Answered step by step

Verified Expert Solution

Question

1 Approved Answer

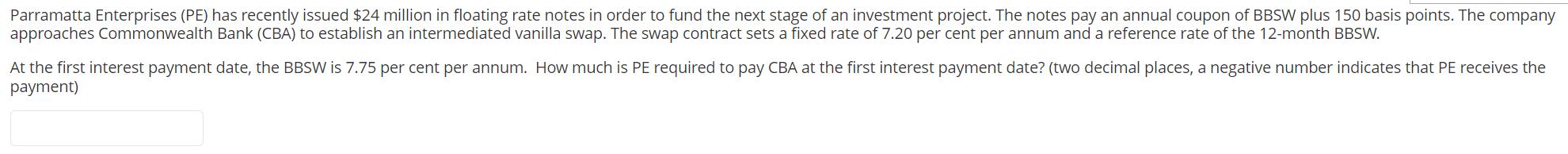

Parramatta Enterprises (PE) has recently issued $24 million in floating rate notes in order to fund the next stage of an investment project. The

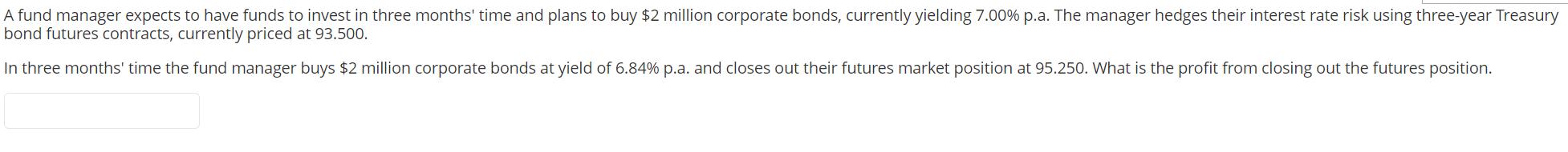

Parramatta Enterprises (PE) has recently issued $24 million in floating rate notes in order to fund the next stage of an investment project. The notes pay an annual coupon of BBSW plus 150 basis points. The company approaches Commonwealth Bank (CBA) to establish an intermediated vanilla swap. The swap contract sets a fixed rate of 7.20 per cent per annum and a reference rate of the 12-month BBSW. At the first interest payment date, the BBSW is 7.75 per cent per annum. How much is PE required to pay CBA at the first interest payment date? (two decimal places, a negative number indicates that PE receives the payment) A fund manager expects to have funds to invest in three months' time and plans to buy $2 million corporate bonds, currently yielding 7.00% p.a. The manager hedges their interest rate risk using three-year Treasury bond futures contracts, currently priced at 93.500. In three months' time the fund manager buys $2 million corporate bonds at yield of 6.84% p.a. and closes out their futures market position at 95.250. What is the profit from closing out the futures position.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

For the first question we need to calculate the interest payment on the floating rate notes and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started