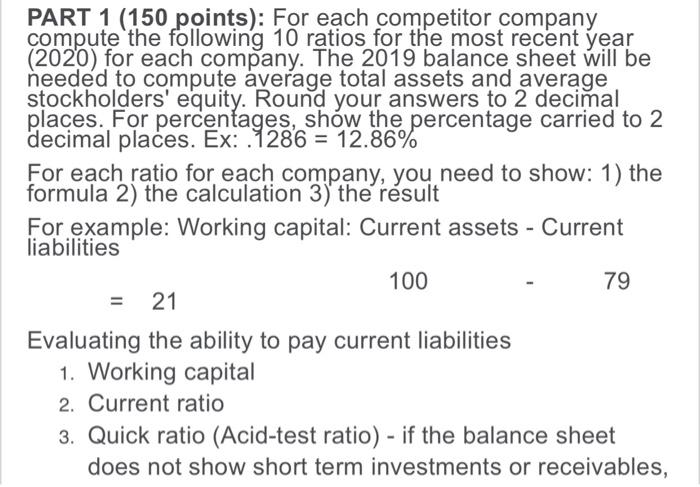

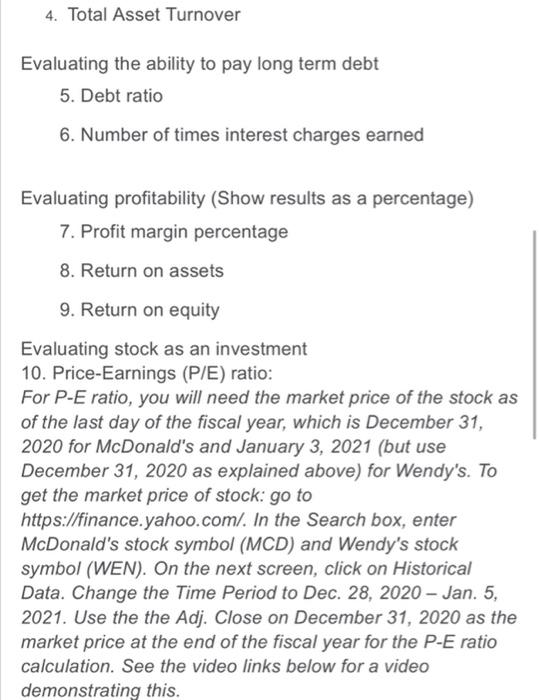

PART 1 (150 points): For each competitor company compute the following 10 ratios for the most recent year (2020) for each company. The 2019 balance sheet will be needed to compute average total assets and average stockholders' equity. Round your answers to 2 decimal places. For percentages, show the percentage carried to 2 decimal places. Ex: 1286 = 12.86% For each ratio for each company, you need to show: 1) the formula 2) the calculation 3) the result For example: Working capital: Current assets - Current liabilities 100 79 = 21 Evaluating the ability to pay current liabilities 1. Working capital 2. Current ratio 3. Quick ratio (Acid-test ratio) - if the balance sheet does not show short term investments or receivables, 4. Total Asset Turnover Evaluating the ability to pay long term debt 5. Debt ratio 6. Number of times interest charges earned Evaluating profitability (Show results as a percentage) 7. Profit margin percentage 8. Return on assets 9. Return on equity Evaluating stock as an investment 10. Price-Earnings (P/E) ratio: For P-E ratio, you will need the market price of the stock as of the last day of the fiscal year, which is December 31, 2020 for McDonald's and January 3, 2021 (but use December 31, 2020 as explained above) for Wendy's. To get the market price of stock: go to https://finance.yahoo.com/. In the Search box, enter McDonald's stock symbol (MCD) and Wendy's stock symbol (WEN). On the next screen, click on Historical Data. Change the Time Period to Dec. 28, 2020 - Jan. 5, 2021. Use the the Adj. Close on December 31, 2020 as the market price at the end of the fiscal year for the P-E ratio calculation. See the video links below for a video demonstrating this. PART 1 (150 points): For each competitor company compute the following 10 ratios for the most recent year (2020) for each company. The 2019 balance sheet will be needed to compute average total assets and average stockholders' equity. Round your answers to 2 decimal places. For percentages, show the percentage carried to 2 decimal places. Ex: 1286 = 12.86% For each ratio for each company, you need to show: 1) the formula 2) the calculation 3) the result For example: Working capital: Current assets - Current liabilities 100 79 = 21 Evaluating the ability to pay current liabilities 1. Working capital 2. Current ratio 3. Quick ratio (Acid-test ratio) - if the balance sheet does not show short term investments or receivables, 4. Total Asset Turnover Evaluating the ability to pay long term debt 5. Debt ratio 6. Number of times interest charges earned Evaluating profitability (Show results as a percentage) 7. Profit margin percentage 8. Return on assets 9. Return on equity Evaluating stock as an investment 10. Price-Earnings (P/E) ratio: For P-E ratio, you will need the market price of the stock as of the last day of the fiscal year, which is December 31, 2020 for McDonald's and January 3, 2021 (but use December 31, 2020 as explained above) for Wendy's. To get the market price of stock: go to https://finance.yahoo.com/. In the Search box, enter McDonald's stock symbol (MCD) and Wendy's stock symbol (WEN). On the next screen, click on Historical Data. Change the Time Period to Dec. 28, 2020 - Jan. 5, 2021. Use the the Adj. Close on December 31, 2020 as the market price at the end of the fiscal year for the P-E ratio calculation. See the video links below for a video demonstrating this