Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART 1 (25 marks) One Stop Invitations & More does customize, hand-crafted wedding memorabilia, in which each batch of items is a job. The

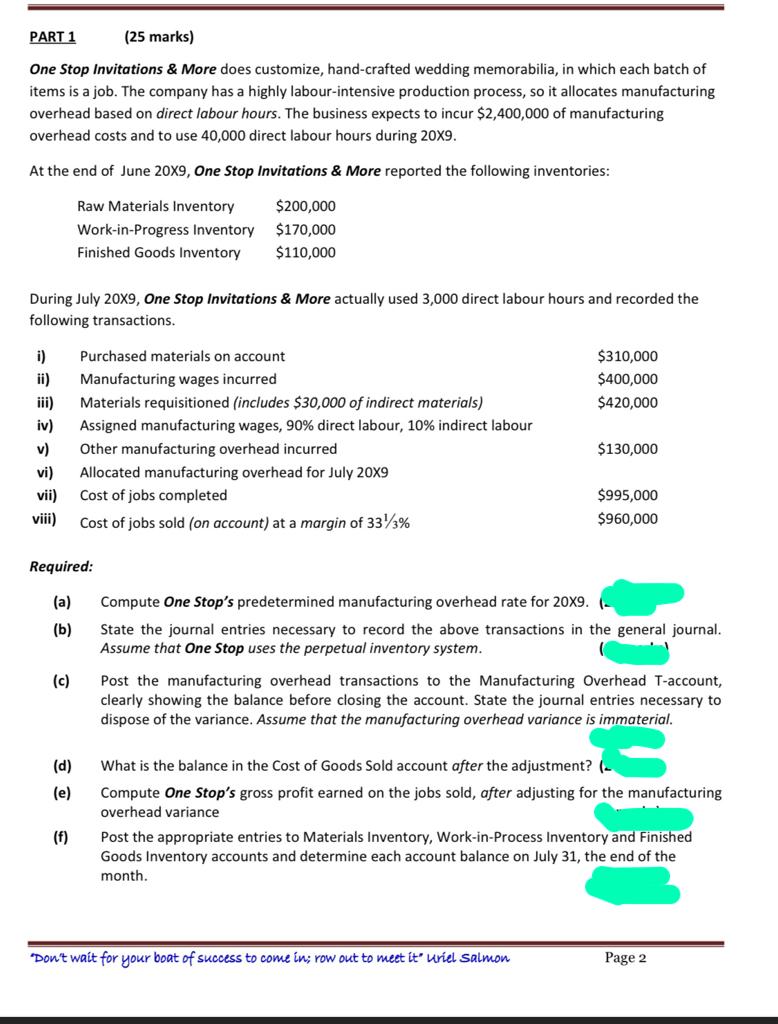

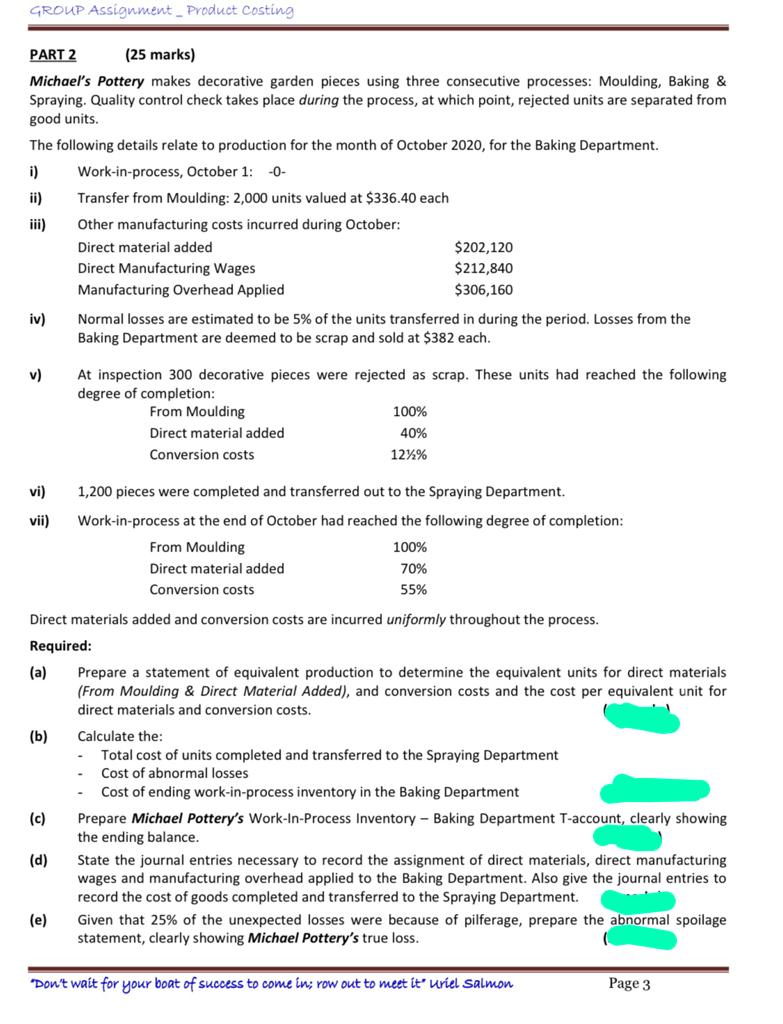

PART 1 (25 marks) One Stop Invitations & More does customize, hand-crafted wedding memorabilia, in which each batch of items is a job. The company has a highly labour-intensive production process, so it allocates manufacturing overhead based on direct labour hours. The business expects to incur $2,400,000 of manufacturing overhead costs and to use 40,000 direct labour hours during 20X9. At the end of June 20X9, One Stop Invitations & More reported the following inventories: Raw Materials Inventory $200,000 Work-in-Progress Inventory $170,000 Finished Goods Inventory $110,000 During July 20X9, One Stop Invitations & More actually used 3,000 direct labour hours and recorded the following transactions. i) Purchased materials on account $310,000 Manufacturing wages incurred $400,000 iii) Materials requisitioned (includes $30,000 of indirect materials) $420,000 vi) Assigned manufacturing wages, 90% direct labour, 10% indirect labour Other manufacturing overhead incurred $130,000 Allocated manufacturing overhead for July 20X9 vii) Cost of jobs completed viii) Cost of jobs sold (on account) at a margin of 3313% $995,000 $960,000 Required: (a) Compute One Stop's predetermined manufacturing overhead rate for 20X9. (b) State the journal entries necessary to record the above transactions in the general journal. Assume that One Stop uses the perpetual inventory system. (c) (d) (e) (f) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly showing the balance before closing the account. State the journal entries necessary to dispose of the variance. Assume that the manufacturing overhead variance is immaterial. What is the balance in the Cost of Goods Sold account after the adjustment? Compute One Stop's gross profit earned on the jobs sold, after adjusting for the manufacturing overhead variance Post the appropriate entries to Materials Inventory, Work-in-Process Inventory and Finished Goods Inventory accounts and determine each account balance on July 31, the end of the month. *Don't wait for your boat of success to come in; row out to meet it" uriel Salmon Page 2 GROUP Assignment_Product Costing PART 2 (25 marks) Michael's Pottery makes decorative garden pieces using three consecutive processes: Moulding, Baking & Spraying. Quality control check takes place during the process, at which point, rejected units are separated from good units. The following details relate to production for the month of October 2020, for the Baking Department. i) Work-in-process, October 1: -0- ii) Transfer from Moulding: 2,000 units valued at $336.40 each iii) Other manufacturing costs incurred during October: Direct material added Manufacturing Overhead Applied iv) v) Direct Manufacturing Wages $202,120 $212,840 $306,160 Normal losses are estimated to be 5% of the units transferred in during the period. Losses from the Baking Department are deemed to be scrap and sold at $382 each. At inspection 300 decorative pieces were rejected as scrap. These units had reached the following degree of completion: From Moulding Direct material added Conversion costs 100% 40% 12%% vi) vii) 1,200 pieces were completed and transferred out to the Spraying Department. Work-in-process at the end of October had reached the following degree of completion: From Moulding Direct material added Conversion costs 100% 70% 55% Direct materials added and conversion costs are incurred uniformly throughout the process. Required: (a) Prepare a statement of equivalent production to determine the equivalent units for direct materials (From Moulding & Direct Material Added), and conversion costs and the cost per equivalent unit for direct materials and conversion costs. (b) Calculate the: (c) (d) (e) - Total cost of units completed and transferred to the Spraying Department Cost of abnormal losses Cost of ending work-in-process inventory in the Baking Department Prepare Michael Pottery's Work-In-Process Inventory - Baking Department T-account, clearly showing the ending balance. State the journal entries necessary to record the assignment of direct materials, direct manufacturing wages and manufacturing overhead applied to the Baking Department. Also give the journal entries to record the cost of goods completed and transferred to the Spraying Department. Given that 25% of the unexpected losses were because of pilferage, prepare the abnormal spoilage statement, clearly showing Michael Pottery's true loss. *Don't wait for your boat of success to come in; row out to meet it uriel Salmon Page 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understood I will provide detailed responses to your questions regarding the product costing for Michaels Pottery Baking Department following the inst...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started