Question

Parsons Company wishes to liquidate the firm by distributing the companys cash to the three partners. Prior to the distribution of cash, the companys balances

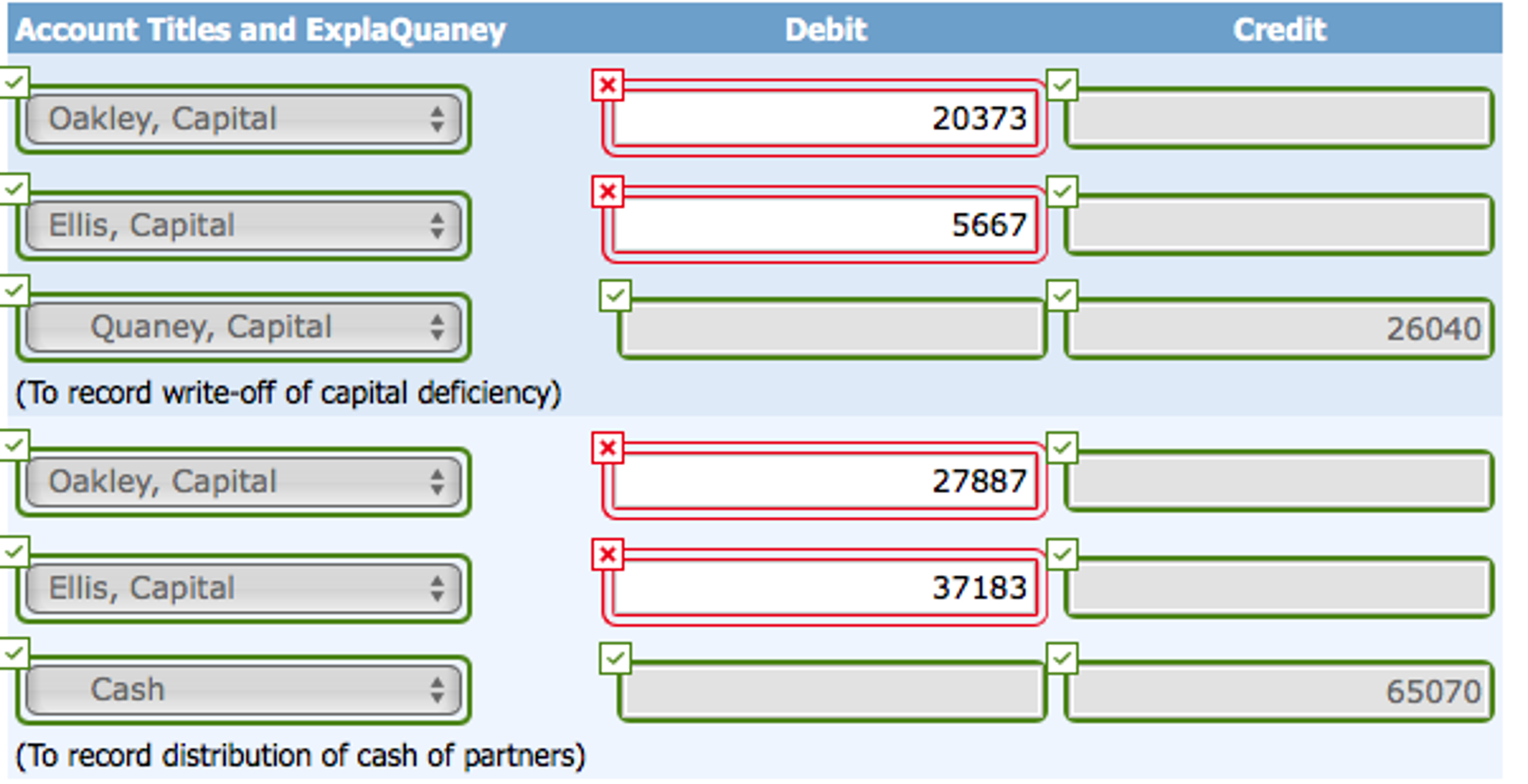

Parsons Company wishes to liquidate the firm by distributing the companys cash to the three partners. Prior to the distribution of cash, the companys balances are: Cash $65,070; Oakley, Capital (Cr.) $48,260; Quaney, Capital (Dr.) $26,040; and Ellis, Capital (Cr.) $42,850. The income ratios of the three partners are 3 : 3 : 4, respectively. Prepare the entry to record the absorption of Quaneys capital deficiency by the other partners and the distribution of cash to the partners with credit balances

I don't understand how to distribute the cash and capital with a 3:3:4 partnership after one partner is disolved and deficient!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started