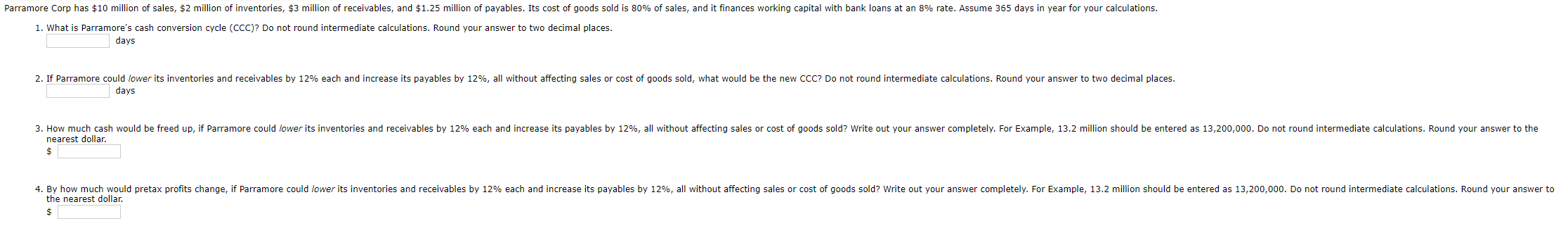

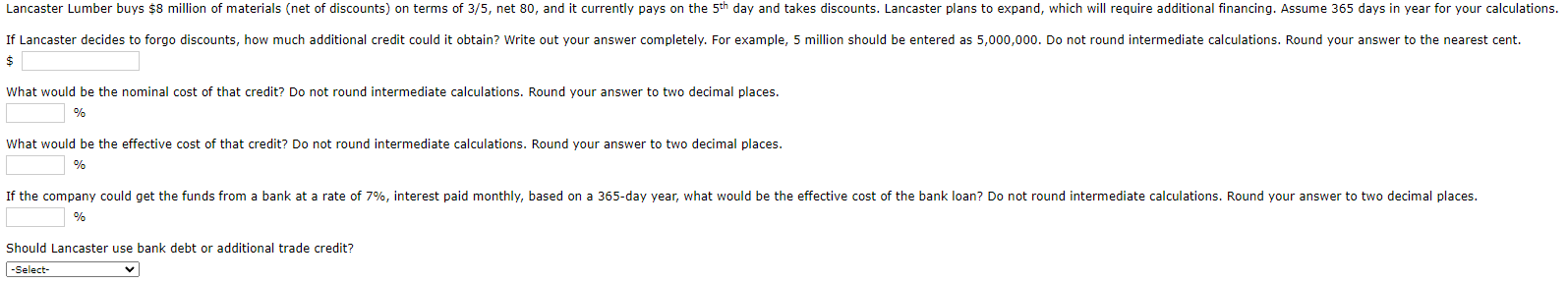

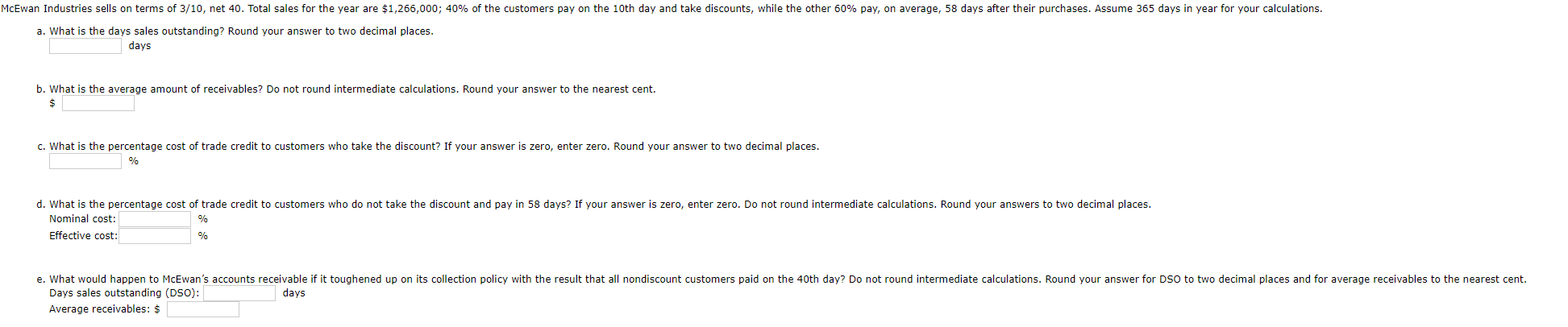

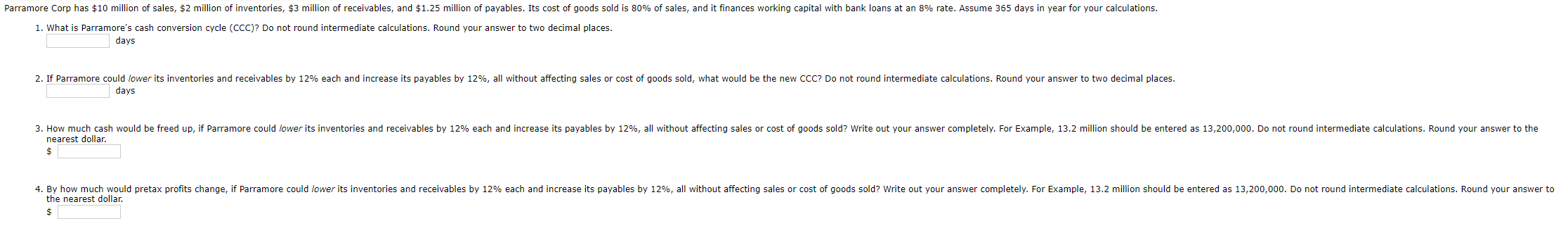

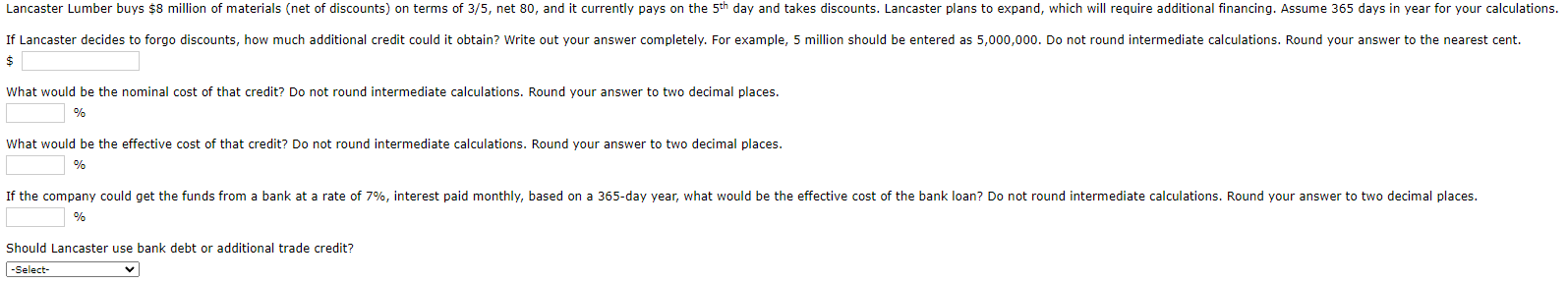

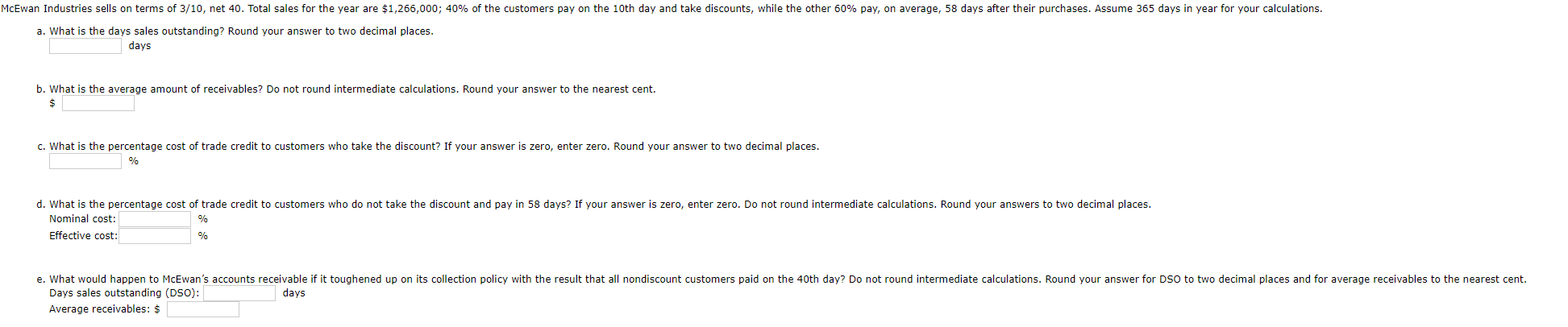

Parramore Corp has $10 million of sales, $2 million of inventories, $3 million of receivables, and $1.25 million of payables. Its cost of goods sold is 80% of sales, and it finances working capital with bank loans at an 8% rate. Assume 365 days in year for your calculations. 1. What is Parramore's cash conversion cycle (CCC)? Do not round intermediate calculations. Round your answer to two decimal places. days 2. If Parramore could lower its inventories and receivables by 12% each and increase its payables by 12%, all without affecting sales or cost of goods sold, what would be the new CCC? Do not round intermediate calculations. Round your answer to two decimal places. days 3. How much cash would be freed up, if Parramore could lower its inventories and receivables by 12% each and increase its payables by 12%, all without affecting sales or cost of goods sold? Write out your answer completely. For example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $ 4. By how much would pretax profits change, if Parramore could lower its inventories and receivables by 12% each and increase its payables by 12%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $ Lancaster Lumber buys $8 million of materials (net of discounts) on terms of 3/5, net 80, and it currently pays on the 5th day and takes discounts. Lancaster plans to expand, which will require additional financing. Assume 365 days in year for your calculations. If Lancaster decides to forgo discounts, how much additional credit could it obtain? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. $ What would be the nominal cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. What would be the effective cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. If the company could get the funds from a bank at a rate of 7%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your answer to two decimal places. Should Lancaster use bank debt or additional trade credit? -Select- McEwan Industries sells on terms of 3/10, net 40. Total sales for the year are $1,266,000; 40% of the customers pay on the 10th day and take discounts, while the other 60% pay, on average, 58 days after their purchases. Assume 365 days in year for your calculations. a. What is the days sales outstanding? Round your answer to two decimal places. days b. What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What is the percentage cost of trade credit to customers who take the discount? If your answer is zero, enter zero. Round your answer to two decimal places. % d. What is the percentage cost of trade credit to customers who do not take the discount and pay in 58 days? If your answer is zero, enter zero. Do not round intermediate calculations. Round your answers to two decimal places. Nominal cost: % Effective cost: % e. What would happen to McEwan's accounts receivable if it toughened up on its collection policy with the result that all nondiscount customers paid on the 40th day? Do not round intermediate calculations. Round your answer for DSO to two decimal places and for average receivables to the nearest cent. Days sales outstanding (DSO): days Average receivables: $ Parramore Corp has $10 million of sales, $2 million of inventories, $3 million of receivables, and $1.25 million of payables. Its cost of goods sold is 80% of sales, and it finances working capital with bank loans at an 8% rate. Assume 365 days in year for your calculations. 1. What is Parramore's cash conversion cycle (CCC)? Do not round intermediate calculations. Round your answer to two decimal places. days 2. If Parramore could lower its inventories and receivables by 12% each and increase its payables by 12%, all without affecting sales or cost of goods sold, what would be the new CCC? Do not round intermediate calculations. Round your answer to two decimal places. days 3. How much cash would be freed up, if Parramore could lower its inventories and receivables by 12% each and increase its payables by 12%, all without affecting sales or cost of goods sold? Write out your answer completely. For example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $ 4. By how much would pretax profits change, if Parramore could lower its inventories and receivables by 12% each and increase its payables by 12%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $ Lancaster Lumber buys $8 million of materials (net of discounts) on terms of 3/5, net 80, and it currently pays on the 5th day and takes discounts. Lancaster plans to expand, which will require additional financing. Assume 365 days in year for your calculations. If Lancaster decides to forgo discounts, how much additional credit could it obtain? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. $ What would be the nominal cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. What would be the effective cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. If the company could get the funds from a bank at a rate of 7%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your answer to two decimal places. Should Lancaster use bank debt or additional trade credit? -Select- McEwan Industries sells on terms of 3/10, net 40. Total sales for the year are $1,266,000; 40% of the customers pay on the 10th day and take discounts, while the other 60% pay, on average, 58 days after their purchases. Assume 365 days in year for your calculations. a. What is the days sales outstanding? Round your answer to two decimal places. days b. What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What is the percentage cost of trade credit to customers who take the discount? If your answer is zero, enter zero. Round your answer to two decimal places. % d. What is the percentage cost of trade credit to customers who do not take the discount and pay in 58 days? If your answer is zero, enter zero. Do not round intermediate calculations. Round your answers to two decimal places. Nominal cost: % Effective cost: % e. What would happen to McEwan's accounts receivable if it toughened up on its collection policy with the result that all nondiscount customers paid on the 40th day? Do not round intermediate calculations. Round your answer for DSO to two decimal places and for average receivables to the nearest cent. Days sales outstanding (DSO): days Average receivables: $