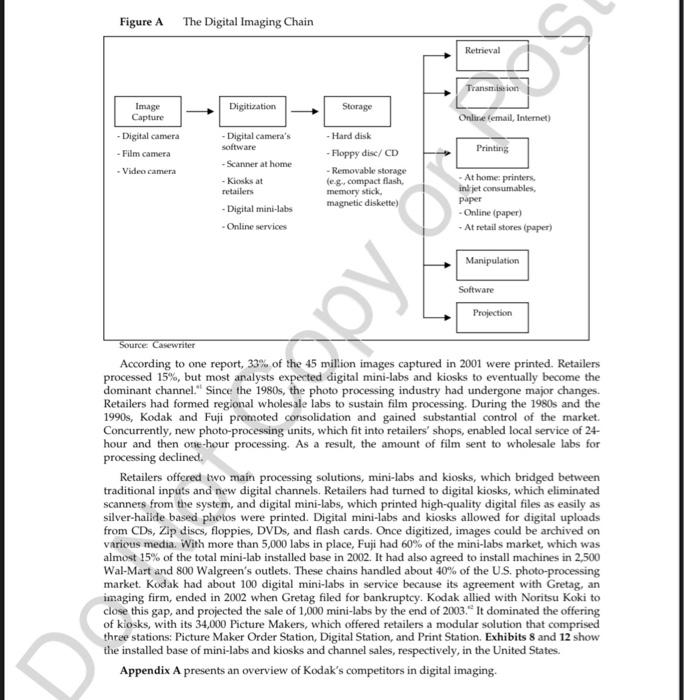

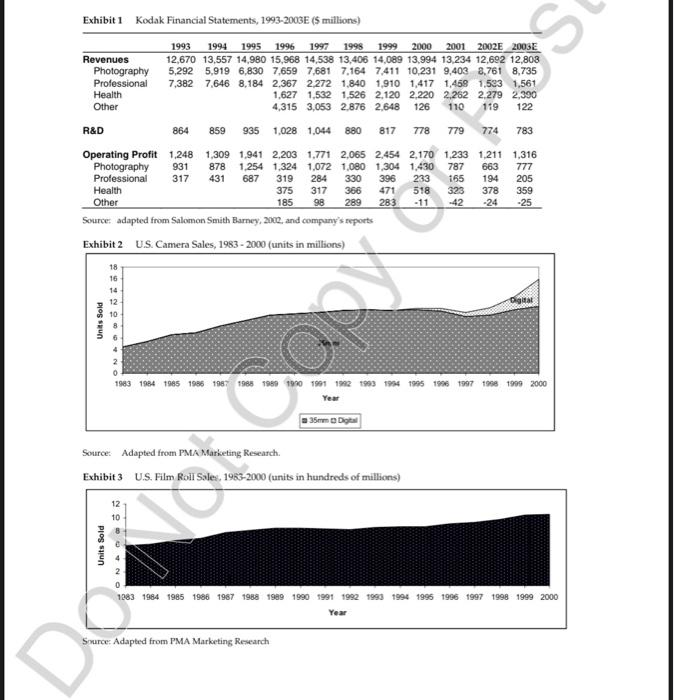

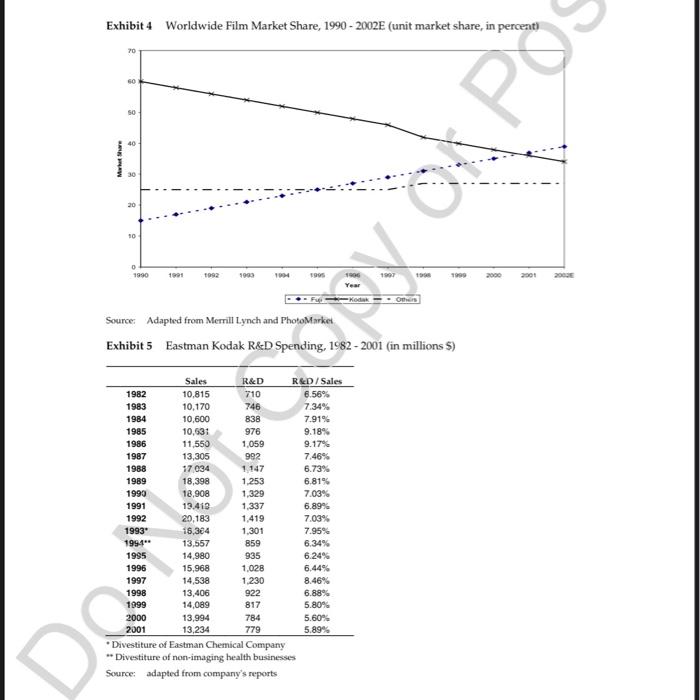

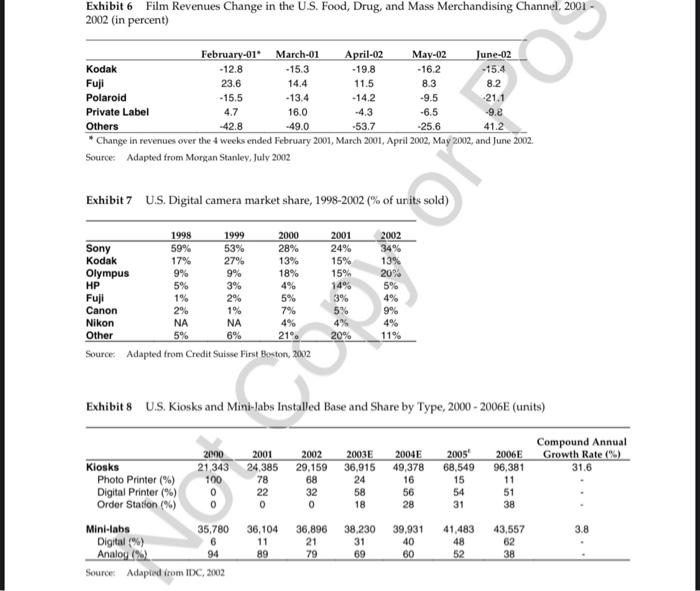

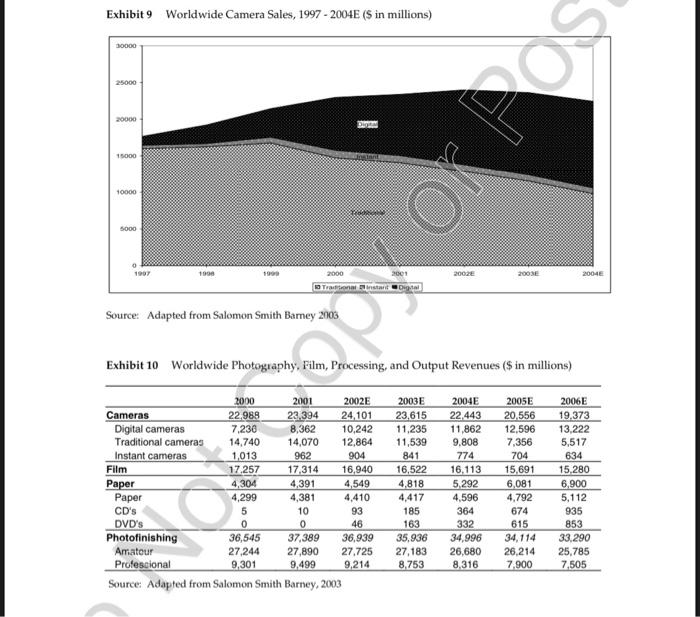

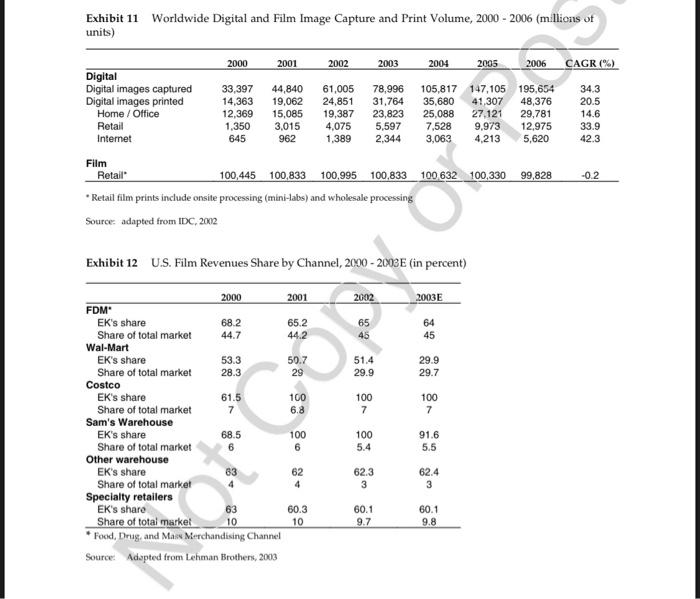

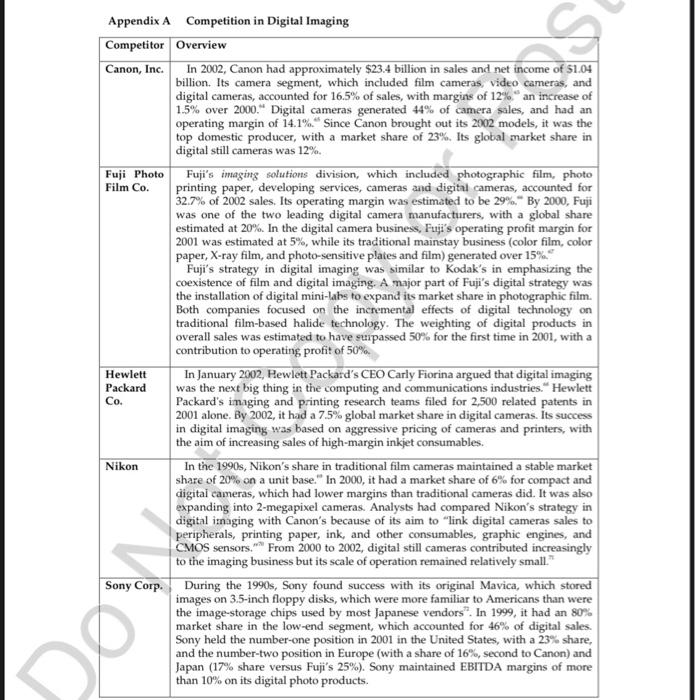

Part 1: Kodak's early success. Here we will evaluate Kodak's strategy in traditional photography. Why has the company been so successful throughout the history of the industry? Questions: 1. Identify Kodak's strengths 2. How did Kodak make money? 3. What was Kodak's key strategic ideas to maintain its success. 4. What else helped it maintain its success? 5. Evaluate Kodak's corporate (leadership) power (i.e., what were their backgrounds? ). Part 2: Here we will evaluate Kodak's decisions in response to new challenges and competitors. Questions: 6. Evaluate Kodak's response to Sony's introduction of the Mavica in 1981. Was it appropriate? (Try to apply some of the concepts we discussed when answering). a. Think about their investment in digital, how they dealt with disposable cameras, creating a new division, a new digital product. 7. How would you assess Fisher's attempt to transform Kodak? Why did it fail? Kodak and the Digital Revolution (A) In February 2003, Daniel A. Carp, Kodak's CEO and chairman, reviewed 2002 sales data with Kodak's senior executives. Film sales had dropped 5% from 2001 and revenues were down 3\%, 2003 did not look any brighter: Carp expected revenues to grow only slightly and net income to remain flat or decrease (see exhibit 1 for information on Kodak's financial performance and exhibits 2 and 3 for information on sales of cameras and film rolls in the United States). The film industry was "under pressure unlike ever before." Carp predicted a "fairly long downturn" for traditional photography sales as consumers turned to digital cameras, which did not require film. Kodak was moving more of its manufacturing to China, where it could boost film sales, and was planning to slash 2,200 jobs, or 3% of its work force, especially in the photo-finishing business. Carp had received a master's in business from MIT. He had begun his career at Kodak in 1970 as a statistical analyst. Since then, he had held a variety of positions at Kodak. In 1997, he became president and COO, and was appointed CEO on January 1, 2000. He believed Kodak's current struggle was one of the toughest it had frced How could he use digital imaging to revitalize Kodak? Kodak, 1880-1983: A brief history In 1880, George Eastman invented and patented a dry-plate formula and a machine for preparing large numbers of plates. He also founded the Eastman Kodak Company in Rochester, New York. In 1884, he replaced glass photographic plates with a roll of film, believing in "the future of the film business." Although Kodak originally faced severe challenges, it quickly became a household name. Eastman believed success came from a user-friendly product that "was as convenient as the pencil." Kodak regarded marketing as essential to its success. It first advertised film in 1885. Eastman coined the slogan "You press the button, we do the rest" when he introduced the first Kodak camera in 1258. He identified Kodak's guiding principles: mass production at low cost, international distribution, extensive advertising, and customer focus, and growth through continuous research. He also articulated Kodak's competitive philosophy: "Nothing is more important than the value of our name and the quality it stands for. We must make quality our fighting argument." In the black-and-white film era, Kodak's leadership came from its marketing and its relationships with retailers (for shelf space, and photo-finishing with Kodak paper). Some competitors had better products, but consumers liked Kodak's offerings, and felt no need to pay for an enhanced product.' The idea that money came from consumables, not from hardware, emerged early. In selling cameras, Kodak used a razor-blade strategy: it sold cameras for a low cost, and film fueled Kodak's growth and profits. Over time, Kodak's managers paid progressively less attention to equipment. One executive commented, "No matter what they said, they were a film company. Equipment was ok as long as it drove consumables." With the advent of color film, which required substantial R\&D, many firms lagged behind. After the early 1960s, attempts to enter the market were rare; the film composition's balance of chemical and physical properties and the know-how embedded in manufacturing made creating compatible products expensive and risky. Kodak had worked to develop color film since 1921 and spent over $120 million to do so by 1963. ? Its photo-finishing process became the industry standard. Most rival brands, although of excellent quality when properly processed, fared badly in typical photo shops." Within Kodak, corporate power centered on Kodak Park's massive film-making plant. Kodak's CEOs typically came from manufacturing jobs in the Park. They were langely similar; most received the same training, and attended MIT's Sloan School of Business as a sort of finishing academy. Since mistakes in the manufacturing process were costly, and profitability was high, Kodak avoided anything risky or innovative. It developed "procedures and policies to maintain the status quo." Kodak reached $1 billion in sales in 1962 . In the 1960 s and 1970 s, it introduced new products like the 126 and 110 cameras, which moved beyond consumer photography to medical imaging and graphic arts. Most of these products exploited silver-halide technology and were incremental improvements. By 1976, Kodak controlled 90% of the film market and 85% of camera sales in the United States. Its technological strength and speed to market precluded the emergence of serious competitors." In 1981, its sales reached $10 billion. In 1981, Sony Corporation atnounced it would launch Mavica, a filmless digital camera that would display pictures on a television screen. Pictures could then be printed onto paper. Kodak CEO Colby Chandler contended people "liked color prints" and Kodak could introduce its own digital camera, but managers became concerned about the longevity of silver-halide technology. A manager said, "It sent fear through the company." The reaction was, "my goodness, photography is dead." Exploration and Diversification, 1983 - 1993 Diversification into other businesses Between 1983 and 1993, Kodak acquired IBM's copier services business; Clinical Diagnostics, which produced in-yitro blood analyzers; Mass Memory, which sold floppy disks; and other bioscience and lab research firms. It also acquired Sterling Drug, a pharmaceutical firm that sold products like Lysol and aspirin, for $5.1 billion. Kodak's managers felt the pharmaceutical industry was related to its core "chemical" business: R\&D was pivotal, and margins were high. Between 1987 and 1992 , Kodak's share of the film market decreased by 5% " Competition in the core imaging business: Fuji Photo Film Co. "We were the imaging company of the toorld. We literally had no competition for so long, management hadn't become accustomed to it. Historically, if there was a conpetitor, Kadak would blow them atway." A former Kodak executive" director of Kodak research noted, "We're moving into an information-based company," "[but] it's very hard to find anything [with profit margins] like color photography that is legal." In 1986, Kodak introduced the world's first electronic image sensor with 1.4 million pixels (or picture elements), and it established an electronic photography division in 1987. By 1989, it had introduced more than 50 products that involved electronic image capture or conversion, including a scanner, a continuous digital tone printer, a professional photography image enhancer, and an HDTV projection system. Within the information sector, it established four centers of exceilence to develop image acquisition, storage systems, software, and printer products. Chandler declared Kodak would "be the world's best in chemical and electronic imaging" by "exploring and defining the best ways to manage the convergence of conventional imaging science with electronics." nit See exhibit 5 for Kodak's R\&D expenditures. "Film-based digital imaging," 1990-1993 Although Kodak had been the first to introduce an image sensor, the heart of the camera, the first widely announced digital product was Photo CD. Kodak wanted to create "film-based digital imaging, "It believed new products had to rely on a hybrid film/electronic imaging technology because silver-halide technology provided the highest-quality images attainable at the lowest price "for the foreseeable future." Kay Whitmore, who became CEO in 1990, noted, "As this company did with black-and-white and color, we intend to set the standards and lead the way in film-based digital imaging, nat Kodak planned to sell new hardware products improved by digital features, to license technology to computer producers, to have more prints from discs at photofinishers, and to apply the knowledge acquired in digital imaging to the motion picture business and commercial products. Money had to come from photographic film and paper, but add "the flexibility offered by electronics." Kodak introduced two new products in 1991, the first professional digital camera and the Photo CD, which it touted in its annual report. This product, developed with Phillips, would combine "the best of the photographic medium with the best attributes of electronic imaging. " It started as a blank CD. A roll of film could be taken to a photofinisher, and images, rather than being printed, were stored on the disc. Images could then be viewed on a TV screen with a special Photo CD player or on a computer screen with a CD-ROM. The project was expected to be a $600 million business by 1997 with $100 million in operational earnings, but there was little evidence that consumers would pay $500 for a player that plugged into a TV, plus $20 per disc." The Photo CD was targeted at consumers, although its invention team had argued its real potential lay in the commercial market. Scott Brownstein, who led the team, said senior managers wanted a quick hit and did not "understand our real vision or strategy." Brownstein's group wanted to make CD-ROMs compatible with the Photo CD, but when senior executives met with Bill Gates, he remembered Whitmore's lack of interest, as he apparently fell asleep." Later, when the Photo CD team worked with the computer firms, they had problems explaining the details to Whitmore. In late 1993, Whitmore stepped down. Kodak hired George M.C. Fisher, Motorola's former CEO, to repiace him. Fisher, after having received his Ph.D. in mathematics, had apprenticed at AT\&T's bell Labs, where he did work related to photography. The first outsider to run Kodak, Fisher felt Kodak was built on "imaging," not film, and that it could grow by focusing on its core business and exploiting new digital technologies. Back to the core business, 1993-2003 Fisher divested Kodak's health segment, except for the health sciences unit, which included X-ray film, other diagnostic imaging hardware, and consumables. Kodak sold Sterling Drug, L\&F Products, and Clinical Diagnostics, using most of the proceeds to pay off debt, as well as Eastman Chemical, which had been formed to supply raw materials for Kodak's photographac business, but now got 8% of its sales from Kodak. Fisher demonstrated his confidence in the future of imaging. "I grew up in the electronics business and 1 looked at the photography and imaging business from the electronics side and it's not such a scary event. Electronics will add a lot to photography and a lot to imaging." Growing in the film business: Fisher's legacy in China Fisher felt scenarios of silver-halide photography's future were too pessimistic and that emerging markets like China offered overlooked growth opportunities, When he joined Kodak, it was third in film share and fourth in paper share in China. He had strong credibility with Beijing officials from his time at Motorola. In 1998, Kodak committed $1.2 billion to two joint ventures with the Chinese government. By 2002, it moved facilities to China that made digital, conventional, and single-use cameras, kiosks, and mini-labs, and it created a network of retail outlets there to increase film sales. By early 2002 , it had 63% of the Chinese retail film market, with 7,000 Kodak Express film stores. Digital imaging in Fisher's era, 1993 - 1997 Kodak had spent $5 billion to research digiial imaging by 1993, but its product development and sales were fragmented and scattered over many divisions. At one time, it had 23 distinct digital scanner projects." In 1994, Fisher separated Kodak's digital imaging operations from its silver-halide photographic division. He created a digital and applied imaging division to centralize Kodak's efforts in this area while building on its core capabilities in imaging technology and color science. Carl E. Gustin Jr., formerly with Digital Euuupment Corporation and Apple Computer, was appointed general manager, and John Scully, former CEO of Apple Computer, was hired as a marketing and strategy consultant. Fisher also appointed Harry Kavetas, a former IBM executive credited with rejuvenating Big Blue's credit anit, as Kodak's chief financial officer. Fisher pushed the introduction of the digital print station (a product sold to retailers that allowed customers to digitize their photos), new models of digital cameras, and thermal printers and paper to make prints from the cameras once the images were loaded into a personal computer. Fisher wanted to bring all the digital programs that had languished in Kodak's labs to market He believed Kodak should participate profitably "in the five links of the imaging chain: image capture, processing, storage, output, and delivery of images for people and machines anywhere." Fisher, who had turned Motorola into a premier pager and cell phone producer, believed "Kodak could be successful in the equipment business" because it possessed the capabilities to "do much besides make film." His first step was to re-engineer the company from top to bottom, and "ten teams of senior managers - two of them led by Mr. Fisher - were charged with rethinking everything from product development to how to expand Kodak's markets:" Each business would be required to calculate its customer satisfaction index and to show improvements. Every division had three years to reduce defects and improve reliability. Cycle times on everything from routine paperwork to manufacturing goods were to be improved by a factor of ten over three years." Fisher met with Bill Gates and other computer executives in order to form alliances and develop new products. He felt profitability in hardware could come only with their help, and hoped to "fill in the blanks" of Kodak's digital products (e.gv, Photo CD or its $29,000 professional digital camera), which had not succeeded." He pushed Kodak to be a high tech-company: "[Fisher] has devoted substantial energy to making Kodak like Motorola, capable of producing state-of-the-art products every few months. Company factories are churning out an impressive array of digital cameras, scanners, and other devices at a breakneck clip." But competition in the market for digital cameras was tough: when Kodak introduced the DC40 in 1995 , there were two other models under $1,000. but by 1996 there were 25 different brands in the category. Many Kodak insiders resisted Fisher's initiatives. As one industry executive commented, "Fisher has been able to change the culture at the very top. But he hasn't been able to change the huge mass of middle managers, and they just don't understand this [digital] world."* Fisher, who was used to dissent and open discussion in Motorola, where "they argued like cats and dogs, loudly, sometimes" felt Kodak's executives avoided confrontations and vencrated authority: "everybody looked to the guy above him for what needed to be done." Fisher tried to introduce the Motorolastyle of open discussion, but change was difficult. The razor-blade culture in Kodak was so deeply ingrained that even disposable cameras had been considered almost sacrilegious. In late 1997, Fisher admitted that 60% of Kodak's losses were "costs linked to digital cameras, scanners, thermal printers, writeable CDs and other products"st and announced a reversal of his hardware-based digital strategy: "[O]ur intention is to use whatever technology is available to us to truly help people do more with their pictures. Electronic imaging will not cannibalize film. One of the mistakes we at Kodak have made is that we've tried to do it all. We do not have to pursue all aspects of the digital opportunity and we see our opportunity in the output and service side." Toward a fully digital world, 1998 - 2003 Fisher felt Kodak needed a "network ard consumables"-based business model: We see a networked worid in making, taking and processing pictures. We will stick ourselves in the middle of that world with services that people are willing to pay for, like creating photo albums online or simply sending photos from point A to point B. Or they'll use one of our 13,000 kiosks...We will always sell film, paper and chemicals...we will let people take pictures and scan them in digital form, and we will make money on the different media (CDs or the Internet, for example) or material for output-inkjet paper, thermal papers, and traditional silver halide paper." Fisher wanted Kodak to be a "horizontal company" that outsourced most digital photographic equipment and built alliances (e.g, with Intel): "Traditionally, our business is chemically based, and we do everything. In the digital world, it is much more important to pick out horizontal layers where you have distinctive capabilities. In the computer world, one company specializes in microprocessors, one in monitors, and another in disk drives. No one company does it all." Oa the film side, Kudak was caught off guard by Fuji, which slashed prices in 1998 to grab market share in the United States, where Kodak still enjoyed the highest margins. Kodak's market share dropped from 46% to 42% in just one year: Its decline in the film business continued into the early 2000 s. See exhibit 6 for changes in film revenue. Fisher contended Fuji was "literally buying presence in this country, buying customers in this country, selling film at unbelievably low price because they could afford it and because they had an infinite source of money coming out of a protected market in Japan.." By late 1999, Kodak had to cut $1.2 billion in costs and 19,900 jobs, almost 20% of its payroll. In early 2000, Daniel A. Carp became CEO. Before becoming President and COO in 1997, he had been general manager of sales for Kodak Canada, general manager of the consumer electronics division, and general manager of the European, African, and Middle Eastern regions. He inherited the "horizontal company" and the "network and consumables"-based business model: We see digitization in creating a film and a photo-finishing aftermarket that should fuel on explosion of pictures and use of digital and 35mm technology. At its core, Kodak's digital strategy is to create a profitable bridge between the old and new worlds of photography. Even as it hopes to jump-start sales of digital cameras, the company wants to transfer as many of its customers' traditional snapshots as possible to digital form." By 1999, Kodak had become number two in digital cameras in the United States, with a 27% market share. Exhibit 7 provides market share data for digital cameras. Kodak had a print-ondemand website and promised to form joint ventures to popularize new distribution channels such as digital photo kiosks and the Internet. Just as the early Kodak pursued the holy trinity of film, paper and chemicals, and dominated all three, the new Kodak worships the digital trinity of image capture (cameras), services (online photo manipulation) and image output (digital kiosks, inkjet printers, paper and inks)." Kodak's network of 19,000 Picture Maker kiosks at retail stores vas also successful. At $15,000 each, Carp said they were highly profitable and accounted for $200 million in sales; "with 95% of customers who used them coming back repeatedly, they produced steady photo paper sales." See exhibit 8 for information on the installed base of kioslss. Kodak also battled with Hewlett Packard for the printing segment, investing much of its R\&D budget in inkjet printers, which drove sales of highmargin inkjet cartridges and specialized paper." In fall 2000, another round of corporate restructuring brought digital and applied imaging and consumer imaging into one division; this move was expected to end the internal war between the film and the digital segments." Still, Kodak lost \$60 in 2001 on every digital camera it sold. Yet Carp invested in digital imaging, and Kodak boosted its advertising as it tried to create an integrated marketing effort and message to the customer, with its "Where it all clicks" theme, and consumer imaging, digital and applied imaging, and Kodak.com went to market with one campaign." Kodak also invested heavily in developing software for image manipulation that enhanced what could be done on a computer to a digital picture and at a retail store to traditional film. In October 2002, it launched the first mass-market product for digital film processing. With this software, film was still developed traditionaliy, but digital processing then scanned each negative and analyzed it, looking for areas that had been expused to too much or too little light. It filled in light where needed and cut back on it where there was too much. Carp noted, "This is the most important innovation for us since color. Using digital technology to enhance photos consumers take with existing analog cameras is an extension of Kodak's basic strategy of making it easier to take pictures. mht At Kodak's 2002 meeting, Carp outlined four paths to move Kodak into the new millennium:" - Expand film's benefits: Kodak would grow its market share by offering premium products (e.g., the Max Versatility products), leveraging its distribution, and increasing its exposure through more targeted marketing.i - Drive image output in all forms to achieve higher retail margins. Kodak planned to introduce the Perfect Touch premium processing system and expand its portfolio of digital mini-labs; - Simplify the digital photo experience for consumers, with an emphasis on products such as the EasyShare digital camera platform, Picture Maker kiosks, and Picture CDs; - Grow in emerging markets, where it already operated thousands of Kodak Express Stores. By January 2003, digital cameras remained unprofitable; Kodak had weak fourth-quarter earnings and announced more layoffs. Yet it controlled most photofinishing transactions in the United States, and had 15% of the U.S. digital camera market." The digital imaging market expanded in 1993 and 1994 as many products came out. By August 1994, 22 filmless camera models were sold. In 1995, three models were priced under $1.000. By 1996, 25 models cost under $1,000. The high end included studio photography like magazines and commercial studios. The middle segment included photojournalists and professional photographers. Kodak was competitive in each segment. The low end was consumer and business applications like real estate, advertising, and website displays. The first low-end product was Apple's QuickTake 100, priced at $749 in early 1994. Major competitors included Logitech's Pixtura and Kodak's DC-40. All three used the image sensor developed by Kodak in 1986. Other digital products included 35 mm scanners, image-editing, and printers; Kodak sold a dye sublimation printer. By 1999, digital imaging had four distinct sub-markets: digital cameras, home printing, online services, and retail kiosks and mini-labs. Acquiring, digitizing, storing, printing, manipulating, transmitting, retrieving and projecting digital images had become easier, and options for each had increased. (Figure A on page 9 depicts the digital imaging chain.) Falling prices helped drive digital camera sales. Between 2000 and 2002 , the estimated average price of a 3 megapixel camera had decreased from $865 to $396. New digital cameras with higher resolutions were projected to follow roughly the same price trend. Exhibit 9 provides data on sales of 35mm, instant, and digital cameras. With 6 million units soid in 2001 (almost a 50% increase over 2000), the installed base of digital cameras in the United States was 13 million, or 12.5% of total US households. By September 2002, digital camera sales had increased 60% relative to 2001 and the average price for all digital cameras sold had dropped to $350. Competition was based mainly on features, functionality, and price, but Sony, Kodak, Olympus, and Hewlett Packard increasingly dominated the market. Yet profitability remained elusive for most firms, which were moving their manufacturing infrastructures to China to reduce costs. Exhibit 10 shows revenue data for different parts of the photography market. Almost all traditional film images were processed at retail locations. For digital images, users had many processing choices. Printing occurred at the home/office, Internet photo service providers, and retail photofinishing. Industry experts estimated that in 2002, most digital prints were done in the office or at home, but that home printing would decline to 65% of all digital prints by 2005 (see exhibit 11). Hewlett Packard, Lexmark, Epson, and Canon dominated the printing market. Kodak had a small role thanks to its relationship with Lexmark. Hewlett Packard and Kodak dominated the specialty printing paper niche, which had estimated EBIT margins of 25% after retail mark-up. In 2000, over a hundred firms competed in online services, which included digitization, photo finishing, and storage. By 2003. Fuji, Kodak/Ofoto, and Shutterfly remained. Ofoto, bought in 2001 by Kodak, offered free online storage of photos. It charged for prints, enlargements, photo cards, and other photo-related products, which it delivered directly to customers. Its clients could have their silver-halide pictures digitized and posted online for about $4. In 2002, these services accounted for 10% of all digital prints. " Prices decreased as service fees were eliminated. Industry experts expected the model to be profitable in a few years since there was no retail markup. According to one report, 33% of the 45 million images captured in 2001 were printed. Retailers processed 15\%, but most analysts experted digital mini-labs and kiosks to eventually become the dominant channel." Since the 1980 s, the photo processing industry had undergone major changes. Retailers had formed regional wholesale labs to sustain film processing. During the 1980 s and the 1990 s, Kodak and Fuji promoted consolidation and gained substantial control of the market. Concurrently, new photo-processing units, which fit into retailers' shops, enabled local service of 24hour and then one-hour processing. As a result, the amount of film sent to wholesale labs for processing declined. Retailers offered two main processing solutions, mini-labs and kiosks, which bridged between traditional inputs and new digital channels. Retailers had turned to digital kiosks, which eliminated scanners from the system, and digital mini-labs, which printed high-quality digital files as easily as silver-hailide based photos were printed. Digital mini-labs and kiosks allowed for digital uploads from CDs, Zip discs, floppies, DVDs, and flash cards. Once digitized, images could be archived on various media. With more than 5,000 labs in place, Fuji had 60% of the mini-labs market, which was almost 15% of the total mini-lab installed base in 2002 . It had also agreed to install machines in 2,500 Wal-Mart and 800 Walgreen's outlets. These chains handled about 40% of the U.S. photo-processing market. Kodak had about 100 digital mini-labs in service because its agreement with Gretag, an imaging firm, ended in 2002 when Gretag filed for bankruptcy. Kodak allied with Noritsu Koki to close this gap, and projected the sale of 1,000 mini-labs by the end of 2003..2 It dominated the offering of kiosks, with its 34,000 Picture Makers, which offered retailers a modular solution that comprised three stations: Picture Maker Order Station, Digital Station, and Print Station. Exhibits 8 and 12 show the installed base of mini-labs and kiosks and channel sales, respectively, in the United States. Appendix A presents an overview of Kodak's competitors in digital imaging. Exhibit 1 Kodak Financial Statements, 1993-2003E (S millions) Source: adapted from Salomon Smith Blarney, 20ec, and company's reports Fvhihits It C Camara Gales 1083 - 3m funite in millionel Source: Adapted from PMA Marketing Research. Exhibit 3 U.S. Film Roll S.les, 19632000 (units in hundreds of millions) Smurce: Adapted from PMA Marketing Reseanch Exhibit 4 Worldwide Film Market Share, 1990 - 2002E (unit market share, in percent) Source: Adapted from Merrill Lynch and PhotoMarkei Exhibit 5 Eastman Kodak R\&D Spending, 1982 - 2001 (in millions \$) - Divestiture of Eastman Chemical Company " Divestiture of non-imaging health businesses Source: adapted from company's reports Exhibit 6 Film Revenues Change in the U.S. Food, Drug, and Mass Merchandising Channel, 20012002 (in percent) " Change in revenues over the 4 weeks ended February 2001, March 2001, April 2002, May 2002, and June 2002. Source: Adapted from Morgan Stanley, July 2002 Exhibit 7 U.S. Digital camera market share, 1998-2002 (\% of units sold) Source: Adapted from Credit Suisse First Blecton, 2002 Exhibit 8 U.S. Kiosks and Mini-labs Installed Base and Share by Type, 2000-2006E (units) Exhibit 9 Worldwide Camera Sales, 1997 - 2004E ( S in millions) Source: Adapted from Salomon Smith Bamey 2005 Exhibit 10 Worldwide Photography, Film, Processing, and Output Revenues (\$ in millions) Source: Adapted from Salomon Smith Barney, 2003 Exhibit 11 Worldwide Digital and Film Image Capture and Print Volume, 20002006 (millions of units) - Retail film prints include onsite processing (mini-labs) and wholesale processing Source: adapted from IDC, 2002 Exhibit 12 U.S. Film Revenues Share by Channel, 2000 - 2003E (in percent) Appendix A Competition in Digital Imaging