Question

Horizontal Analysis Using 2013 and 2012 data, prepare a horizontal analysis of the balance sheet, statement of operations, and change in net assets. Use the

Horizontal Analysis Using 2013 and 2012 data, prepare a horizontal analysis of the balance sheet, statement of operations, and change in net assets. Use the financial statements that are provided in the instructions. Part 2: Calculating Financial Ratios Compute and evaluate the following ratios for 2013 and 2012: Liquidity Ratios Current ratio Acid test ratio (*For this assignment, assume that marketable securities is the same as short-term investments.) Days in accounts receivable Revenue, Expense, and Profitability Ratios Salary and benefits as a percent of operating expense Operating margin Return on total assets Activity Ratios Total asset turnover ratio Net fixed assets turnover ratio Capital Structure Ratios Long term debt to net asset ratio Net assets turnover ratio Part 3: Analyzing Ratios Analyze your findings for each of the four categories of ratios. For each category (liquidity, activity, capital structure, revenue, expense, and profitability), evaluate and summarize your findings.

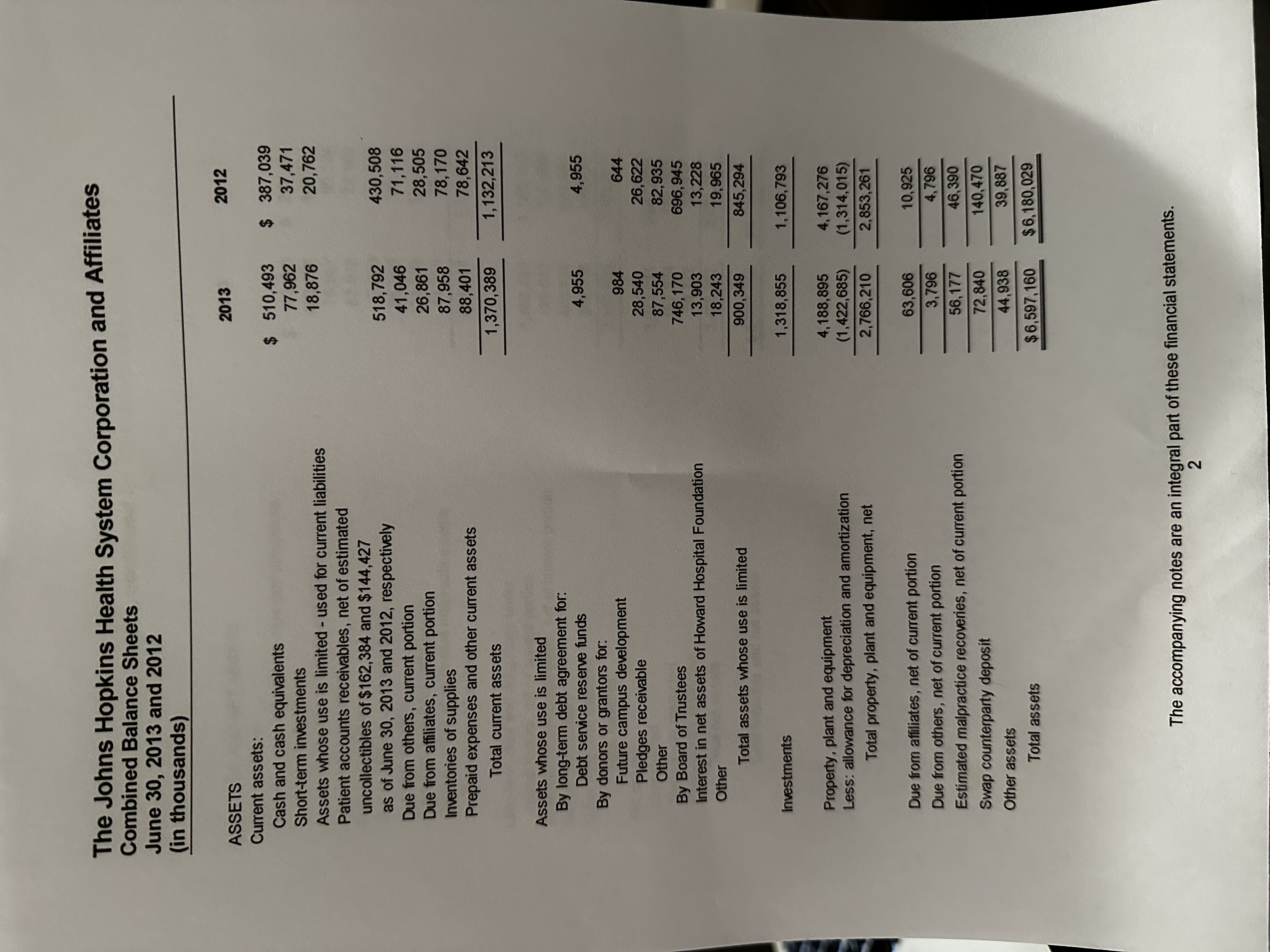

The Johns Hopkins Health System Corporation and Affiliates Combined Balance Sheets June 30, 2013 and 2012 (in thousands) ASSETS Current assets: Cash and cash equivalents Short-term investments Assets whose use is limited - used for current liabilities Patient accounts receivables, net of estimated uncollectibles of $162,384 and $144,427 2013 2012 $ 510,493 77,962 $ 387,039 37,471 18,876 20,762 as of June 30, 2013 and 2012, respectively 518,792 430,508 Due from others, current portion Inventories of supplies 41,046 71,116 Due from affiliates, current portion 26,861 28,505 87,958 78,170 Prepaid expenses and other current assets 88,401 78,642 1,370,389 1,132,213 Total current assets Assets whose use is limited By long-term debt agreement for: Debt service reserve funds 4,955 4,955 By donors or grantors for: Future campus development 984 644 Pledges receivable 28,540 26,622 Other 87,554 82,935 By Board of Trustees 746,170 696,945 Interest in net assets of Howard Hospital Foundation 13,903 13,228 Other 18,243 19,965 Total assets whose use is limited 900,349 845,294 Investments 1,318,855 1,106,793 Property, plant and equipment 4,188,895 4,167,276 Less: allowance for depreciation and amortization (1,422,685) (1,314,015) Total property, plant and equipment, net 2,766,210 2,853,261 Due from affiliates, net of current portion 63,606 10,925 Due from others, net of current portion 3,796 4,796 Estimated malpractice recoveries, net of current portion 56,177 46,390 Swap counterparty deposit 72,840 140,470 Other assets 44,938 39,887 Total assets $6,597,160 $6,180,029 The accompanying notes are an integral part of these financial statements. 2

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Horizontal analysis for the balance sheet statement of operations and change in net assets using the data for 2013 and 2012 Horizontal Analysis Balance Sheet Assets 2013 000 2012 000 Change ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started