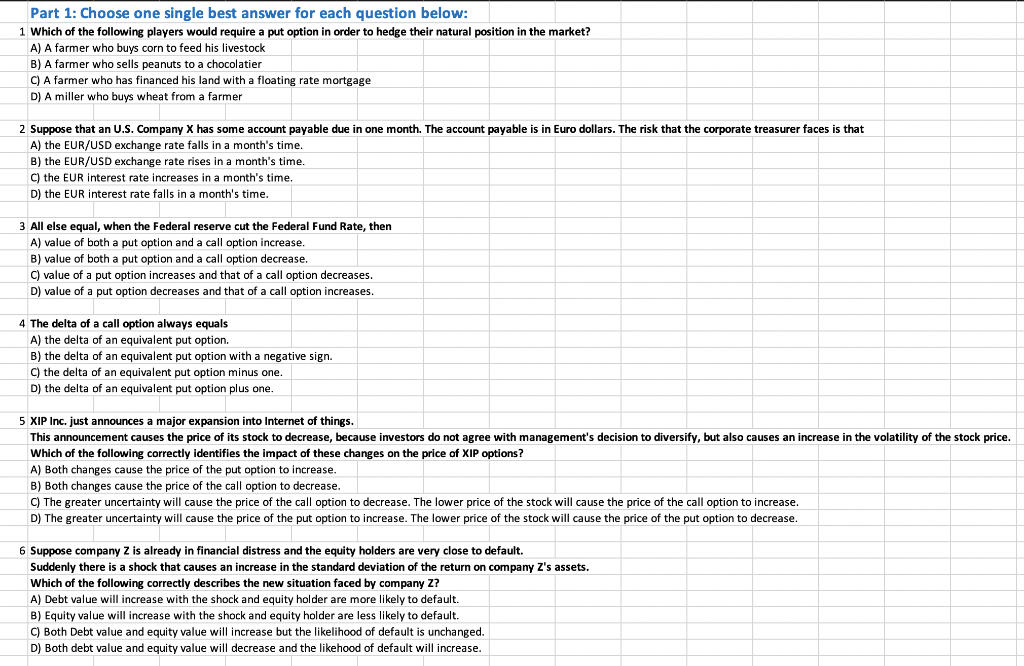

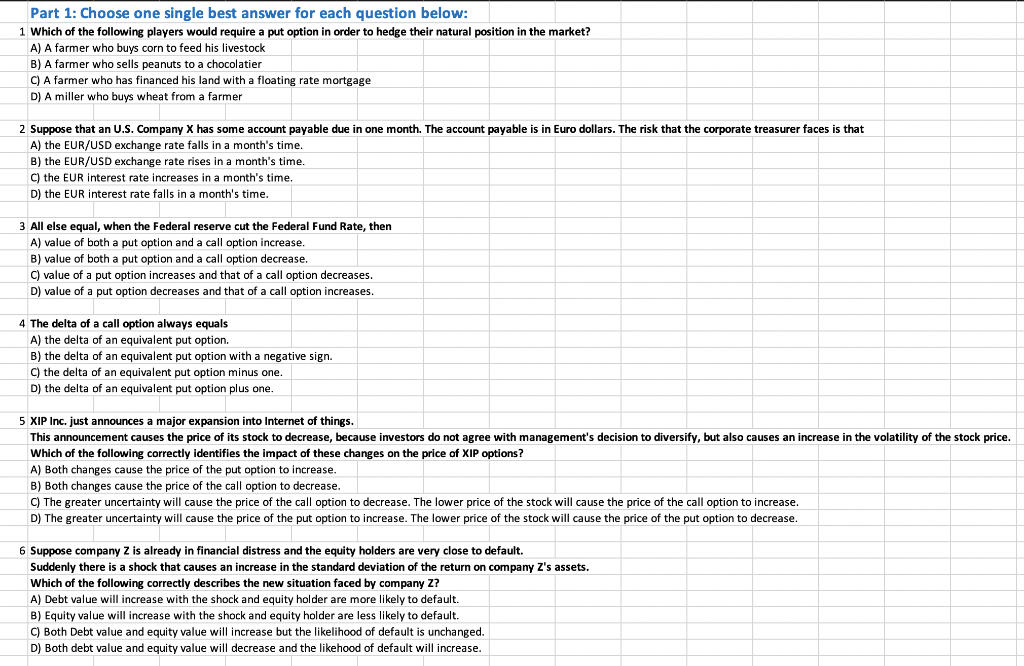

Part 1: Choose one single best answer for each question below: 1 Which of the following players would require a put option in order to hedge their natural position in the market? A) A farmer who buys corn to feed his livestock B) A farmer who sells peanuts to a chocolatier C) A farmer who has financed his land with a floating rate mortgage D) A miller who buys wheat from a farmer 2 Suppose that an U.S. Company X has some account payable due in one month. The account payable is in Euro dollars. The risk that the corporate treasurer faces is that A) the EUR/USD exchange rate falls in a month's time. B) the EUR/USD exchange rate rises in a month's time. C) the EUR interest rate increases in a month's time. D) the EUR interest rate falls in a month's time. 3 All else equal, when the Federal reserve cut the Federal Fund Rate, then A) value of both a put option and a call option increase. B) value of both a put option and a call option decrease. C) value of a put option increases and that of a call option decreases. D) value of a put option decreases and that of a call option increases. 4 The delta of a call option always equals A) the delta of an equivalent put option. B) the delta of an equivalent put option with a negative sign. C) the delta of an equivalent put option minus one. D) the delta an equivalent put option plus one. 5 XIP Inc. just announces a major expansion into Internet of things. This announcement causes the price of its stock to decrease, because investors do not agree with management's decision to diversify, but also causes an increase in the volatility of the stock price. Which of the following correctly identifies the impact of these changes on the price of XIP options? A) Both changes cause the price of the put option to increase B) Both changes cause the price of the call option to decrease. C) The greater uncertainty will cause the price of the call option to decrease. The lower price of the stock will cause the price of the call option to increase. D) The greater uncertainty will cause the price of the put option to increase. The lower price of the stock will cause the price of the put option to decrease. 6 Suppose company Z is already in financial distress and the equity holders are very close to default. Suddenly there is a shock that causes an increase in the standard deviation of the return on company Z's assets. Which of the following correctly describes the new situation faced by company Z? A) Debt value will increase with the shock and equity holder are more likely to default. B) Equity value will increase with the shock and equity holder are less likely to default. C) Both Debt value and equity value will increase but the likelihood of default is unchanged. D) Both debt value and equity value will decrease and the likehood of default will increase