Question

Parker Piano Company purchases a tract of land and an existing building for $1,000,000. The company plans to remove the old building and construct a

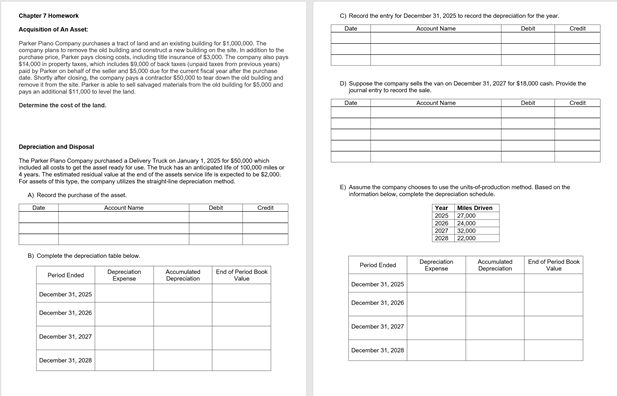

Parker Piano Company purchases a tract of land and an existing building for $1,000,000. The company plans to remove the old building and construct a new building on the site. In addition to the purchase price, Parker pays closing costs, including title insurance of $3,000. The company also pays $14,000 in property taxes, which includes $9,000 of back taxes (unpaid taxes from previous years) paid by Parker on behalf of the seller and $5,000 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $50,000 to tear down the old building and remove it from the site. Parker is able to sell salvaged materials from the old building for $5,000 and pays an additional $11,000 to level the land.

Determine the cost of the land.

Depreciation and Disposal

The Parker Piano Company purchased a Delivery Truck on January 1, 2025 for $50,000 which included all costs to get the asset ready for use. The truck has an anticipated life of 100,000 miles or 4 years. The estimated residual value at the end of the assets service life is expected to be $2,000. For assets of this type, the company utilizes the straight-line depreciation method.

- Record the purchase of the asset.

| Date | Account Name | Debit | Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Complete the depreciation table below.

| Period Ended | Depreciation Expense | Accumulated Depreciation | End of Period Book Value |

|

December 31, 2025 |

|

|

|

|

December 31, 2026 |

|

|

|

|

December 31, 2027 |

|

|

|

|

December 31, 2028

|

|

|

|

- Record the entry for December 31, 2025 to record the depreciation for the year.

| Date | Account Name | Debit | Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Suppose the company sells the van on December 31, 2027 for $18,000 cash. Provide the journal entry to record the sale.

| Date | Account Name | Debit | Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Assume the company chooses to use the units-of-production method. Based on the information below, complete the depreciation schedule.

| Year | Miles Driven |

| 2025 | 27,000 |

| 2026 | 24,000 |

| 2027 | 32,000 |

| 2028 | 22,000 |

| Period Ended | Depreciation Expense | Accumulated Depreciation | End of Period Book Value |

|

December 31, 2025 |

|

|

|

|

December 31, 2026 |

|

|

|

|

December 31, 2027 |

|

|

|

|

December 31, 2028

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started