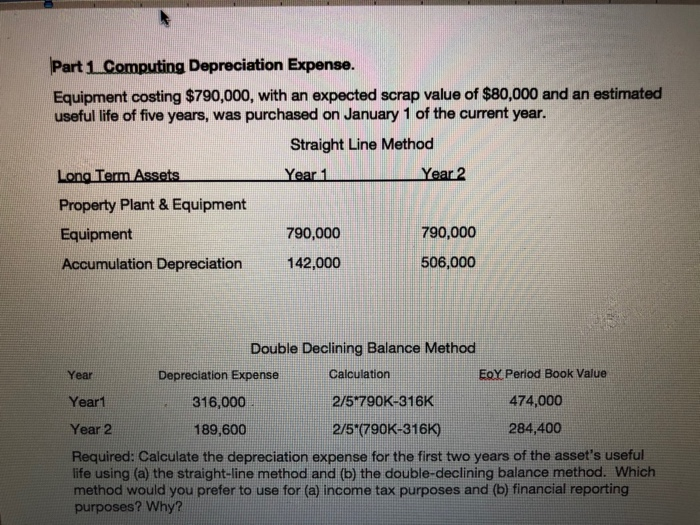

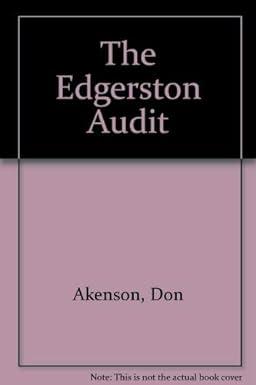

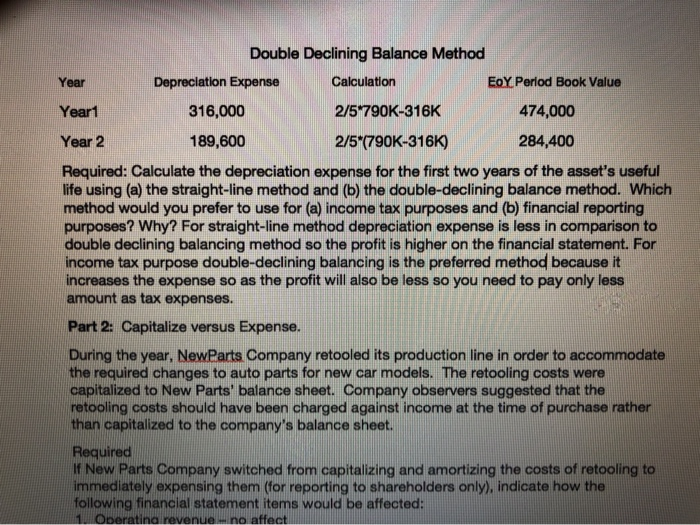

Part 1 Computing Depreciation Expense. Equipment costing $790,000, with an expected scrap value of $80,000 and an estimated useful life of five years, was purchased on January 1 of the current year. Straight Line Method Long Term Assets Year 1 Year 2 Property Plant & Equipment Equipment 790,000 790,000 Accumulation Depreciation 142,000 506,000 Double Declining Balance Method Year Depreciation Expense Calculation EOY Period Book Value Year1 316,000 2/5-790K-316K 474,000 Year 2 189,600 2/5*(790K-316K) 284,400 Required: Calculate the depreciation expense for the first two years of the asset's useful life using (a) the straight-line method and (b) the double-declining balance method. Which method would you prefer to use for (a) income tax purposes and (b) financial reporting purposes? Why? Double Declining Balance Method Year Depreciation Expense Calculation EoY Period Book Value Year1 316,000 2/5 790K-316K 474,000 Year 2 189,600 2/5*(790K-316K) 284,400 Required: Calculate the depreciation expense for the first two years of the asset's useful life using (a) the straight-line method and (b) the double-declining balance method. Which method would you prefer to use for (a) income tax purposes and (b) financial reporting purposes? Why? For straight-line method depreciation expense is less in comparison to double declining balancing method so the profit is higher on the financial statement. For income tax purpose double-declining balancing is the preferred method because it increases the expense so as the profit will also be less so you need to pay only less amount as tax expenses. Part 2: Capitalize versus Expense. During the year, NewParts Company retooled its production line in order to accommodate the required changes to auto parts for new car models. The retooling costs were capitalized to New Parts' balance sheet. Company observers suggested that the retooling costs should have been charged against income at the time of purchase rather than capitalized to the company's balance sheet. Required If New Parts Company switched from capitalizing and amortizing the costs of retooling to immediately expensing them (for reporting to shareholders only), indicate how the following financial statement items would be affected: 1. Operatina revenueno affect