Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 Instructions: Prepare all the journal entries necessary to record the transactions noted below. 1. Cash sales were received for December, which include

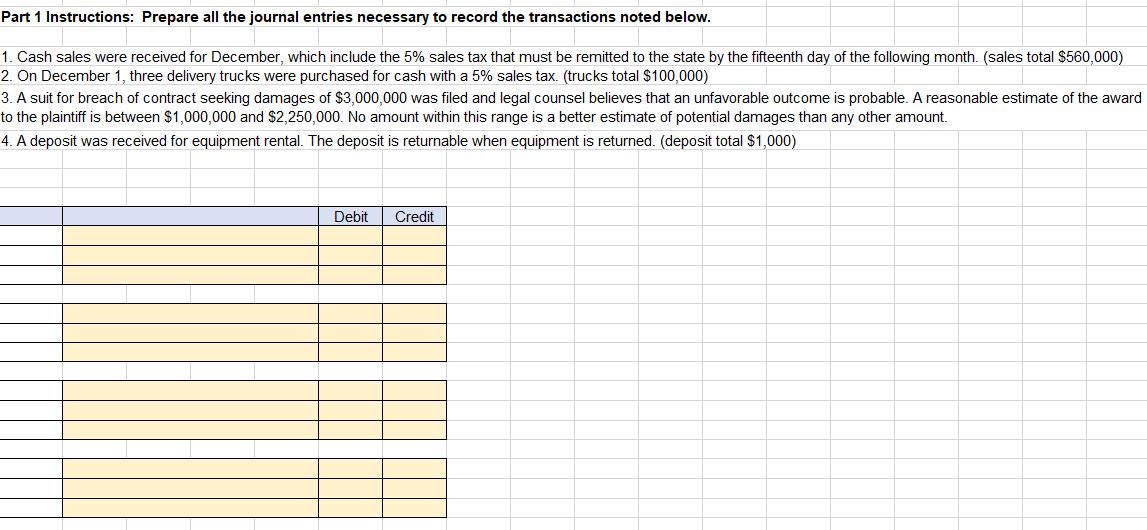

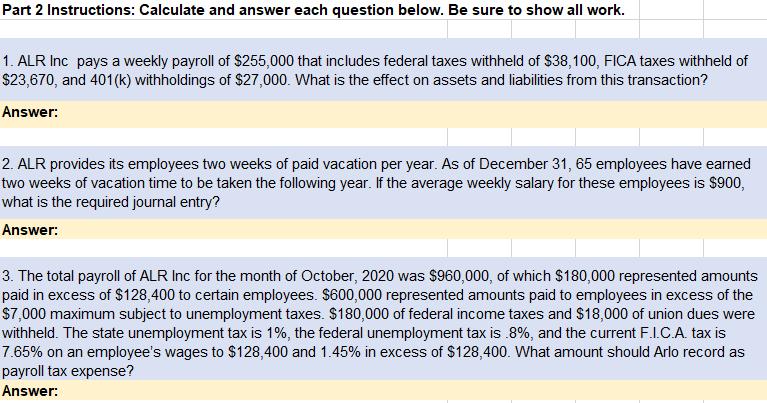

Part 1 Instructions: Prepare all the journal entries necessary to record the transactions noted below. 1. Cash sales were received for December, which include the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. (sales total $560,000) 2. On December 1, three delivery trucks were purchased for cash with a 5% sales tax. (trucks total $100,000) 3. A suit for breach of contract seeking damages of $3,000,000 was filed and legal counsel believes that an unfavorable outcome is probable. A reasonable estimate of the award to the plaintiff is between $1,000,000 and $2,250,000. No amount within this range is a better estimate of potential damages than any other amount. 4. A deposit was received for equipment rental. The deposit is returnable when equipment is returned. (deposit total $1,000) Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started