Parfait Company acquired 90% of Sundae Corporation's 10,000 common shares for $90 per share on January 1, 2018. On that date, Sundae had share

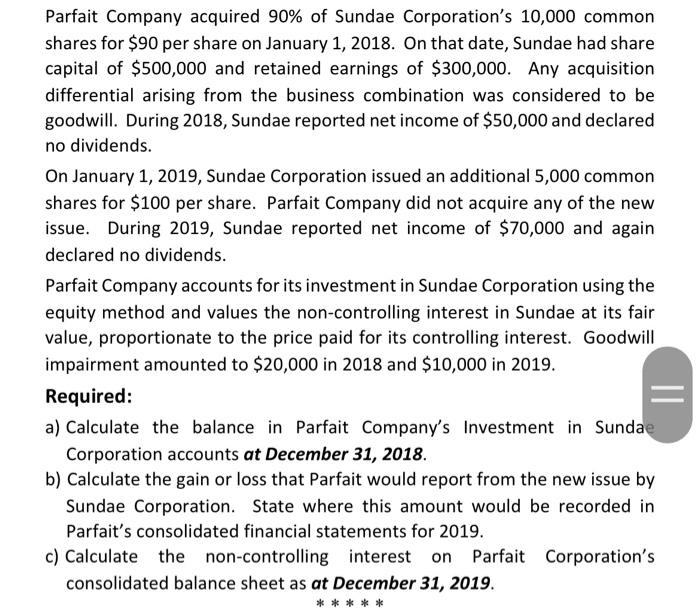

Parfait Company acquired 90% of Sundae Corporation's 10,000 common shares for $90 per share on January 1, 2018. On that date, Sundae had share capital of $500,000 and retained earnings of $300,000. Any acquisition differential arising from the business combination was considered to be goodwill. During 2018, Sundae reported net income of $50,000 and declared no dividends. On January 1, 2019, Sundae Corporation issued an additional 5,000 common shares for $100 per share. Parfait Company did not acquire any of the new issue. During 2019, Sundae reported net income of $70,000 and again declared no dividends. Parfait Company accounts for its investment in Sundae Corporation using the equity method and values the non-controlling interest in Sundae at its fair value, proportionate to the price paid for its controlling interest. Goodwill impairment amounted to $20,000 in 2018 and $10,000 in 2019. Required: a) Calculate the balance in Parfait Company's Investment in Sundae Corporation accounts at December 31, 2018. b) Calculate the gain or loss that Parfait would report from the new issue by Sundae Corporation. State where this amount would be recorded in Parfait's consolidated financial statements for 2019. c) Calculate the non-controlling interest on Parfait Corporation's consolidated balance sheet as at December 31, 2019. *****

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of Parfait Companys Investment in Sundae Corporation as of December 31 2018 Purchase price per share 90 Number of shares acquired 9000 9...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started