Question

Parri Corp. has following transactions during July: a. Common stock of $4,000 was issued to a stockholder in exchange for equipment. b. Provided services

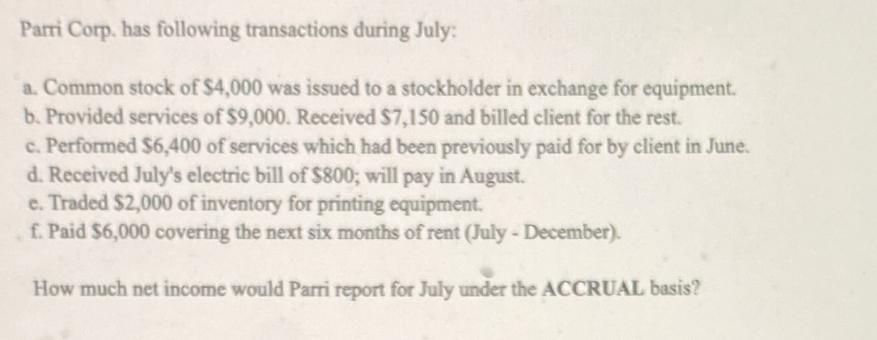

Parri Corp. has following transactions during July: a. Common stock of $4,000 was issued to a stockholder in exchange for equipment. b. Provided services of $9,000. Received $7,150 and billed client for the rest. c. Performed $6,400 of services which had been previously paid for by client in June. d. Received July's electric bill of $800; will pay in August. e. Traded $2,000 of inventory for printing equipment. f. Paid $6,000 covering the next six months of rent (July - December). How much net income would Parri report for July under the ACCRUAL basis?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the net income for July under the accrual basis we need to recognize revenue w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

3rd edition

978-1-119-3916, 1119392132, 1119392136, 9781119391609, 1119391601, 978-1119392132

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App