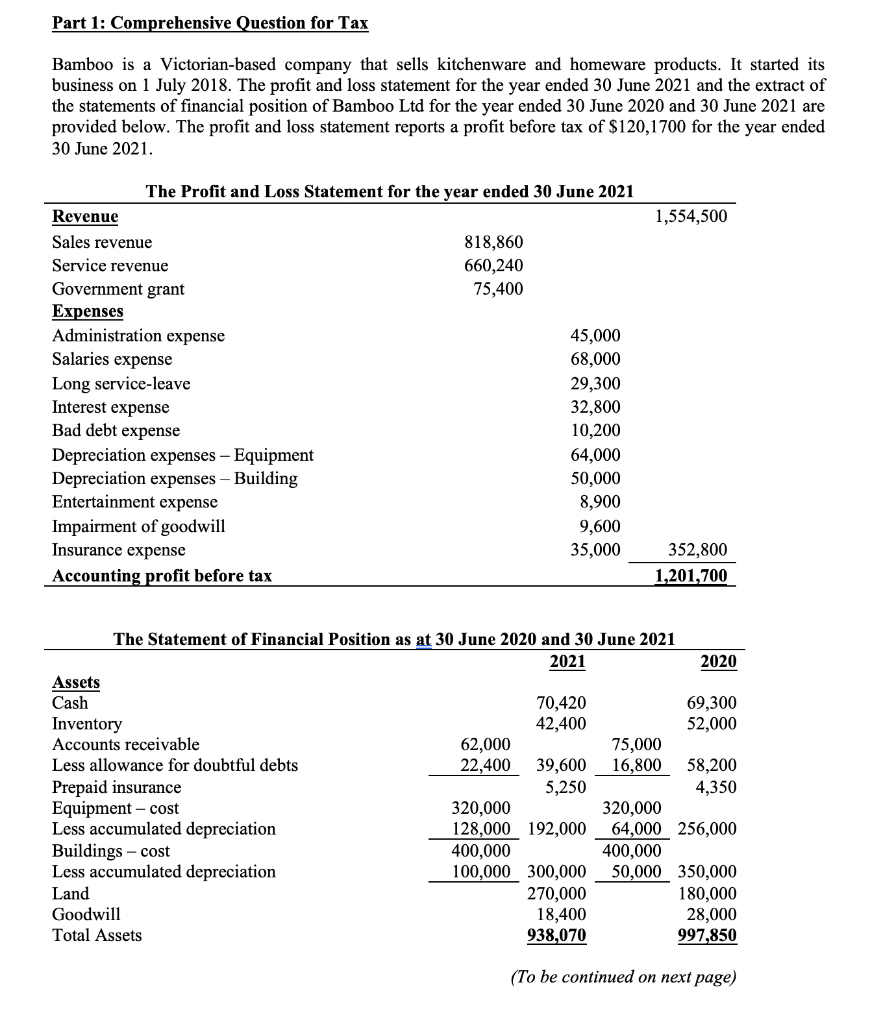

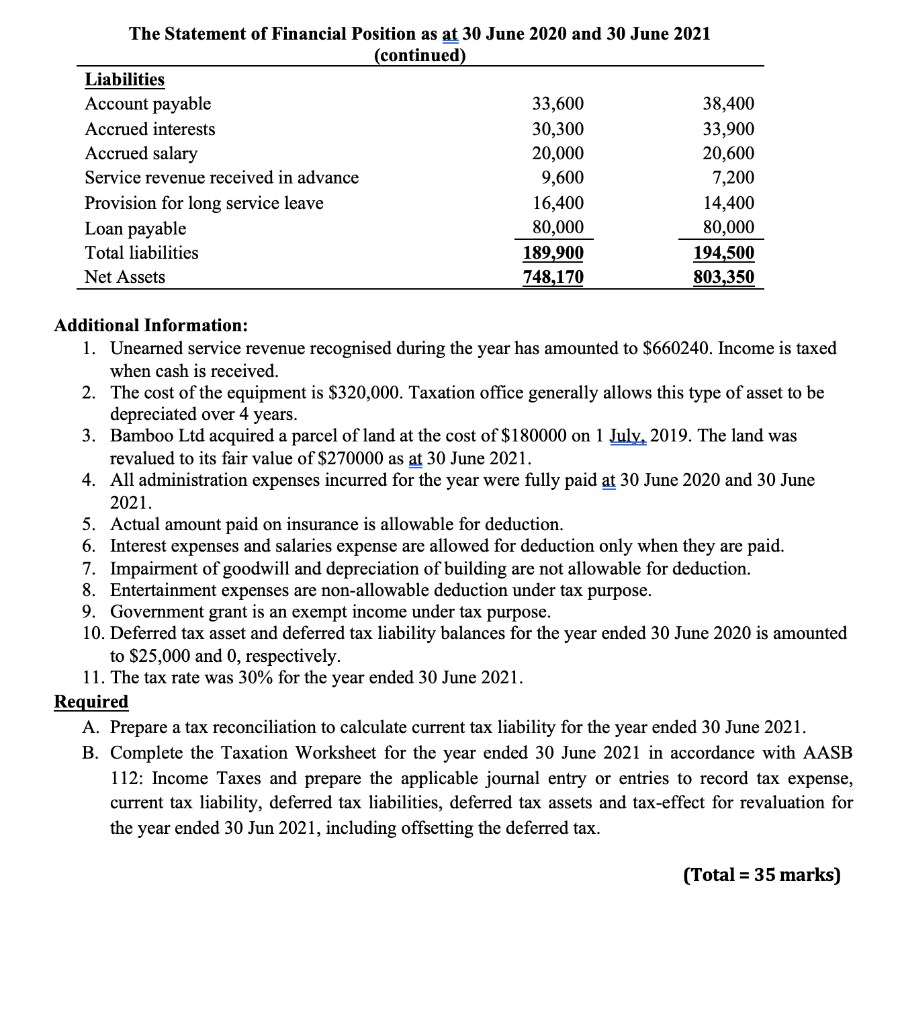

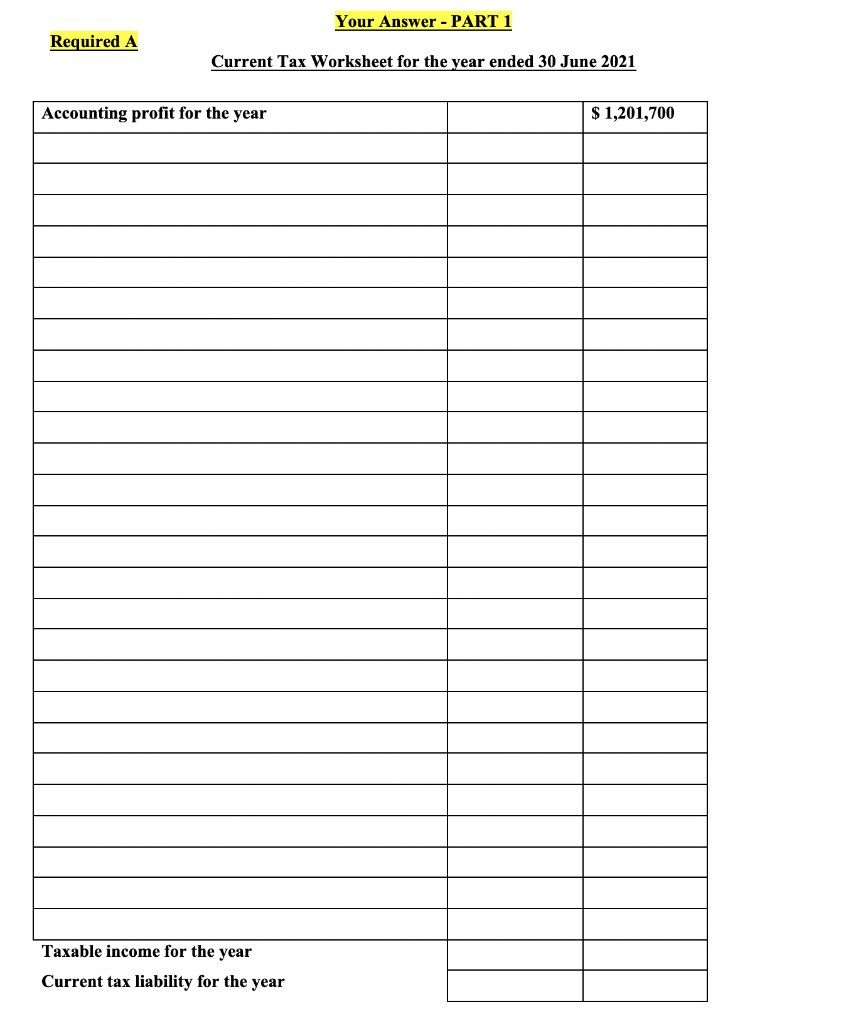

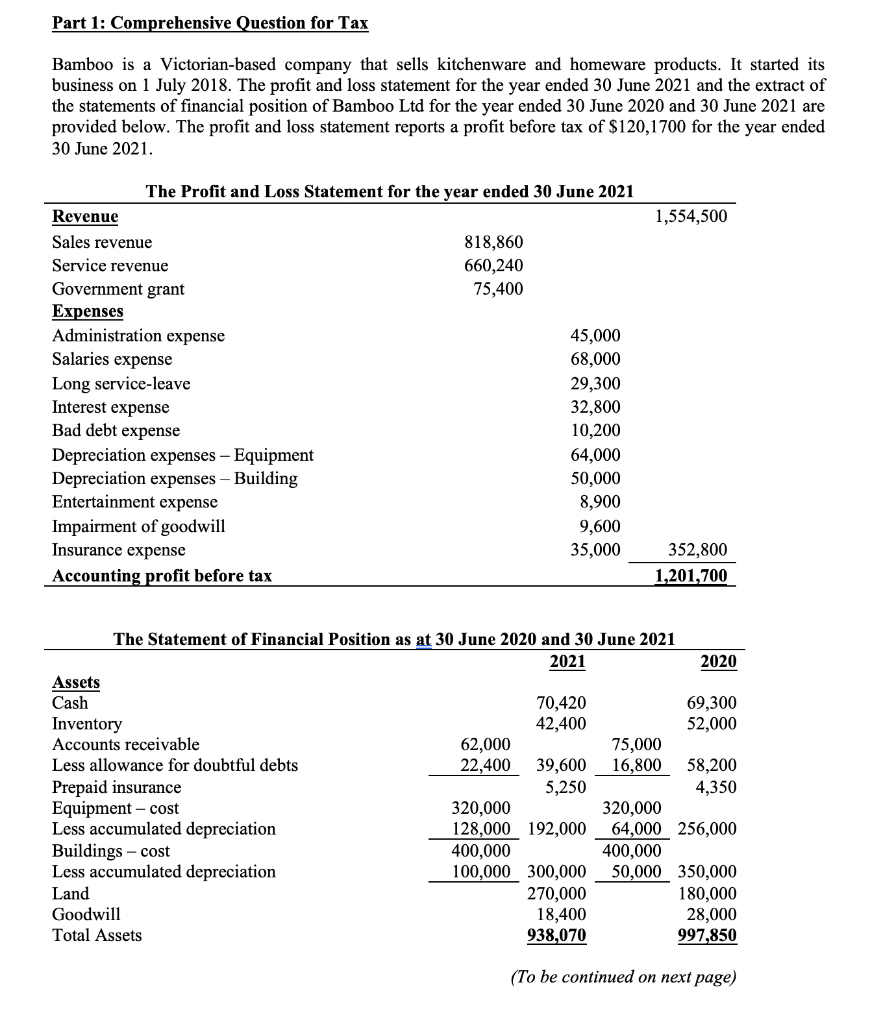

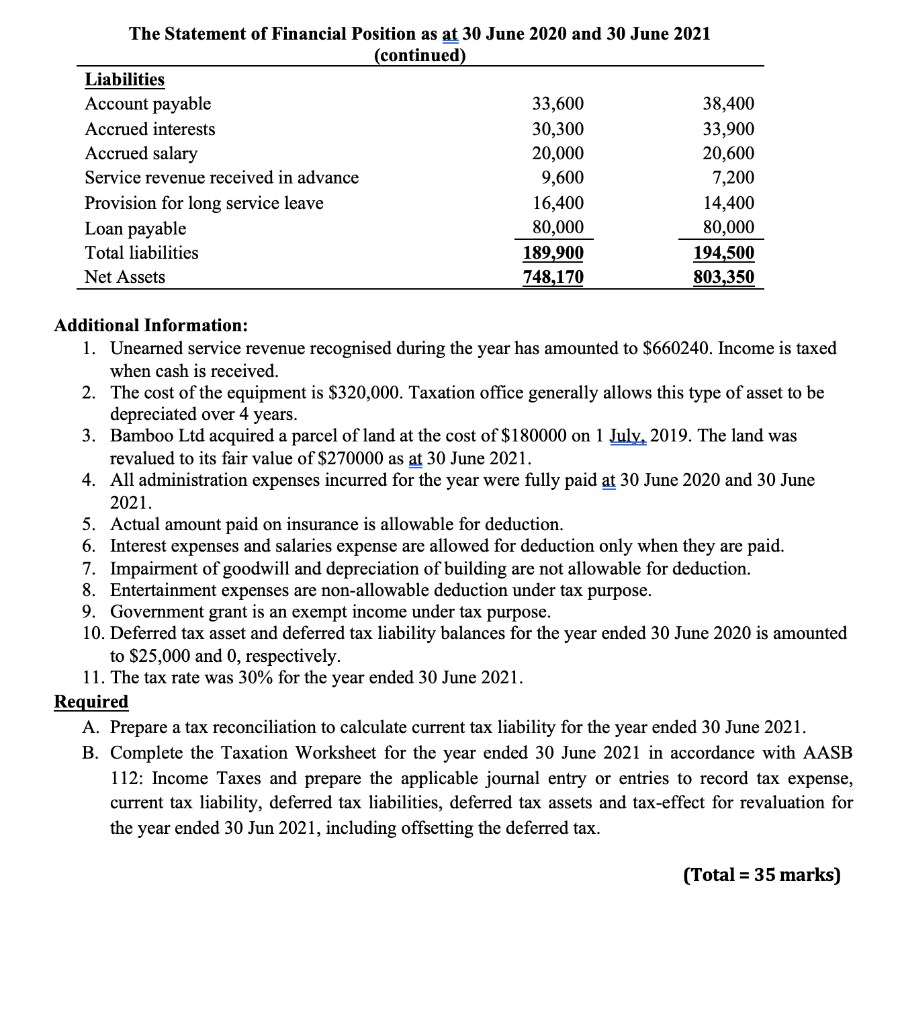

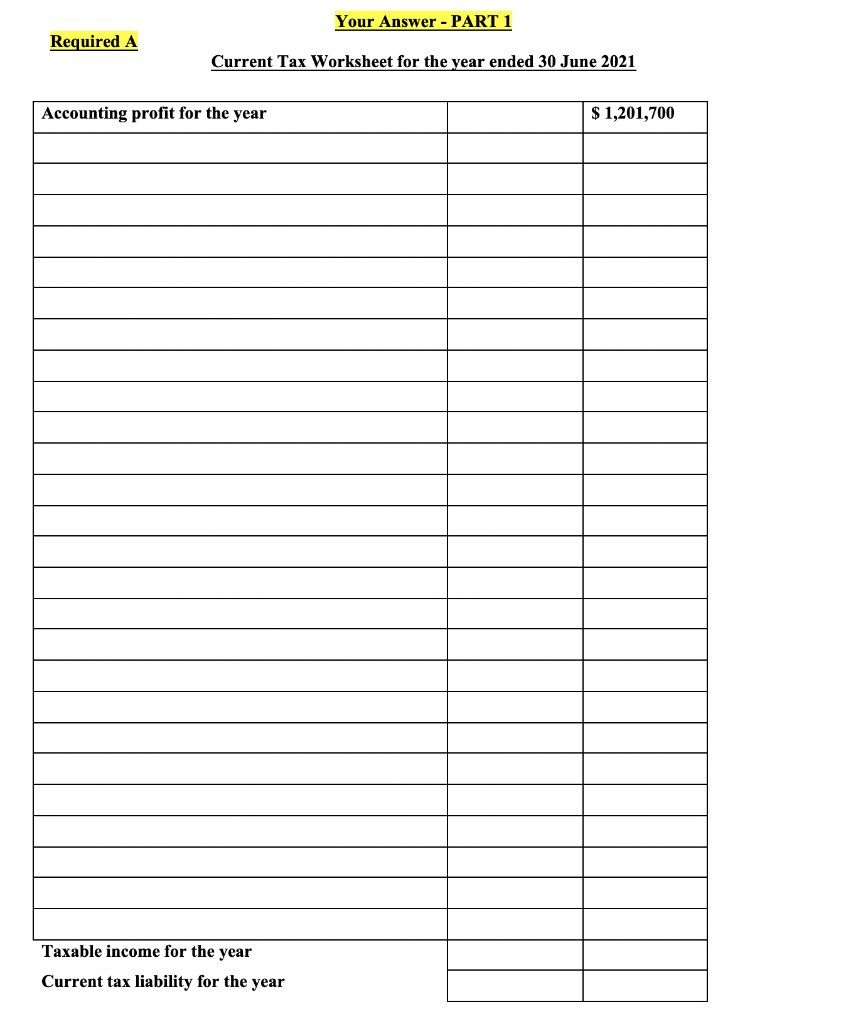

Part 1: Comprehensive Question for Tax Bamboo is a Victorian-based company that sells kitchenware and homeware products. It started its business on 1 July 2018. The profit and loss statement for the year ended 30 June 2021 and the extract of the statements of financial position of Bamboo Ltd for the year ended 30 June 2020 and 30 June 2021 are provided below. The profit and loss statement reports a profit before tax of $120,1700 for the year ended 30 June 2021. 1,554,500 The Profit and Loss Statement for the year ended 30 June 2021 Revenue Sales revenue 818,860 Service revenue 660,240 Government grant 75,400 Expenses Administration expense 45,000 Salaries expense 68,000 Long service-leave 29,300 Interest expense 32,800 Bad debt expense 10,200 Depreciation expenses - Equipment 64,000 Depreciation expenses - Building 50,000 Entertainment expense 8,900 Impairment of goodwill 9,600 Insurance expense 35,000 Accounting profit before tax 352,800 1,201,700 The Statement of Financial Position as at 30 June 2020 and 30 June 2021 2021 2020 Assets Cash 70,420 69,300 Inventory 42,400 52,000 Accounts receivable 62,000 75,000 Less allowance for doubtful debts 22,400 39,600 16,800 58,200 Prepaid insurance 5,250 4,350 Equipment -cost 320,000 320,000 Less accumulated depreciation 128,000 192,000 64,000 256,000 Buildings - cost 400,000 400,000 Less accumulated depreciation 100,000 300,000 50,000 350,000 Land 270,000 180,000 Goodwill 18,400 28,000 Total Assets 938,070 997,850 (To be continued on next page) The Statement of Financial Position as at 30 June 2020 and 30 June 2021 (continued) Liabilities Account payable 33,600 38,400 Accrued interests 30,300 33,900 Accrued salary 20,000 20,600 Service revenue received in advance 9,600 7,200 Provision for long service leave 16,400 14,400 Loan payable 80,000 80,000 Total liabilities 189,900 194,500 Net Assets 748,170 803,350 Additional Information: 1. Unearned service revenue recognised during the year has amounted to $660240. Income is taxed when cash is received. 2. The cost of the equipment is $320,000. Taxation office generally allows this type of asset to be depreciated over 4 years. 3. Bamboo Ltd acquired a parcel of land at the cost of $180000 on 1 July, 2019. The land was revalued to its fair value of $270000 as at 30 June 2021. 4. All administration expenses incurred for the year were fully paid at 30 June 2020 and 30 June 2021. 5. Actual amount paid on insurance is allowable for deduction. 6. Interest expenses and salaries expense are allowed for deduction only when they are paid. 7. Impairment of goodwill and depreciation of building are not allowable for deduction. 8. Entertainment expenses are non-allowable deduction under tax purpose. 9. Government grant is an exempt income under tax purpose. 10. Deferred tax asset and deferred tax liability balances for the year ended 30 June 2020 is amounted to $25,000 and 0, respectively. 11. The tax rate was 30% for the year ended 30 June 2021. Required A. Prepare a tax reconciliation to calculate current tax liability for the year ended 30 June 2021. B. Complete the Taxation Worksheet for the year ended 30 June 2021 in accordance with AASB 112: Income Taxes and prepare the applicable journal entry or entries to record tax expense, current tax liability, deferred tax liabilities, deferred tax assets and tax-effect for revaluation for the year ended 30 Jun 2021, including offsetting the deferred tax. (Total = 35 marks) Your Answer - PART 1 Required A Current Tax Worksheet for the year ended 30 June 2021 Accounting profit for the year $ 1,201,700 Taxable income for the year Current tax liability for the year Required B (continued) Journal Entries