Answered step by step

Verified Expert Solution

Question

1 Approved Answer

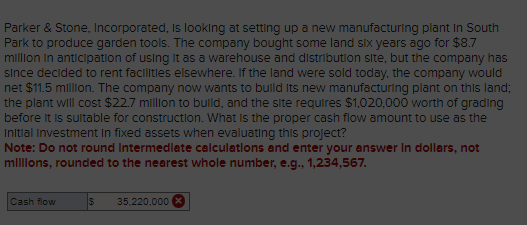

Parker & Stone, Incorporated, Is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land

Parker & Stone, Incorporated, Is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land six years ago for $ million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent facilitles elsewhere. If the land were sold today, the company would net $ million. The company now wants to bulld its new manufacturing plant on this land; the plant will cost $ million to bulld, and the site requires $ worth of grading before it is sultable for construction. What is the proper cash flow amount to use as the Initial Investment in fixed assets when evaluating this project? Note: Do not round Intermedlate calculatlons and enter your answer In dollars, not millions, rounded to the nearest whole number, eg Cash flow $

Parker & Stone, Incorporated, Is looking at setting up a new manufacturing plant in South

Park to produce garden tools. The company bought some land six years ago for $

million in anticipation of using it as a warehouse and distribution site, but the company has

since decided to rent facilitles elsewhere. If the land were sold today, the company would

net $ million. The company now wants to bulld its new manufacturing plant on this land;

the plant will cost $ million to bulld, and the site requires $ worth of grading

before it is sultable for construction. What is the proper cash flow amount to use as the

Initial Investment in fixed assets when evaluating this project?

Note: Do not round Intermedlate calculatlons and enter your answer In dollars, not

millions, rounded to the nearest whole number, eg

Cash flow

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started