Question

Parrot Corporation acquired 90% of Swallow Co. on January 1, 2014 for $27,000 cash when Swallow's stockholders' equity consisted of $10,000 of Capital Stock and

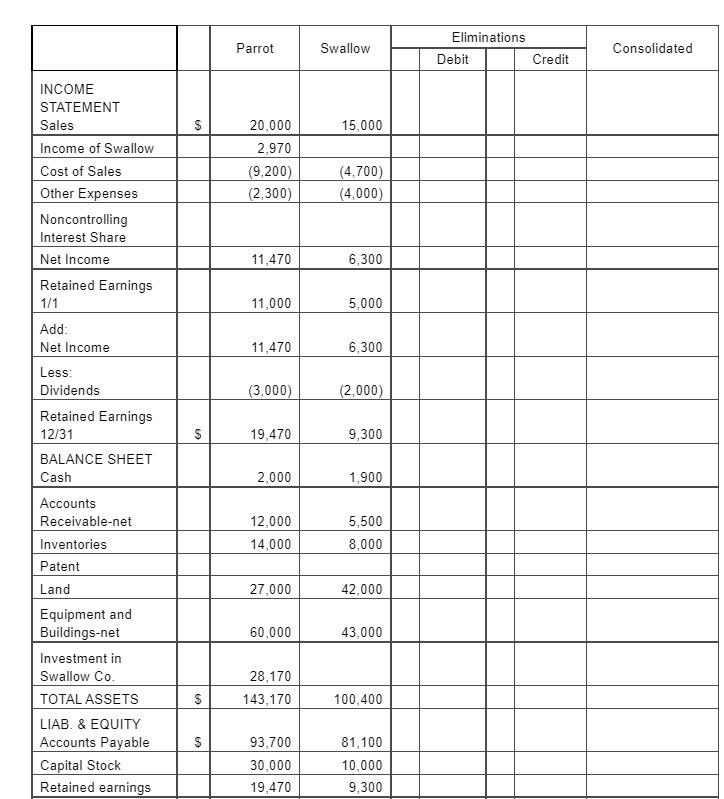

Parrot Corporation acquired 90% of Swallow Co. on January 1, 2014 for $27,000 cash when Swallow's stockholders' equity consisted of $10,000 of Capital Stock and $5,000 of Retained Earnings. The difference between the fair value and book value of Swallow's net assets was allocated solely to a patent amortized over 5 years. The separate company statements for Parrot and Swallow appear in the first two columns of the partially completed consolidation working papers.

Complete the consolidation working papers for Parrot and Swallow for the year 2014.

Eliminations Parrot Swallow Consolidated Debit Credit INCOME STATEMENT Sales 20,000 15,000 Income of Swallow 2,970 Cost of Sales (9,200) (4,700) (4,000) Other Expenses (2,300) Noncontrolling Interest Share Net Income 11,470 6,300 Retained Earnings 1/1 11,000 5,000 Add: Net Income 11,470 6,300 Less: Dividends (3,000) (2,000) Retained Earnings 12/31 19,470 9,300 BALANCE SHEET Cash 2,000 1,900 Accounts Receivable-net 12,000 5,500 Inventories 14,000 8,000 Patent Land 27,000 42,000 Equipment and Buildings-net 60,000 43,000 Investment in Swallow Co. 28,170 TOTAL ASSETS 143,170 100,400 LIAB. & EQUITY Accounts Payable 93,700 81,100 Capital Stock Retained earnings 30,000 10,000 19,470 9,300 %24

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started