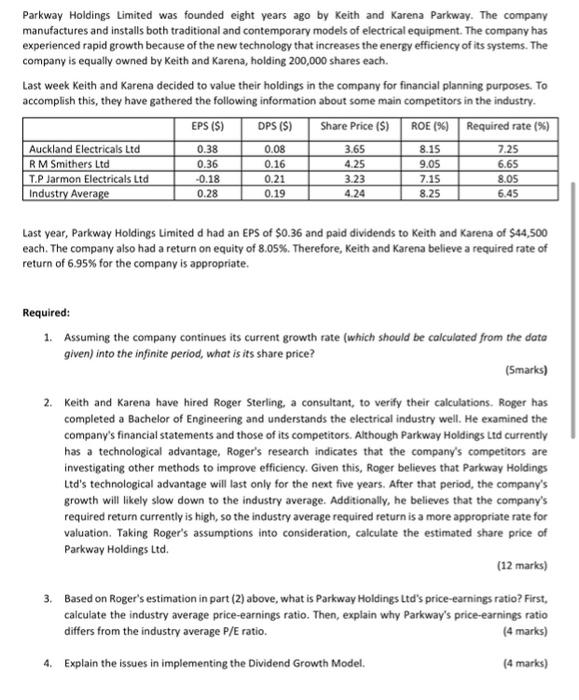

Parkway Holdings Limited was founded eight years ago by Keith and Karena Parkway. The company manufactures and installs both traditional and contemporary models of electrical equipment. The company has experienced rapid growth because of the new technology that increases the energy efficiency of its systems. The company is equally owned by Keith and Karena, holding 200,000 shares each. Last week Keith and Karena decided to value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about some main competitors in the industry. Last year, Parkway Holdings Limited d had an EPS of $0.36 and paid dividends to Keith and Karena of $44,500 each. The company also had a return on equity of 8.05%. Therefore, Keith and Karena believe a required rate of return of 6.95% for the company is appropriate. Required: 1. Assuming the company continues its current growth rate (which should be calculated from the dato given) into the infinite period, what is its share price? (Smarks) 2. Keith and Karena have hired Roger Sterling, a consultant, to verify their calculations. Roger has completed a Bachelor of Engineering and understands the electrical industry well. He examined the company's financial statements and those of its competitors. Although Parkway Holdings Ltd currently has a technological advantage, Roger's research indicates that the company's competitors are investigating other methods to improve efficiency. Given this, Roger believes that Parkway Holdings Ltd's technological advantage will last only for the next five years. After that period, the company's growth will likely slow down to the industry average. Additionally, he believes that the company's required return currently is high, so the industry average required return is a more appropriate rate for valuation. Taking Roger's assumptions into consideration, calculate the estimated share price of Parkway Holdings Ltd. (12 marks) 3. Based on Roger's estimation in part (2) above, what is Parkway Holdings Ltd's price-earnings ratio? First, calculate the industry average price-earnings ratio. Then, explain why Parkway's price-earnings ratio differs from the industry average P/E ratio. (4 marks) 4. Explain the issues in implementing the Dividend Growth Model. (4 marks) Parkway Holdings Limited was founded eight years ago by Keith and Karena Parkway. The company manufactures and installs both traditional and contemporary models of electrical equipment. The company has experienced rapid growth because of the new technology that increases the energy efficiency of its systems. The company is equally owned by Keith and Karena, holding 200,000 shares each. Last week Keith and Karena decided to value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about some main competitors in the industry. Last year, Parkway Holdings Limited d had an EPS of $0.36 and paid dividends to Keith and Karena of $44,500 each. The company also had a return on equity of 8.05%. Therefore, Keith and Karena believe a required rate of return of 6.95% for the company is appropriate. Required: 1. Assuming the company continues its current growth rate (which should be calculated from the dato given) into the infinite period, what is its share price? (Smarks) 2. Keith and Karena have hired Roger Sterling, a consultant, to verify their calculations. Roger has completed a Bachelor of Engineering and understands the electrical industry well. He examined the company's financial statements and those of its competitors. Although Parkway Holdings Ltd currently has a technological advantage, Roger's research indicates that the company's competitors are investigating other methods to improve efficiency. Given this, Roger believes that Parkway Holdings Ltd's technological advantage will last only for the next five years. After that period, the company's growth will likely slow down to the industry average. Additionally, he believes that the company's required return currently is high, so the industry average required return is a more appropriate rate for valuation. Taking Roger's assumptions into consideration, calculate the estimated share price of Parkway Holdings Ltd. (12 marks) 3. Based on Roger's estimation in part (2) above, what is Parkway Holdings Ltd's price-earnings ratio? First, calculate the industry average price-earnings ratio. Then, explain why Parkway's price-earnings ratio differs from the industry average P/E ratio. (4 marks) 4. Explain the issues in implementing the Dividend Growth Model. (4 marks)