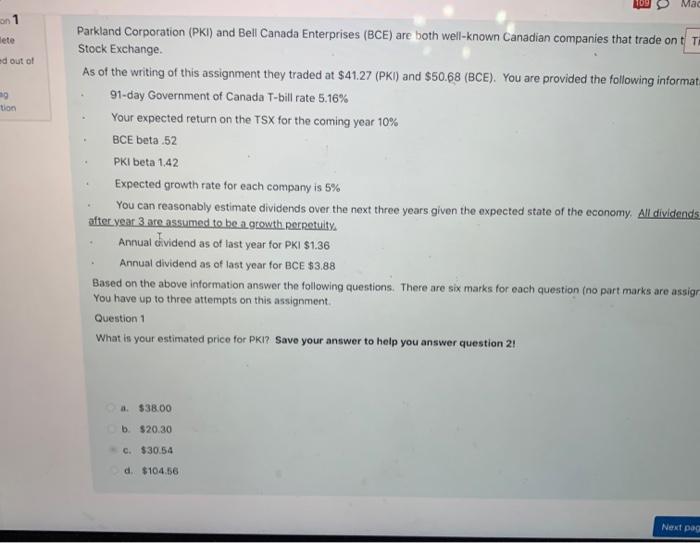

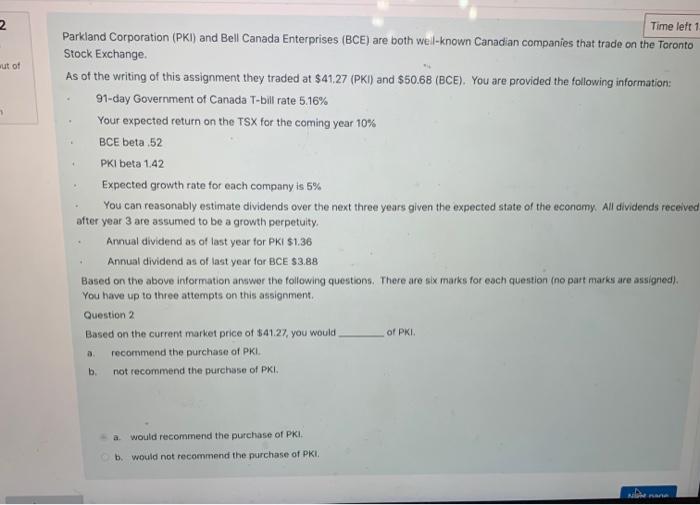

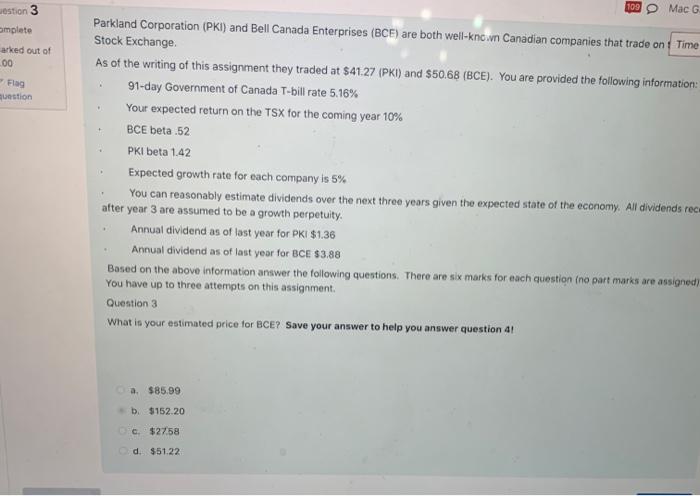

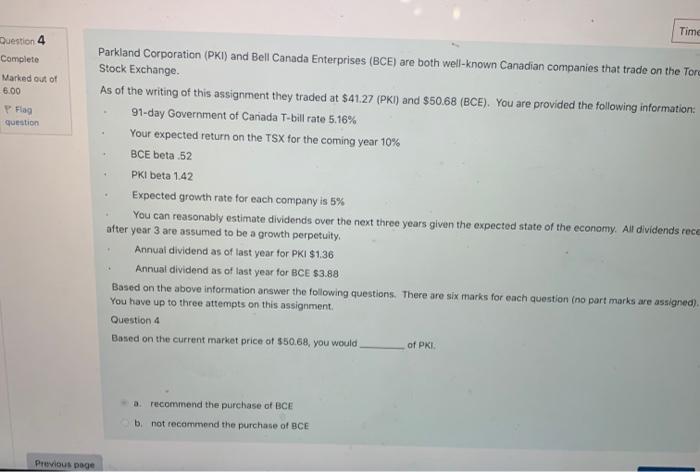

Parkland Corporation (PKI) and Bell Canada Enterprises (BCE) are both well-knoivn Canadian companies that trade on Stock Exchange. As of the writing of this assignment they traded at $41.27 (PKI) and $50.68 (BCE). You are provided the following information: 91-day Government of Canada T-bill rate 5.16% Your expected return on the TSX for the coming year 10% BCE beta . 52 PKI beta 1.42 Expected growth rate for each company is 5% You can reasonabiy estimate dividends over the next three years given the expected state of the economy. All dividends rec after year 3 are assumed to be a growh perpetuity. Annual dividend as of last year for PKI $1.36 Annual dividend as of last year for BCE $3.88 Based on the above information answer the following questions. There are six marks for each question (no part marks are assigned) You have up to three attempts on this assignment. Question 3 What is your estimated price for BCE? Save your answer to help you answer question 4 ! a. $85.99 b. $152.20 c. $2758 d. $51.22 Parkland Corporation (PKI) and Bell Canada Enterprises (BCE) are both well-known Canadian companies that trade on Stock Exchange. As of the writing of this assignment they traded at $41.27 (PKI) and $50.68 (BCE). You are provided the following informat 91-day Government of Canada T-bill rate 5.16% Your expected return on the TSX for the coming year 10% BCE beta .52 PKI beta 1.42 Expected growth rate for each company is 5% You can reasonably estimate dividends over the next three years given the expected state of the economy. All dividends after year 3 are assumed to bengrowth perpetuity, Annual cividend as of last year for PKI \$1.36 Annual dividend as of last year for BCE $3.88 Based on the above information answer the following questions. There are six marks for each question (no part marks are assigr You have up to three attempts on this assignment. Question 1 What is your estimated price for PKI? Save your answer to help you answer question 2 ! a. $38.00 b. $20.30 c. $30.54 d. $104.56 Question 4 Camplete Marked out of 6.00 Flap question Parkland Corporation (PKI) and Bell Canada Enterprises (BCE) are both well-known Canadian companies that trade on the Tor Stock Exchange. As of the writing of this assignment they traded at $41.27 (PKI) and $50.68 (BCE). You are provided the following information: 91-day Government of Canada T-bill rate 5.16% Your expected return on the TSX for the coming year 10% BCE beta 52 PKI beta 1.42 Expected growth rate for each company is 5% You can reasonably estimate dividends over the next three years given the expected state of the economy. All dividends rect after year 3 are assumed to be a growth perpetuity. Annual dividend as of last year for PKI $1,36 Annual dividend as of last year for BCE $3.88 Based on the above information answer the following questions. There are six marks for each question (no part marks are assigned). You have up to three attempts on this assignment. Question 4 Based on the current market price of $50.68, you would of PKI. a. recommend the purchase of BCE b. not recommend the purchase of BCE Parkland Corporation (PKI) and Bell Canada Enterprises (BCE) are both weil-known Canadian companies that trade on the Toronto Stock Exchange. As of the writing of this assignment they traded at $41.27 (PKI) and $50.68 (BCE), You are provided the following information: 91-day Government of Canada T-bill rate 5.16% Your expected return on the TSX for the coming year 10% BCE beta 52 PKI beta 1.42 Expected growth rate for each company is 5% You can reasonably estimate dividends over the next three years given the expected state of the economy. All dividends received after year 3 are assumed to be a growth perpetuity. Annual dividend as of last year for PKI $1.36 Annual dividend as of last year for BCE $3.88 Based on the above information answer the following questions. There are six marks for each question (no part marks are assigned). You have up to three attempts on this assignment. Question 2 Based on the current market price of $41.27, you would of PKI. a. recommend the purchase of PKL. b. not recommend the purchase of PKI