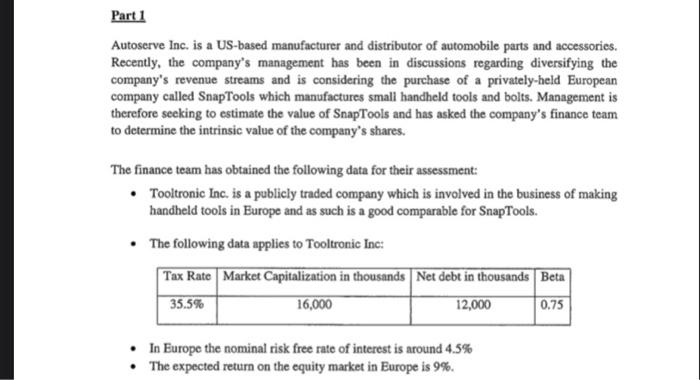

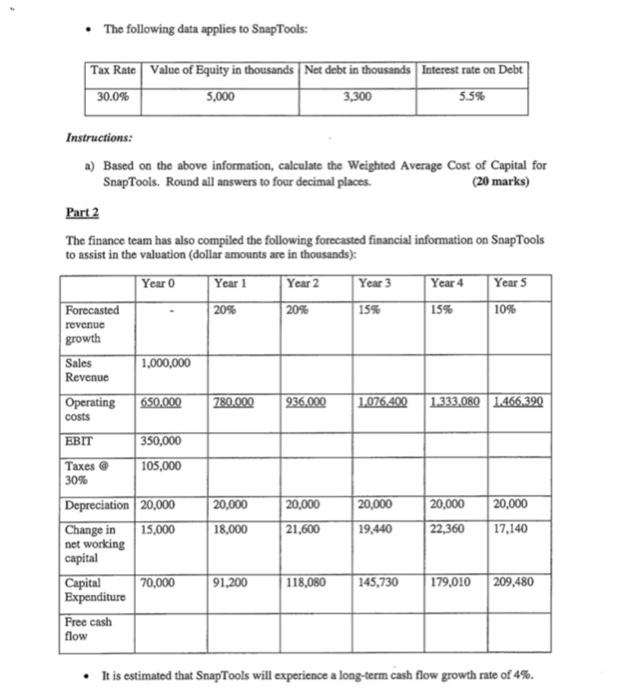

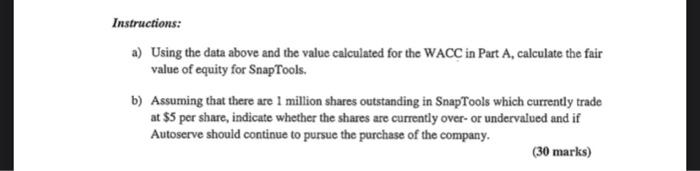

Part 1 Autoserve Inc. is a US-based manufacturer and distributor of automobile parts and accessories. Recently, the company's management has been in discussions regarding diversifying the company's revenue streams and is considering the purchase of a privately-held European company called SnapTools which manufactures small handheld tools and bolts. Management is therefore seeking to estimate the value of SnapTools and has asked the company's finance team to determine the intrinsic value of the company's shares. The finance team has obtained the following data for their assessment: Tooltronic Inc. is a publicly traded company which is involved in the business of making handheld tools in Europe and as such is a good comparable for SnapTools. The following data applies to Tooltronic Inc: Tax Rate Market Capitalization in thousands Net debt in thousands Beta 35.5% 16,000 12,000 0.75 In Europe the nominal risk free rate of interest is around 4.5% The expected return on the equity market in Europe is 9%. The following data applies to SnapTools: Tax Rate Value of Equity in thousands Net debt in thousands Interest rate on Debt 30.0% 5,000 3,300 5.5% Instructions: a) Based on the above information, calculate the Weighted Average Cost of Capital for SnapTools. Round all answers to four decimal places. (20 marks) Part 2 The finance team has also compiled the following forecasted financial information on SnapTools to assist in the valuation dollar amounts are in thousands): Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Forecasted 20% 20% 15% 10% revenue growth Sales 1,000,000 Revenue Operating 650.000 780.000 936.000 1076.400 1.333,080 1.466.390 15% costs 20,000 18,000 20,000 21,600 20,000 19,440 20,000 22,360 20,000 17,140 EBIT 350,000 Taxes @ 105,000 30% Depreciation 20,000 Change in 15,000 net working capital Capital 70,000 Expenditure Free cash flow 91,200 118,080 145,730 179,010 209,480 . It is estimated that SnapTools will experience a long-term cash flow growth rate of 4%. Instructions: a) Using the data above and the value calculated for the WACC in Part A, calculate the fair value of equity for SnapTools. b) Assuming that there are 1 million shares outstanding in SnapTools which currently trade at $5 per share, indicate whether the shares are currently over- or undervalued and if Autoserve should continue to pursue the purchase of the company. (30 marks)