Question

Park Ltd is a retail company based in Shanghai. The company has a subsidiary, Sung Ltd, which complements the parent business in the retailing process.

Park Ltd is a retail company based in Shanghai. The company has a subsidiary, Sung Ltd, which complements the parent business in the retailing process. Jing, the Group Accountant, has asked you to draft the company’s group accounts in two separate stages. Jing has emphasised that the company has a staff code of conduct, which requires staff to treat all company information as strictly confidential. The code permits reviewing reference material, conducting research, discussing and seeking advice about accounting procedures with others but does not allow sharing financial information with anyone except authorised staff. You observed that this sounds similar to the ethics required of you in the past for your university assignments. Jing warned that breaches of this code lead to disciplinary action and immediate dismissal.

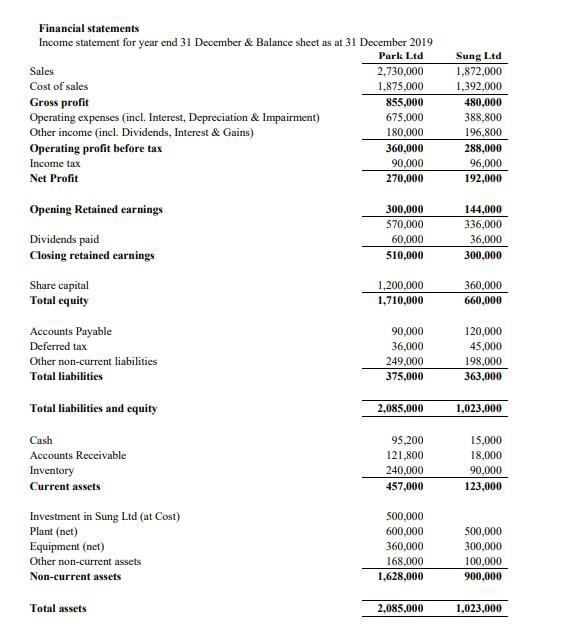

Jing provides you with the following information:

Consolidation:

The consolidated financial statements incorporate the financial statements of the subsidiary (Sung Ltd) of Park Ltd (“Parent”) as at the reporting date. Park Ltd and its subsidiary together are referred to in these financial statements as the “Group” or the consolidated entity. The subsidiary is included in the consolidated financial statements using the acquisition method of consolidation. It is fully consolidated from the date on which control is transferred to the Parent. The Group recognises non-controlling interest at its proportionate share of subsidiary net identifiable assets.

Stage 1

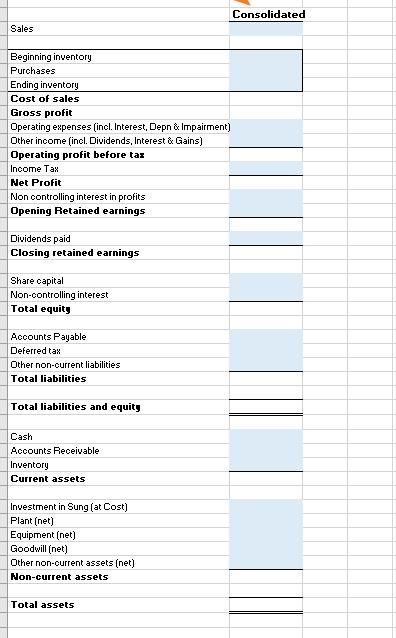

Required: Prepare the consolidated group financial statements for Park Ltd and Sung Ltd as at 31 December 2019, using the ‘Stage 1’ tab on the Excel template provided. Use only the information provided above, as Jing wants further detail on inter-group transactions left to be dealt with at ‘Stage 2’.

Stage 2

Now that you have considered the Stage 1 information and completed the relevant template for Jing’s review, he wants you to go on to consider consolidation adjustments for intra-group transactions in more detail. Jing wants to ensure you have the basics right before you go on to dealing with the impact of these adjustments on the consolidated financial statements. He tells you that profit on merchandise sales was 40%* for Park Ltd and 30%* for Sung Ltd for all sales transactions including inter-group transactions (* = as a percentage of sales). He has asked you to provide him with a spreadsheet showing the consolidation adjustments in journal form only for the following intra-group transactions during 2019:

1. Park Ltd sold inventories to Sung Ltd for $200,000.

2. Sung Ltd sold inventories to Park Ltd for $320,000.

3. $120,000 remained owing by Park Ltd at 31 December 2019 for the inventories sold to it by Sung Ltd.

4. Park Ltd’s inventories included merchandise bought from Sung Ltd of: a. $50,000 at the beginning of 2019, and b. $60,000 at the end of 2019.

5. Sung Ltd’s 2019 inventories included merchandise bought from Park Ltd of: a. Beginning: $30,000, and b. Closing: $35,000.

6. On 1 January 2019 Park Ltd sold an item of plant to Sung Ltd for $85,000 when it’s carrying amount in Park Ltd’s accounts was $60,000 (cost $100,000, accumulated depreciation of $40,000). This plant is assessed as having a remaining useful life of 5 years.

7. The ‘Other non-current assets’ on Park Ltd balance sheet includes a long-term loan to Sung Ltd of $50,000.

8. The terms of the loan to Sung Ltd require 5% annual interest payments. The loan was made on 1 January 2019 and interest is paid on 31 December each year.

Stage 2 Required: Prepare the consolidation journal entries only for the above intragroup transactions for the year ended 31 December 2019. Please use the “Stage 2” tab on the Excel template provided and adhere strictly to the following instructions:

a) You will need to choose the most appropriate accounts to which to post each journal adjustment.

b) Post a separate numbered journal entry for each numbered piece of information above i.e., your journal entries should be posted to the corresponding columns for the above numbers 1 – 8. For example, you will need to post a separate journal entry (Dr and Cr) for #3 and a separate journal entry (Dr and Cr) for #4a.

c) You are only required to prepare journal entries for Stage 2 i.e., Jing does not want you to adjust the Stage 1 figures until he has reviewed and authorised the journal entries.

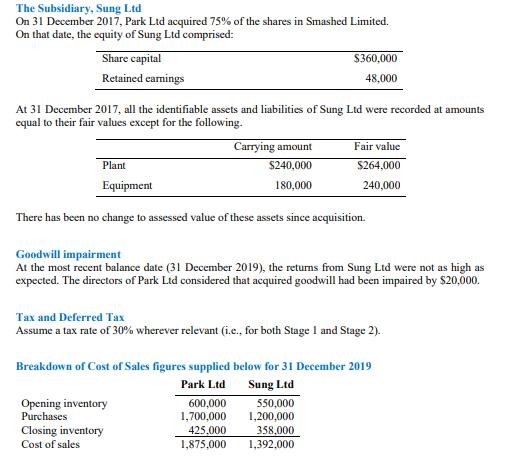

The Subsidiary, Sung Ltd On 31 December 2017, Park Ltd acquired 75% of the shares in Smashed Limited. On that date, the equity of Sung Ltd comprised: Share capital Retained earnings At 31 December 2017, all the identifiable assets and liabilities of Sung Ltd were recorded at amounts equal to their fair values except for the following. Plant Equipment Carrying amount $240,000 180,000 There has been no change to assessed value of these assets since acquisition. $360,000 48,000 Goodwill impairment At the most recent balance date (31 December 2019), the returns from Sung Ltd were not as high as expected. The directors of Park Ltd considered that acquired goodwill had been impaired by $20,000. Opening inventory Purchases Closing inventory Cost of sales Tax and Deferred Tax Assume a tax rate of 30% wherever relevant (i.e., for both Stage 1 and Stage 2). 600,000 1,700,000 425,000 1,875,000 Fair value $264,000 240,000 Breakdown of Cost of Sales figures supplied below for 31 December 2019 Park Ltd Sung Ltd 550,000 1,200,000 358,000 1,392,000

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 a Journal entry assuming dissolution Cash 1450000 Legal fees 20000 Common stock 1000000 Additional paidin capital 500000 Investment in Sand Company 898000 To record acquisition of Sand Company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started