Question

Park Corporation is planning to issue bonds with a face value of $790,000 and a coupon rate of 7.5 percent. The bonds mature in

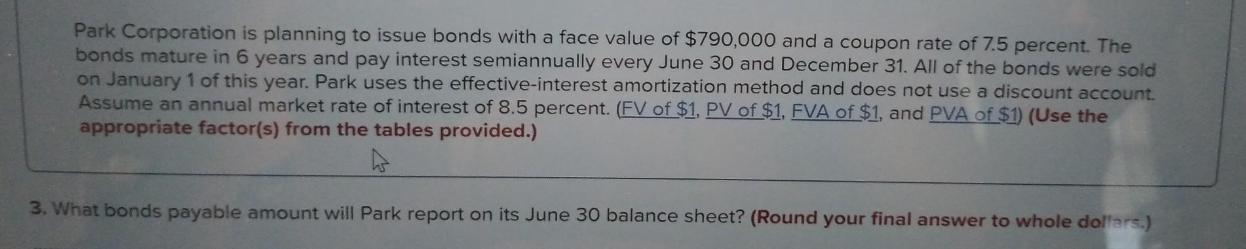

Park Corporation is planning to issue bonds with a face value of $790,000 and a coupon rate of 7.5 percent. The bonds mature in 6 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Park uses the effective-interest amortization method and does not use a discount account. Assume an annual market rate of interest of 8.5 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) 3. What bonds payable amount will Park report on its June 30 balance sheet? (Round your final answer to whole dollars.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Frank Hodge

11th Edition

1264229739, 9781264229734

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App