part 1 I have, i just need to better understand how to calculate part 2 and 3.

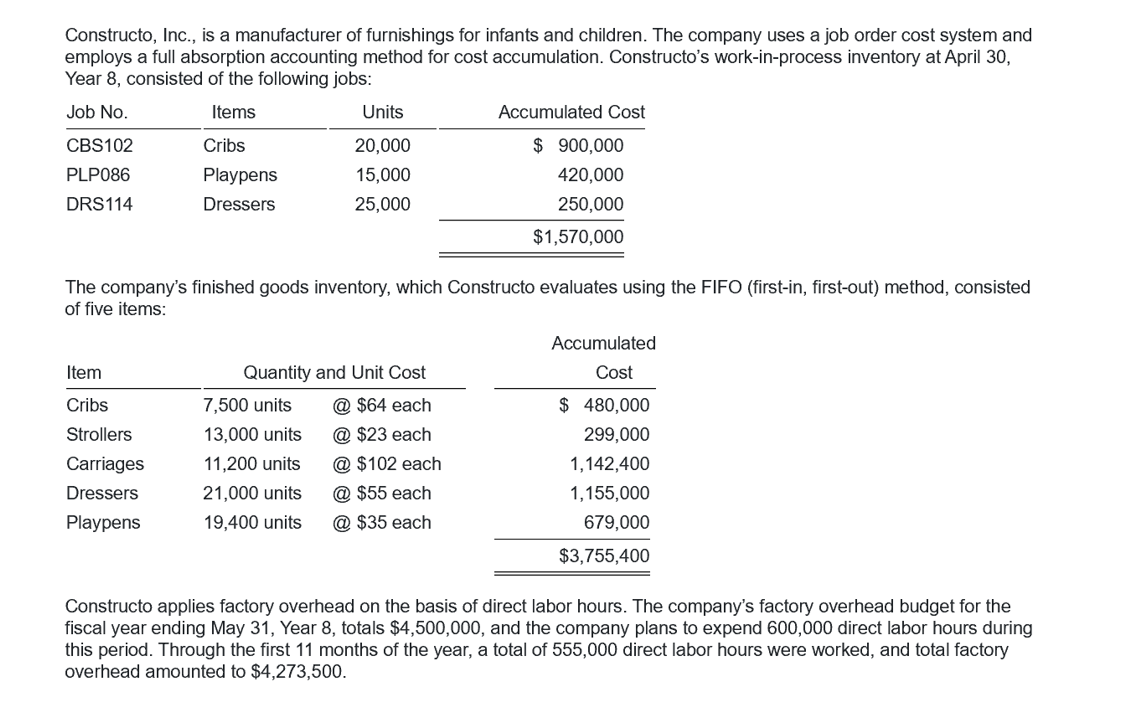

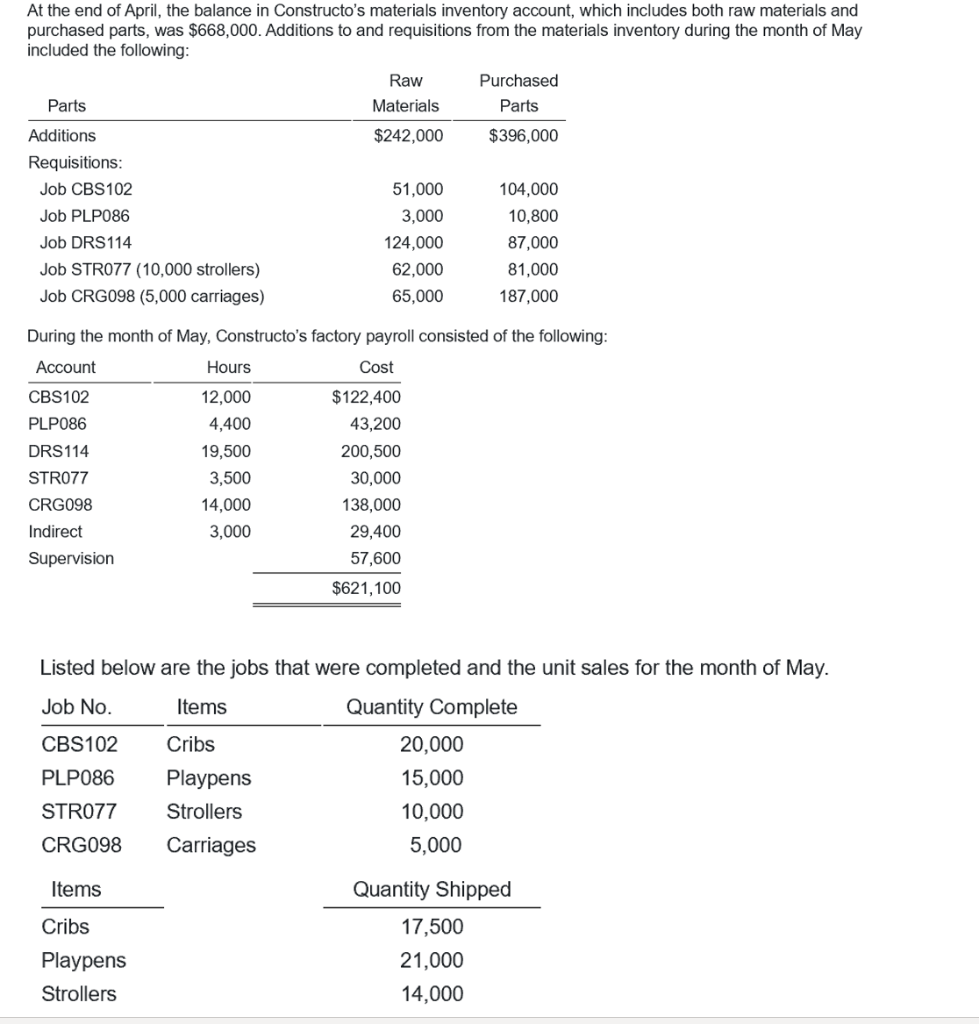

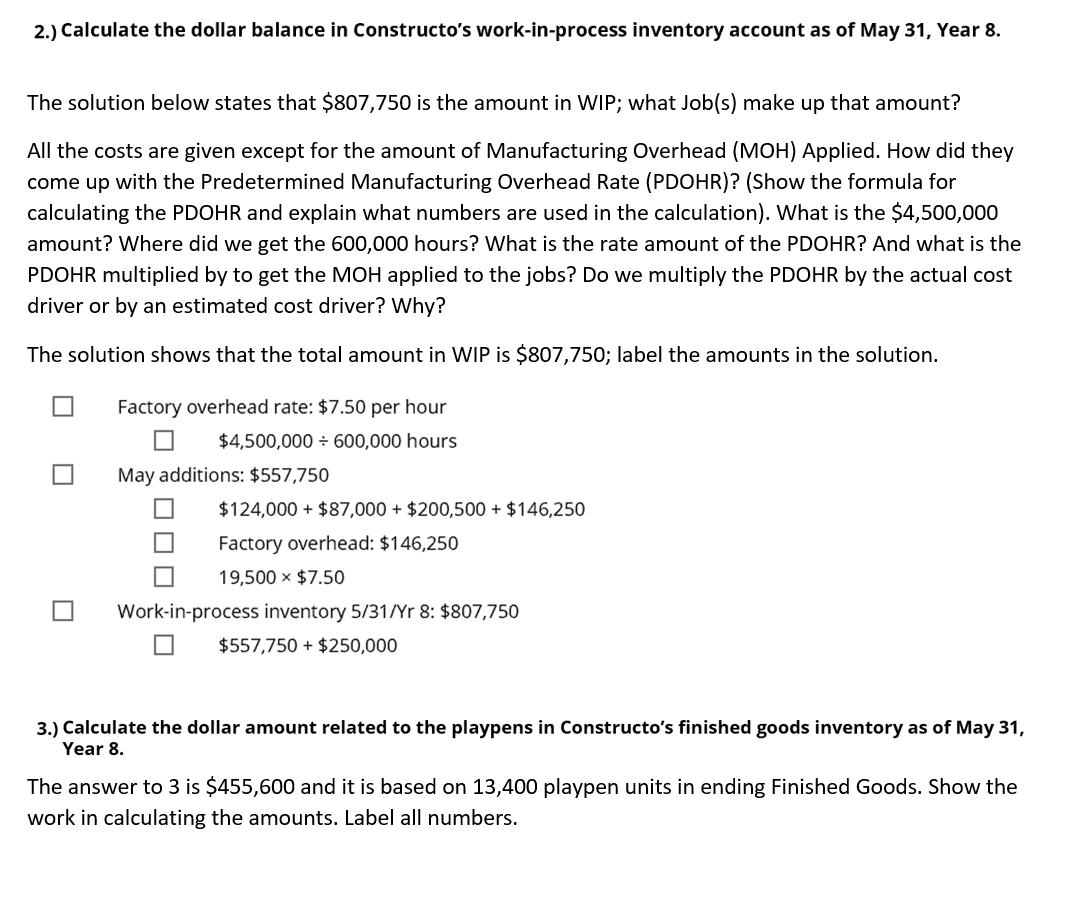

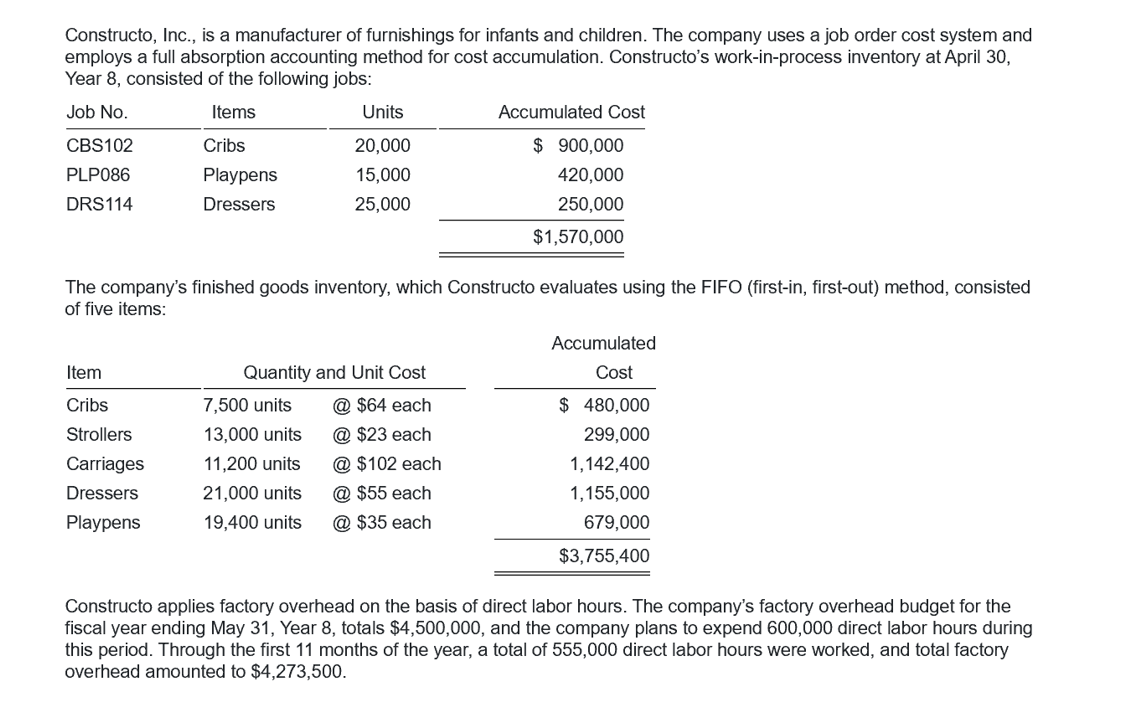

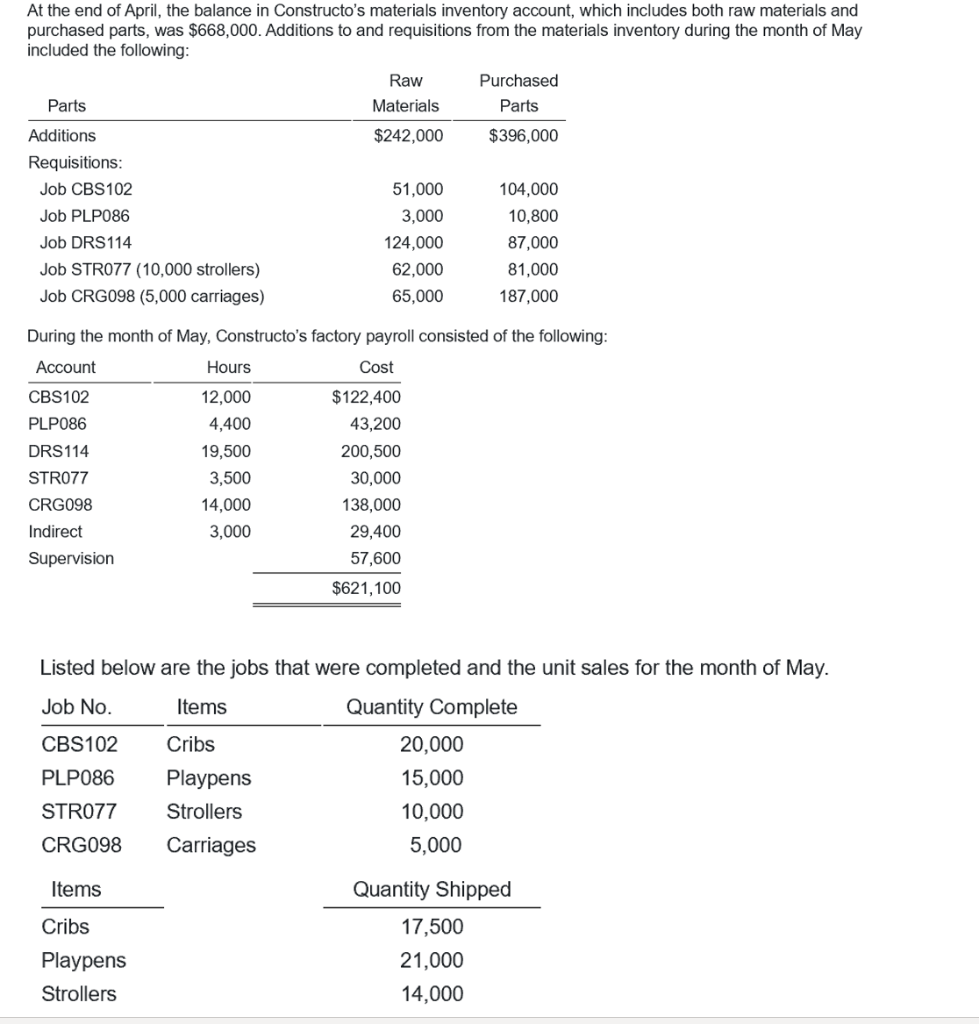

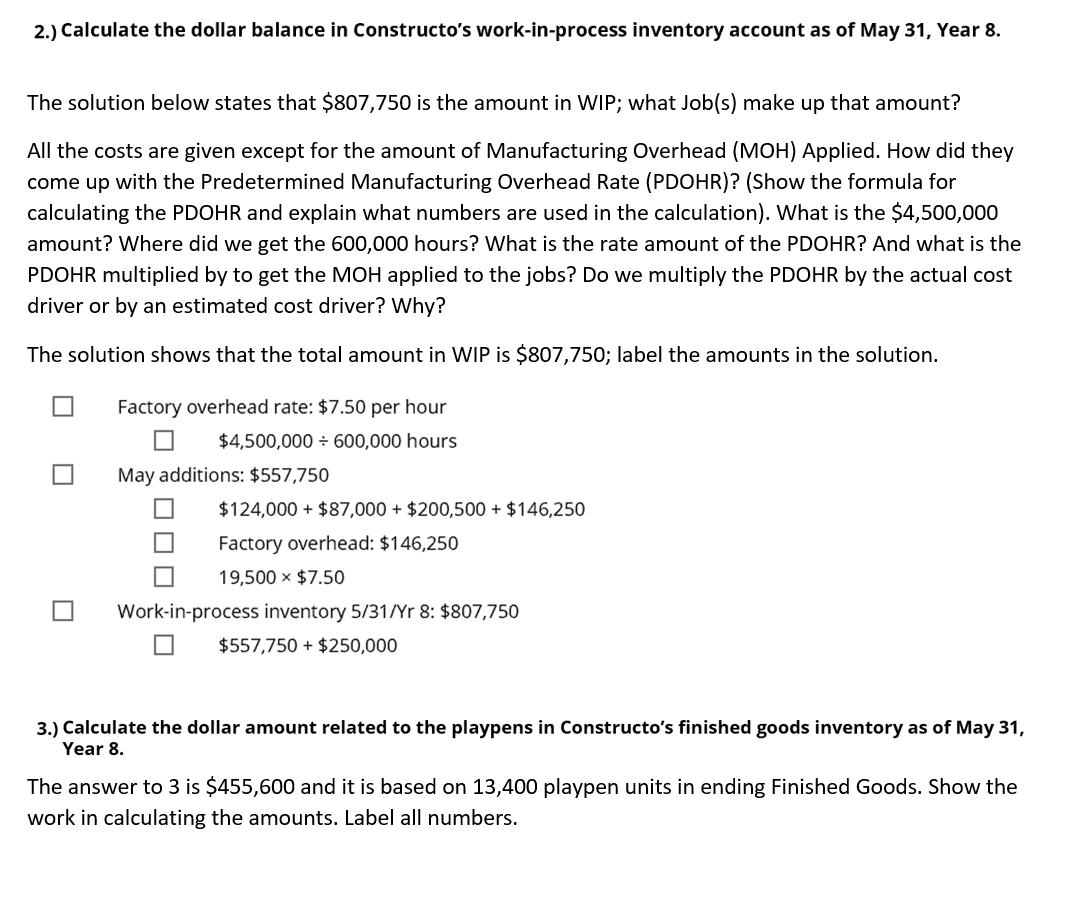

Constructo, Inc., is a manufacturer of furnishings for infants and children. The company uses a job order cost system and employs a full absorption accounting method for cost accumulation. Constructo's work-in-process inventory at April 30, Year 8, consisted of the following jobs: Job No. Items Units Accumulated Cost CBS102 Cribs 20,000 $ 900,000 PLP086 Playpens 15,000 420,000 DRS 114 Dressers 25,000 250,000 $1,570,000 The company's finished goods inventory, which constructo evaluates using the FIFO (first-in, first-out) method, consisted of five items: Accumulated Item Cost Cribs Strollers Carriages Dressers Playpens Quantity and Unit Cost 7,500 units @ $64 each 13,000 units @ $23 each 11,200 units @ $102 each 21,000 units @ $55 each 19,400 units @ $35 each $ 480,000 299,000 1,142,400 1,155,000 679,000 $3,755,400 Constructo applies factory overhead on the basis of direct labor hours. The company's factory overhead budget for the fiscal year ending May 31, Year 8, totals $4,500,000, and the company plans to expend 600,000 direct labor hours during this period. Through the first 11 months of the year, a total of 555,000 direct labor hours were worked, and total factory overhead amounted to $4,273,500. At the end of April, the balance in Constructo's materials inventory account, which includes both raw materials and purchased parts, was $668,000. Additions to and requisitions from the materials inventory during the month of May included the following: Raw Purchased Parts Materials Parts Additions $242,000 $396,000 Requisitions: Job CBS102 51,000 104,000 Job PLP086 3,000 10,800 Job DRS114 124,000 87,000 Job STR077 (10,000 strollers) 62,000 81,000 Job CRG098 (5,000 carriages) 65,000 187,000 During the month of May, Constructo's factory payroll consisted of the following: Account Hours Cost CBS102 PLP086 DRS114 STR077 CRG098 Indirect Supervision 12,000 4,400 19,500 3,500 14,000 3,000 $122,400 43,200 200,500 30,000 138,000 29,400 57,600 $621,100 Listed below are the jobs that were completed and the unit sales for the month of May. Job No. Items Quantity Complete CBS102 Cribs 20,000 PLP086 Playpens 15,000 STR077 Strollers 10,000 CRG098 Carriages 5,000 Items Cribs Playpens Strollers Quantity Shipped 17,500 21,000 14,000 2.) Calculate the dollar balance in Constructo's work-in-process inventory account as of May 31, Year 8. The solution below states that $807,750 is the amount in WIP; what Job(s) make up that amount? All the costs are given except for the amount of Manufacturing Overhead (MOH) Applied. How did they come up with the Predetermined Manufacturing Overhead Rate (PDOHR)? (Show the formula for calculating the PDOHR and explain what numbers are used in the calculation). What is the $4,500,000 amount? Where did we get the 600,000 hours? What is the rate amount of the PDOHR? And what is the PDOHR multiplied by to get the MOH applied to the jobs? Do we multiply the PDOHR by the actual cost driver or by an estimated cost driver? Why? The solution shows that the total amount in WIP is $807,750; label the amounts in the solution. Factory overhead rate: $7.50 per hour $4,500,000 = 600,000 hours May additions: $557,750 $124,000 + $87,000 + $200,500 + $146,250 Factory overhead: $146,250 19,500 $7.50 Work-in-process inventory 5/31/Yr 8: $807,750 $557,750 + $250,000 3.) Calculate the dollar amount related to the playpens in Constructo's finished goods inventory as of May 31, Year 8. The answer to 3 is $455,600 and it is based on 13,400 playpen units in ending Finished Goods. Show the work in calculating the amounts. Label all numbers. Constructo, Inc., is a manufacturer of furnishings for infants and children. The company uses a job order cost system and employs a full absorption accounting method for cost accumulation. Constructo's work-in-process inventory at April 30, Year 8, consisted of the following jobs: Job No. Items Units Accumulated Cost CBS102 Cribs 20,000 $ 900,000 PLP086 Playpens 15,000 420,000 DRS 114 Dressers 25,000 250,000 $1,570,000 The company's finished goods inventory, which constructo evaluates using the FIFO (first-in, first-out) method, consisted of five items: Accumulated Item Cost Cribs Strollers Carriages Dressers Playpens Quantity and Unit Cost 7,500 units @ $64 each 13,000 units @ $23 each 11,200 units @ $102 each 21,000 units @ $55 each 19,400 units @ $35 each $ 480,000 299,000 1,142,400 1,155,000 679,000 $3,755,400 Constructo applies factory overhead on the basis of direct labor hours. The company's factory overhead budget for the fiscal year ending May 31, Year 8, totals $4,500,000, and the company plans to expend 600,000 direct labor hours during this period. Through the first 11 months of the year, a total of 555,000 direct labor hours were worked, and total factory overhead amounted to $4,273,500. At the end of April, the balance in Constructo's materials inventory account, which includes both raw materials and purchased parts, was $668,000. Additions to and requisitions from the materials inventory during the month of May included the following: Raw Purchased Parts Materials Parts Additions $242,000 $396,000 Requisitions: Job CBS102 51,000 104,000 Job PLP086 3,000 10,800 Job DRS114 124,000 87,000 Job STR077 (10,000 strollers) 62,000 81,000 Job CRG098 (5,000 carriages) 65,000 187,000 During the month of May, Constructo's factory payroll consisted of the following: Account Hours Cost CBS102 PLP086 DRS114 STR077 CRG098 Indirect Supervision 12,000 4,400 19,500 3,500 14,000 3,000 $122,400 43,200 200,500 30,000 138,000 29,400 57,600 $621,100 Listed below are the jobs that were completed and the unit sales for the month of May. Job No. Items Quantity Complete CBS102 Cribs 20,000 PLP086 Playpens 15,000 STR077 Strollers 10,000 CRG098 Carriages 5,000 Items Cribs Playpens Strollers Quantity Shipped 17,500 21,000 14,000 2.) Calculate the dollar balance in Constructo's work-in-process inventory account as of May 31, Year 8. The solution below states that $807,750 is the amount in WIP; what Job(s) make up that amount? All the costs are given except for the amount of Manufacturing Overhead (MOH) Applied. How did they come up with the Predetermined Manufacturing Overhead Rate (PDOHR)? (Show the formula for calculating the PDOHR and explain what numbers are used in the calculation). What is the $4,500,000 amount? Where did we get the 600,000 hours? What is the rate amount of the PDOHR? And what is the PDOHR multiplied by to get the MOH applied to the jobs? Do we multiply the PDOHR by the actual cost driver or by an estimated cost driver? Why? The solution shows that the total amount in WIP is $807,750; label the amounts in the solution. Factory overhead rate: $7.50 per hour $4,500,000 = 600,000 hours May additions: $557,750 $124,000 + $87,000 + $200,500 + $146,250 Factory overhead: $146,250 19,500 $7.50 Work-in-process inventory 5/31/Yr 8: $807,750 $557,750 + $250,000 3.) Calculate the dollar amount related to the playpens in Constructo's finished goods inventory as of May 31, Year 8. The answer to 3 is $455,600 and it is based on 13,400 playpen units in ending Finished Goods. Show the work in calculating the amounts. Label all numbers