 HK$1.00 S$0.20 HK$1.00 S$0.30 HK$1.00 = S$0.25 Required: (a) (b) Prepare all the consolidation journal entries necessary for the preparation of the consolidated financial statements of Parent Ltd group for the financial year 2021. (25 marks) Prepare the Consolidated Statement of Financial Position, and the Consolidated Statement of Comprehensive Income for Parent Ltd Group for the financial year 2021. Note: You are not required to prepare the Consolidated Statement of Changes in Equity. You are also not required to include the foreign currency translation worksheets or the individual translated financial statements of the Subsi and Assoc in your answer. (12 marks) (c) (d) Compute the amount of the following items to be presented in the consolidated financial statements of Parent Ltd group for the financial year 2021: (i) (ii) Translation gain/loss in the Consolidated Statement of Comprehensive Income; and Goodwill on consolidation. (7 marks) Prepare independent calculation to verify the following items in the consolidated financial statements of Parent Ltd group for the financial year 2021: Profit after tax attributable to the shareholders of Parent Ltd; (i) (ii) Profit after tax attributable to non-controlling interest; (iii) Retained profit in the Consolidated Statement of Financial Position; (iv) Non-controlling interests in the Consolidated Statement of Financial Position; Translation reserve in the Consolidated Statement of Financial Position; (v) (vi) Investment in associate in the Consolidated Statement of Financial Position; and (vii) Revaluation reserve in the Consolidated Statement of Financial Position. (24 marks) Parent Pte Ltd (Parent), a company incorporated in Singapore, is preparing its consolidated financial statements for the financial year ended 31 December 2021. It has control over its Subsidiary Bhd (Subsi), a company incorporated in Malaysia, and has significant influence over its Associate Ltd (Assoc), a company incorporated in Hong Kong. The accounting standards adopted by Subsi and Assoc are very similar to the FRS in Singapore (SFRS). As such, there is no adjustment required to make Subsi's and Assoc's financial statements to comply with SFRS. Parent acquired 80% interest in Subsi on 1 January 2018. On this date, Subsi's net assets were represented by share capital of RM10,000,000, revaluation reserve of RM2,000,000 and retained profit of RM4,000,000. Parent acquired 30% interest in Assoc on 1 January 2021. The functional/presentation currencies of Parent, Subsi and Assoc are respectively Singapore Dollar (S$), Ringgit Malaysia (RM) and Hong Kong Dollar (HK$). Parent has adopted FRS 21 and FRS 103 since 1 January 2018. There has been no impairment on goodwill. The financial statements of Parent, Subsi and Assoc for the year 2021 are as follows. Statement of Financial Position As at 31 December 2021 Non-current assets Land Machinery Accumulated depreciation Investment in Subsi Equity loan to Subsi Investment in associate Current assets Stock Trade debtors Cash Current liabilities Trade creditors Tax payable Net current assets Parent Subsi Assoc S$'000 RM'000 HK$'000 15,000 18,000 6,000 (5,000) (2,400) 6,750 600 650 - 1,140 900 2,040 6,000 600 1,350 1,950 - 1,770 5,200 2,600 1,690 2,200 700 380 650 400 3,840 8,050 3,700 - 1,050 350 1,400 1,800 6,100 2,300 Non-current liabilities Equity loan from Parent Net assets Share capital Revaluation reserve Retained profit Shareholders' equity Sales Less: Cost of sales Gross profit Less: Expenses Profit before tax Less: Tax Profit after tax 22,800 22,700 16,000 6,800 2,000 Statement of Comprehensive Income For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 22,800 22,700 10,000 5,000 7,700 6,000 2,200 12,000 9,000 6,000 4,000 3,800 1,380 2,420 8,300 5,000 2,200 2,800 800 2,000 5,000 1,000 2,300 8,300 6,500 2,500 4,000 2,800 1,200 400 800 Less: Statement of Changes in Equity (extracts only) For the financial year ended 31 December 2021 Parent Subsi Assoc S$'000 RM'000 HK$'000 Revaluation reserve: Beginning balance Profit for the year Ending balance Retained profits: Beginning balance Profit for the year Dividends Ending balance - 2,000 3,000 5,000 5,080 2,420 (700) 6,800 7,700 5,700 2,000 0 1,000 1,000 1,500 800 2,300 In 2021, Parent sold goods invoiced at S$600,000 to Subsi and sold goods invoiced at S$150,000 to Assoc. On 31 December 2021, there are unrealised profits (arising from the intragroup sales) of $200,000 in Subsi's stock, and S$50,000 in Assoc's stock. Ignore the tax effect arising from consolidation adjustments. On 1 January 2018, Parent extended an interest-free loan of RM2,000,000 to Subsi, for which repayment was not scheduled. This loan has been properly accounted for as part of Parent's net investment in a foreign operation in the respective financial statements of Parent and Subsi. Additional information regarding Subsi's financial statements: (a) (b) (d) (b) There was an accumulated translation loss of S$1,500,000 and retained profit of S$3,180,000 in the 31 December 2020 translated balance sheet of Subsi. (c) Land was acquired in December 2014 for RM10,000,000. It was revalued to RM12,000,000 on 31 December 2017, and to RM15,000,000 on 31 December 2021. The ordinary shares of Subsi were issued at par of RM1.00 each in January 2011. The relevant exchange rates between RM and S$ are as follows: RM1.00 = S$0.45 RM1.00 S$0.40 RM1.00 = S$0.30 RM1.00 S$0.35 Additional information regarding Assoc's financial statements: (a) 1 January 2018 31 December 2020 31 December 2021 Average for 2021 The land was purchased in 2016 for cash consideration of HK$5,000,000 and revalued to HK$6,000,000 on 31 December 2021. Assoc was incorporated in 2011 with a paid-up capital of 5,000,000 ordinary shares. The relevant exchange rates between HK$ and S$ were as follows: 1 January 2021 31 December 2021 Average for 2021 HK$1.00 S$0.20 HK$1.00 S$0.30 HK$1.00 = S$0.25 Required: (a) (b) Prepare all the consolidation journal entries necessary for the preparation of the consolidated financial statements of Parent Ltd group for the financial year 2021. (25 marks) Prepare the Consolidated Statement of Financial Position, and the Consolidated Statement of Comprehensive Income for Parent Ltd Group for the financial year 2021. Note: You are not required to prepare the Consolidated Statement of Changes in Equity. You are also not required to include the foreign currency translation worksheets or the individual translated financial statements of the Subsi and Assoc in your answer. (12 marks) (c) (d) Compute the amount of the following items to be presented in the consolidated financial statements of Parent Ltd group for the financial year 2021: (i) (ii) Translation gain/loss in the Consolidated Statement of Comprehensive Income; and Goodwill on consolidation. (7 marks) Prepare independent calculation to verify the following items in the consolidated financial statements of Parent Ltd group for the financial year 2021: Profit after tax attributable to the shareholders of Parent Ltd; (i) (ii) Profit after tax attributable to non-controlling interest; (iii) Retained profit in the Consolidated Statement of Financial Position; (iv) Non-controlling interests in the Consolidated Statement of Financial Position; Translation reserve in the Consolidated Statement of Financial Position; (v) (vi) Investment in associate in the Consolidated Statement of Financial Position; and (vii) Revaluation reserve in the Consolidated Statement of Financial Position. (24 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Journal entries for the preparation of the consolidated financial statements of Parent Ltd group for the financial year 2021 are as follows 1 January 2021 Parent Ltd Equity loan to Subsi 600 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started