Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parker Chemicals purchased a metal stamping machine 10 years ago for $120,000. It is fully depreciated. It can be sold today for $10,000. Last

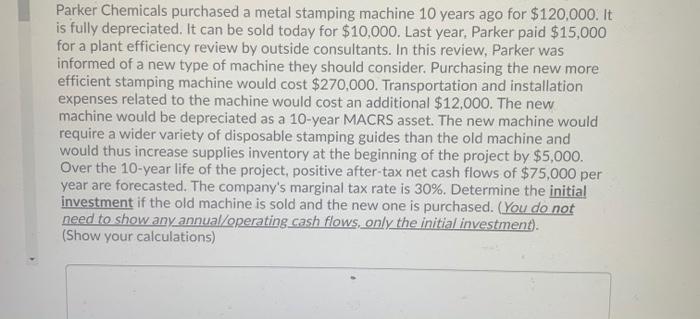

Parker Chemicals purchased a metal stamping machine 10 years ago for $120,000. It is fully depreciated. It can be sold today for $10,000. Last year, Parker paid $15,000 for a plant efficiency review by outside consultants. In this review, Parker was informed of a new type of machine they should consider. Purchasing the new more efficient stamping machine would cost $270,000. Transportation and installation expenses related to the machine would cost an additional $12,000. The new machine would be depreciated as a 10-year MACRS asset. The new machine would require a wider variety of disposable stamping guides than the old machine and would thus increase supplies inventory at the beginning of the project by $5,000. Over the 10-year life of the project, positive after-tax net cash flows of $75,000 per year are forecasted. The company's marginal tax rate is 30%. Determine the initial investment if the old machine is sold and the new one is purchased. (You do not need to show any annual/operating cash flows, only the initial investment). (Show your calculations)

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Solution Initial Investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started