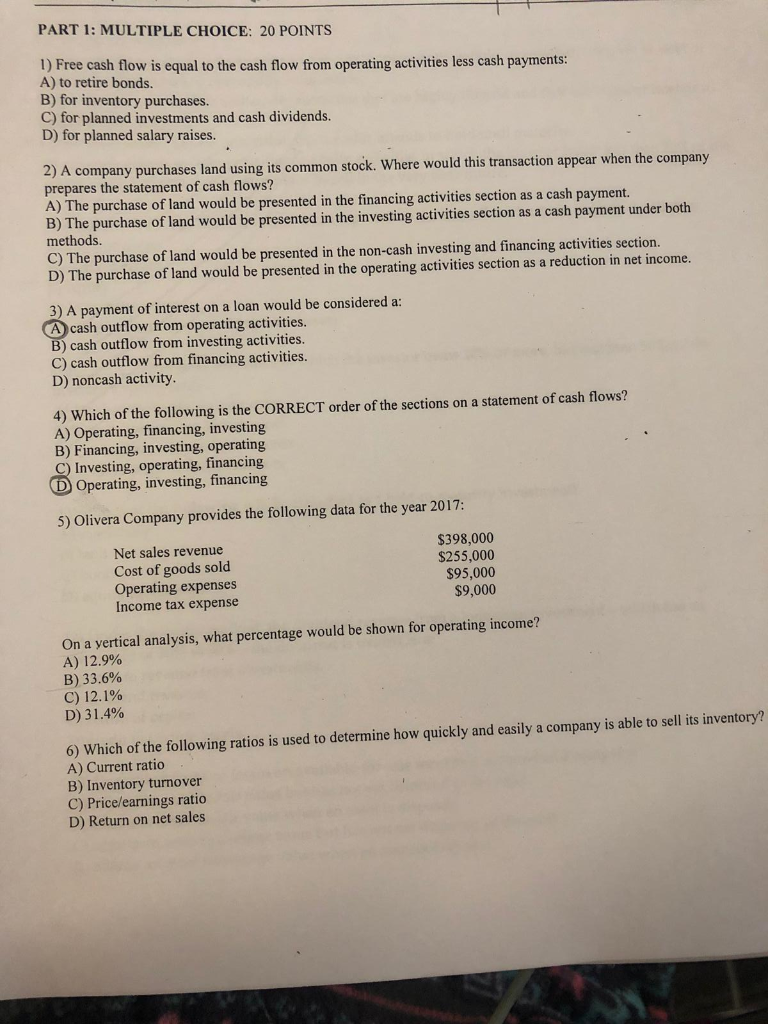

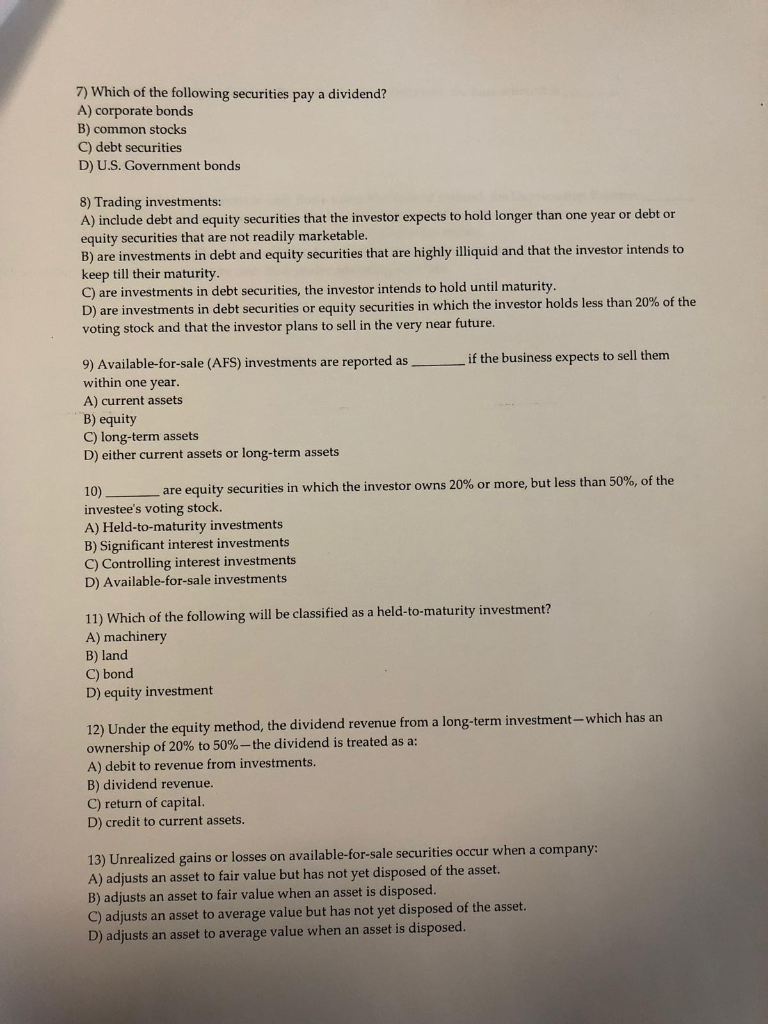

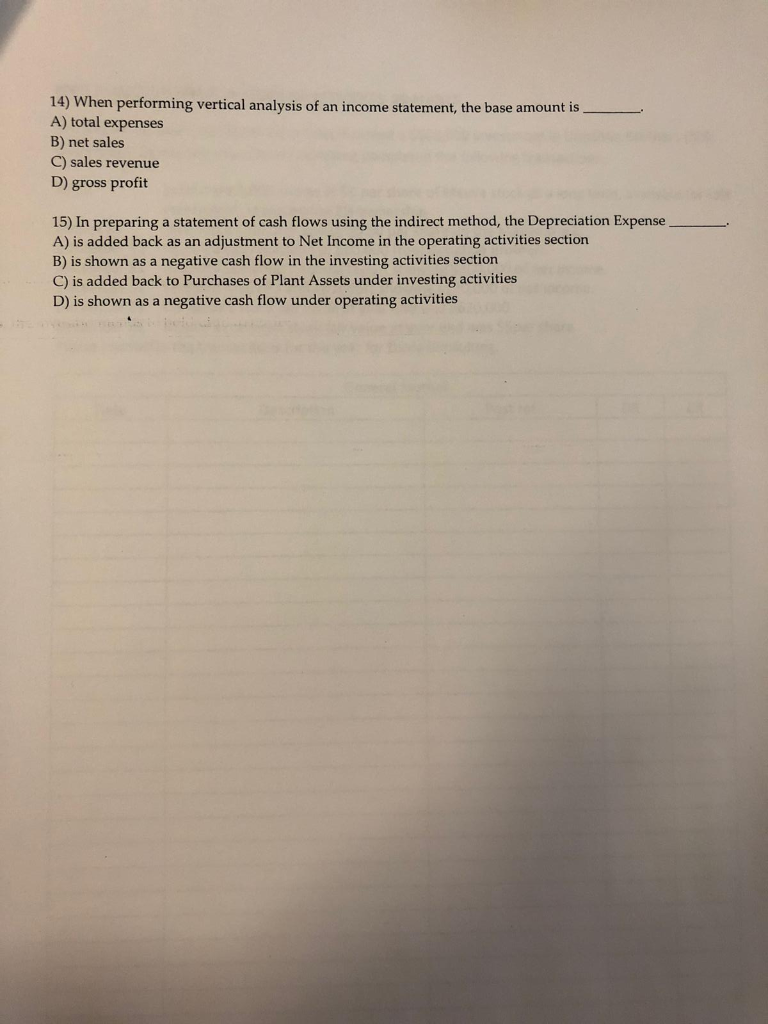

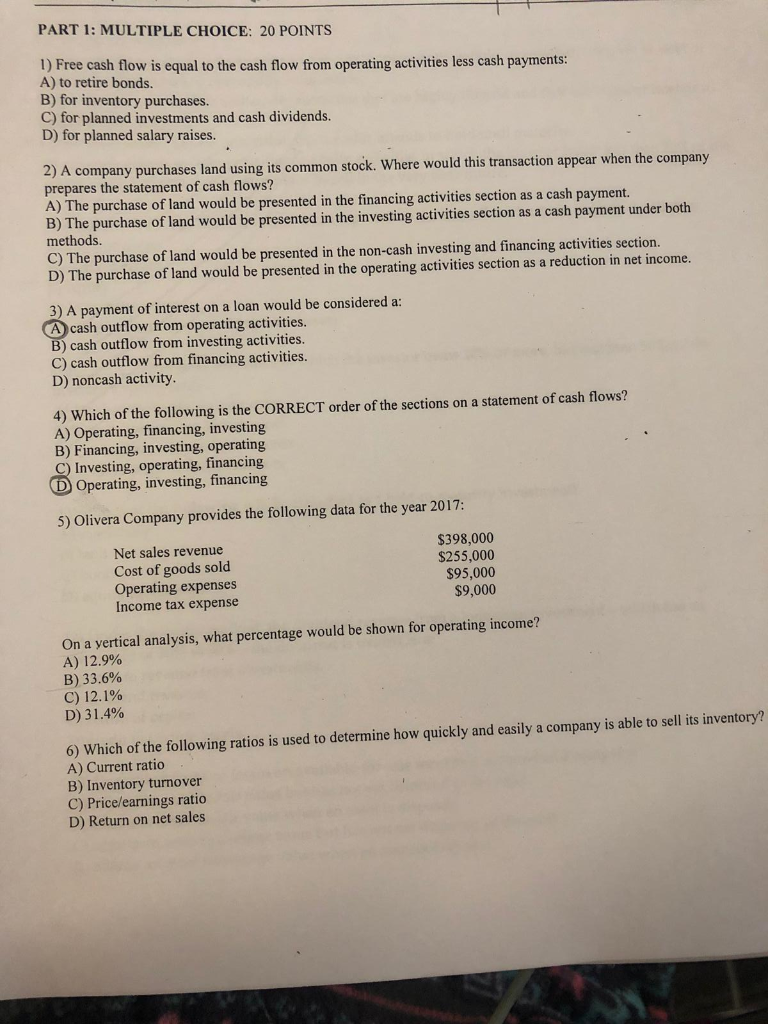

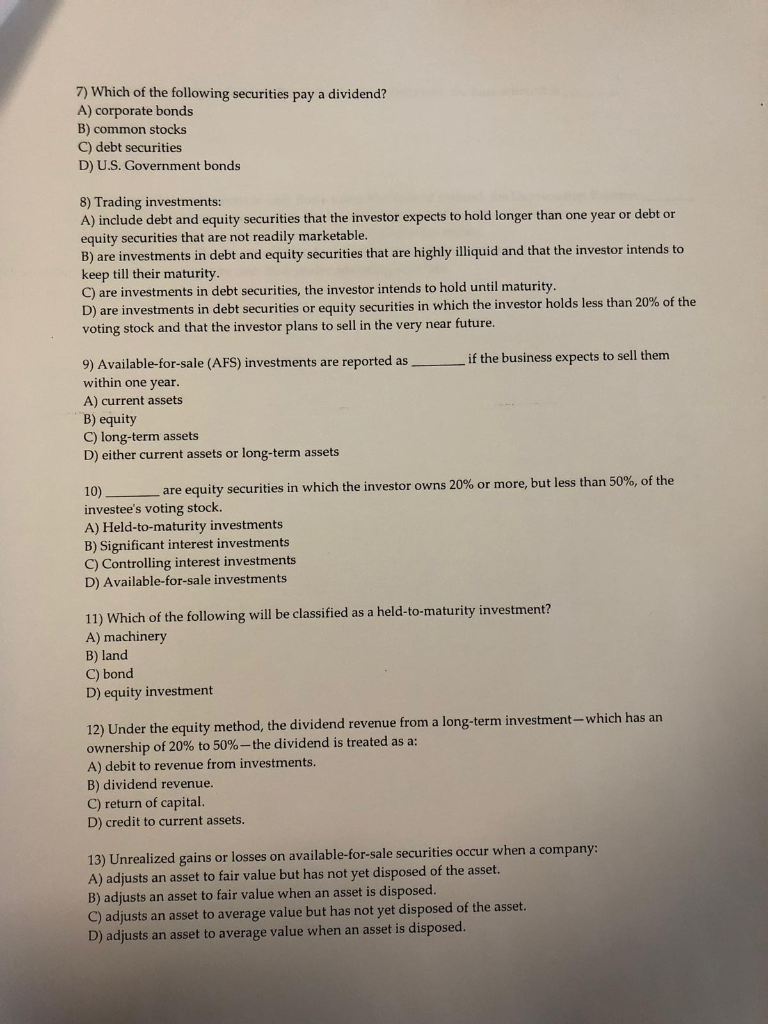

PART 1: MULTIPLE CHOICE: 20 POINTS 1) Free cash flow is equal to the cash flow from operating activities less cash payments: A) to retire bonds. B) for inventory purchases. C) for planned investments and cash dividends. D) for planned salary raises. 2) A company purchases land usin prepares the statement of cash flows? A) The purchase of land would be presented in the financing activities section as a cash payment. B) The purchase of land would be presented in the investing activities section as a cash payment under both methods. C) T g its common stock. Where would this transaction appear when the company he purchase of land would be presented in the non-cash investing and financing activities section. D) The purchase of land would be presented in the operating activities section as a reduction in net income. 3) A payment of interest on a loan would be considered a: A cash outflow from operating activities cash outflow from investing activities. C) cash outflow from financing activities. D) noncash activity. 4) Which of the following is the CORRECT order of the sections on a statement of cash flows? A) Operating, financing, investing B) Financing, investing, operating C) Investing, operating, financing Operating, investing, financing 5) Olivera Company provides the following data for the year 2017: Net sales revenue Cost of goods sold Operating expenses Income tax expense S398,000 $255,000 $95,000 $9,000 On a yertical analysis, what percentage would be shown for operating income? A) 12.9% B) 33.6% C) 12.1% D)31.4% 6) Which of the following ratios is used to determine how quickly and easily a company is able to sell its inventory? A) Current ratio B) Inventory turnover C) Price/earnings ratio D) Return on net sales 7) Which of the following securities pay a dividend? A) corporate bonds B) common stocks C) debt securities D) U.S. Government bonds 8) Trading investments: A) include debt and equity securities that the investor expects to hold longer than one year or debt or equity securities that are not readily marketable. B) are investments in debt and equity securities that are highly illiquid and that the investor intends to keep till their maturity. C) are investments in debt securities, the investor intends to hold until maturity D) are investments in debt securities or equity securities in which the investor hold voting stock and that the investor plans to sell in the very near future s less than 20% of the the business expects to sell them 9) Available-for-sale (AFS) investments are reported asif within one year A) current assets B) equity C) long-term assets D) either current assets or long-term assets are equity securities in which the investor owns 20% or m ore, but less than 50%, of the 10) investee's voting stock. A) Held-to-maturity investments B) Significant interest investments C) Controlling interest investments D) Available-for-sale investments 11) Which of the following will be classified as a held-to-maturity investment? A) machinery B) land C) bond D) equity investment 12) Under the equity method, the dividend revenue from a long-term investment ownership of 20% to 50%--the dividend is treated as a: A) debit to revenue from investments B) dividend revenue. C) return of capital D) credit to current assets. -which has an 13) Unrealized gains or losses on available-for-sale securities occur when a company: A) adjusts an asset to fair value but has not yet disposed of the asset. B) adjusts an asset to fair value when an asset is disposed. C) adjusts an asset to average value but has not yet disposed of the asset. D) adjusts an asset to average value when an asset is dispo sed 14) When performing vertical analysis of an income statement, the base amount is_ A) total expenses B) net sales C) sales revenue D) gross profit 15) In preparing a statement of cash flows using the indirect method, the Depreciation Expense A) is added back as an adjustment to Net Income in the operating activities section B) is shown as a negative cash flow in the investing activities section C) is added back to Purchases of Plant Assets under investing activities D) is shown as a negative cash flow under operating activities