Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 Fruit Inc. buys apples by the truckload in season and separates them into three categories: premium, good, and fair. Premium apples can

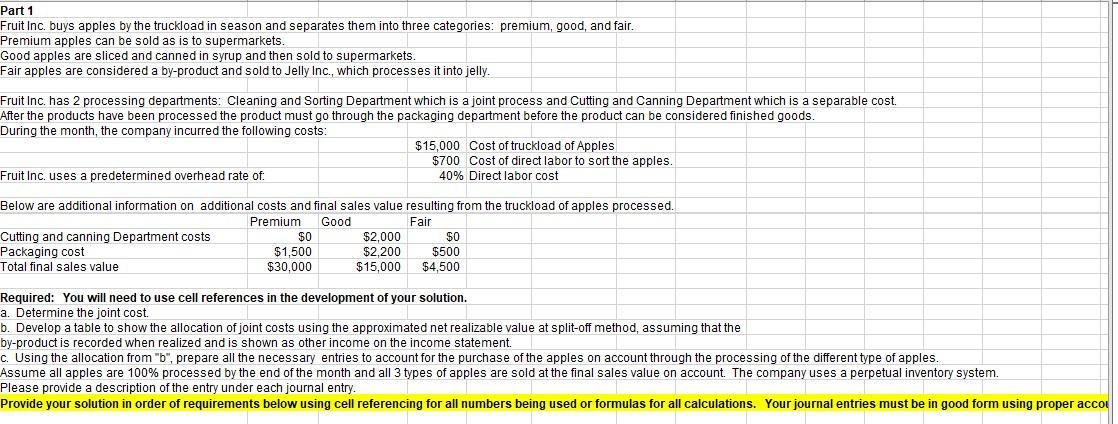

Part 1 Fruit Inc. buys apples by the truckload in season and separates them into three categories: premium, good, and fair. Premium apples can be sold as is to supermarkets. Good apples are sliced and canned in syrup and then sold to supermarkets. Fair apples are considered a by-product and sold to Jelly Inc., which processes it into jelly. Fruit Inc. has 2 processing departments: Cleaning and Sorting Department which is a joint process and Cutting and Canning Department which is a separable cost. After the products have been processed the product must go through the packaging department before the product can be considered finished goods. During the month, the company incurred the following costs: Fruit Inc. uses a predetermined overhead rate of: Below are additional information on additional costs and final sales value resulting from the truckload of apples processed. Premium Good Fair Cutting and canning Department costs Packaging cost Total final sales value $0 $1,500 $30,000 $15,000 Cost of truckload of Apples $700 Cost of direct labor sort the apples. 40% Direct labor cost $2,000 $2,200 $15,000 $0 $500 $4,500 Required: You will need to use cell references in the development of your solution. a. Determine the joint cost. b. Develop a table to show the allocation of joint costs using the approximated net realizable value at split-off method, assuming that the by-product recorded when realized and is shown as other income on the income statement. c. Using the allocation from "b", prepare all the necessary entries to account for the purchase of the apples on account through the processing of the different type of apples. Assume all apples are 100% processed by the end of the month and all 3 types of apples are sold at the final sales value on account. The company uses a perpetual inventory system. Please provide a description of the entry under each journal entry. Provide your solution in order of requirements below using cell referencing for all numbers being used or formulas for all calculations. Your journal entries must be in good form using proper acco

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Calculation of joint cost Particulars Amount Cost of one truckload 15000 Cost of labor 700 Cost of overhead 700 40 280 Total joint cost 15980 Therefore the total joint cost is 15980 b Diagram ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started