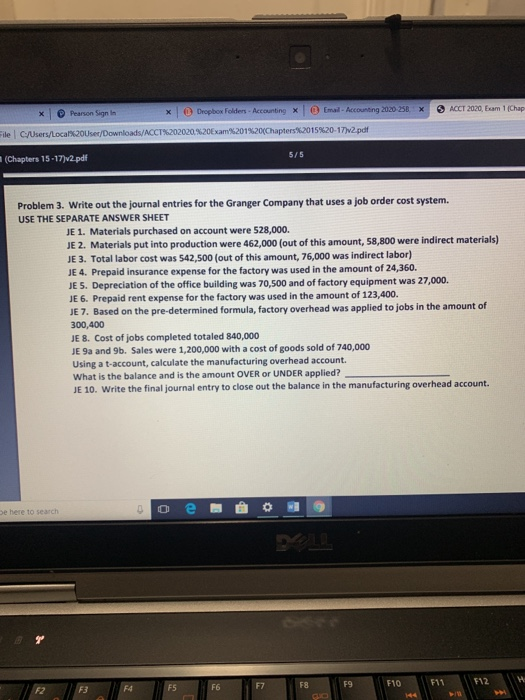

* Parson Sign in Dropbox Folders Accounting X Email Accounting 2020 BB X ACCT 2020. Esam 1(Cha File /Users/Local%20User/Downloads/ACCT%202020,%20Exam'.201%20(Chapters 2015%20-17)2.pdf (Chapters 15-17) 2.pdf 575 Problem 3. Write out the journal entries for the Granger Company that uses a job order cost system. USE THE SEPARATE ANSWER SHEET JE 1. Materials purchased on account were 528,000. JE 2. Materials put into production were 462,000 (out of this amount, 58,800 were indirect materials) JE 3. Total labor cost was 542,500 (out of this amount, 76,000 was indirect labor) JE 4. Prepaid insurance expense for the factory was used in the amount of 24,360. JE 5. Depreciation of the office building was 70,500 and of factory equipment was 27,000. JE 6. Prepaid rent expense for the factory was used in the amount of 123,400. JE 7. Based on the pre-determined formula, factory overhead was applied to jobs in the amount of 300,400 JE 8. Cost of jobs completed totaled 840,000 JE 9a and 9b. Sales were 1,200,000 with a cost of goods sold of 740,000 Using a t-account, calculate the manufacturing overhead account. What is the balance and is the amount OVER or UNDER applied? JE 10. Write the final journal entry to close out the balance in the manufacturing overhead account. ne here to search o e do F10 511 * Parson Sign in Dropbox Folders Accounting X Email Accounting 2020 BB X ACCT 2020. Esam 1(Cha File /Users/Local%20User/Downloads/ACCT%202020,%20Exam'.201%20(Chapters 2015%20-17)2.pdf (Chapters 15-17) 2.pdf 575 Problem 3. Write out the journal entries for the Granger Company that uses a job order cost system. USE THE SEPARATE ANSWER SHEET JE 1. Materials purchased on account were 528,000. JE 2. Materials put into production were 462,000 (out of this amount, 58,800 were indirect materials) JE 3. Total labor cost was 542,500 (out of this amount, 76,000 was indirect labor) JE 4. Prepaid insurance expense for the factory was used in the amount of 24,360. JE 5. Depreciation of the office building was 70,500 and of factory equipment was 27,000. JE 6. Prepaid rent expense for the factory was used in the amount of 123,400. JE 7. Based on the pre-determined formula, factory overhead was applied to jobs in the amount of 300,400 JE 8. Cost of jobs completed totaled 840,000 JE 9a and 9b. Sales were 1,200,000 with a cost of goods sold of 740,000 Using a t-account, calculate the manufacturing overhead account. What is the balance and is the amount OVER or UNDER applied? JE 10. Write the final journal entry to close out the balance in the manufacturing overhead account. ne here to search o e do F10 511