Answered step by step

Verified Expert Solution

Question

1 Approved Answer

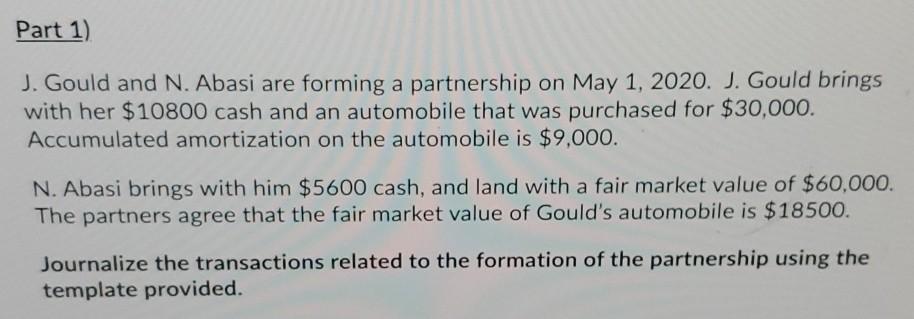

Part 1) J. Gould and N. Abasi are forming a partnership on May 1, 2020. J. Gould brings with her $10800 cash and an automobile

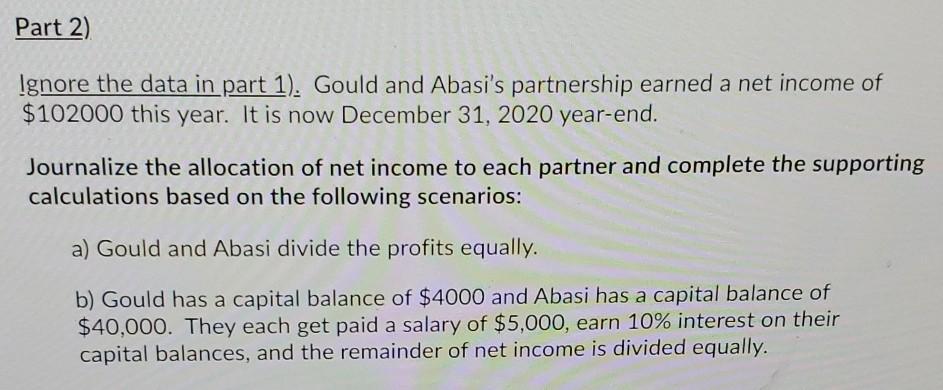

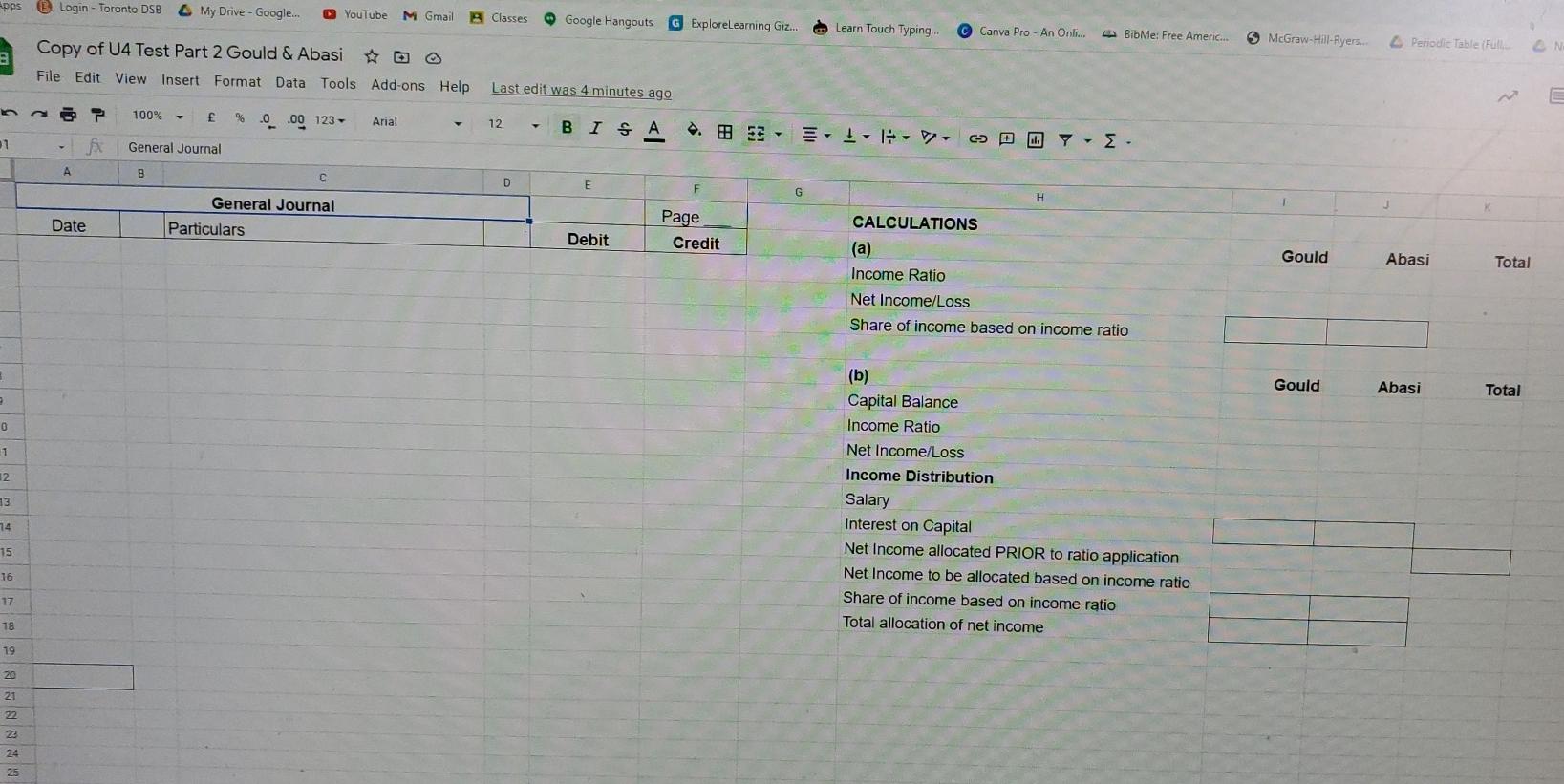

Part 1) J. Gould and N. Abasi are forming a partnership on May 1, 2020. J. Gould brings with her $10800 cash and an automobile that was purchased for $30,000. Accumulated amortization on the automobile is $9,000. N. Abasi brings with him $5600 cash, and land with a fair market value of $60,000. The partners agree that the fair market value of Gould's automobile is $18500. Journalize the transactions related to the formation of the partnership using the template provided. Part 2) Ignore the data in part 1). Gould and Abasi's partnership earned a net income of $102000 this year. It is now December 31, 2020 year-end. Journalize the allocation of net income to each partner and complete the supporting calculations based on the following scenarios: a) Gould and Abasi divide the profits equally. b) Gould has a capital balance of $4000 and Abasi has a capital balance of $40,000. They each get paid a salary of $5,000, earn 10% interest on their capital balances, and the remainder of net income is divided equally. Gould & Abasi General Journal Particulars Page Credit Debit Date Apps Login - Toronto DSB My Drive - Google... You Tube M Gmail B Classes ~ Google Hangouts G ExploreLearning Giz... Learn Touch Typing Canva Pro - An Onli... BibMe: Free Americ... 3 McGraw-Hill-Ryers.. Penodic Table Full N Copy of U4 Test Part 2 Gould & Abasi File Edit View Insert Format Data Tools Add-ons Help Last edit was 4 minutes ago 100% f % 0 .00 123 Arial 12 BISA 1 General Journal - . A B C D E F H General Journal Particulars Date Page Credit Debit Gould Abasi Total CALCULATIONS (a) Income Ratio Net Income/Loss Share of income based on income ratio Gould Abasi Total e 0 11 12 13 (b) Capital Balance Income Ratio Net Income/Loss Income Distribution Salary Interest on Capital Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income 74 15 16 17 18 19 20 21 22 24 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started