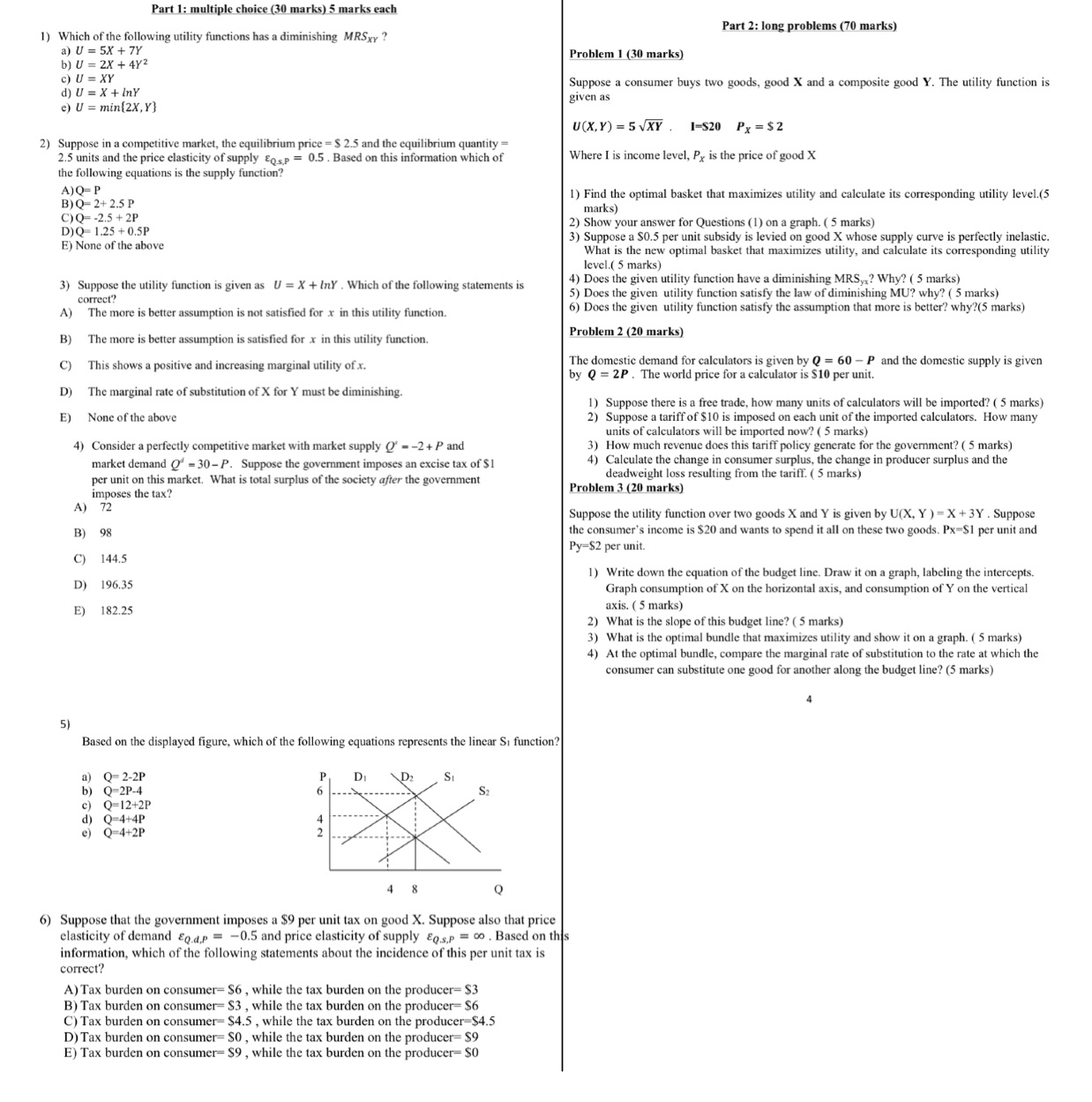

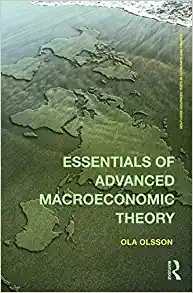

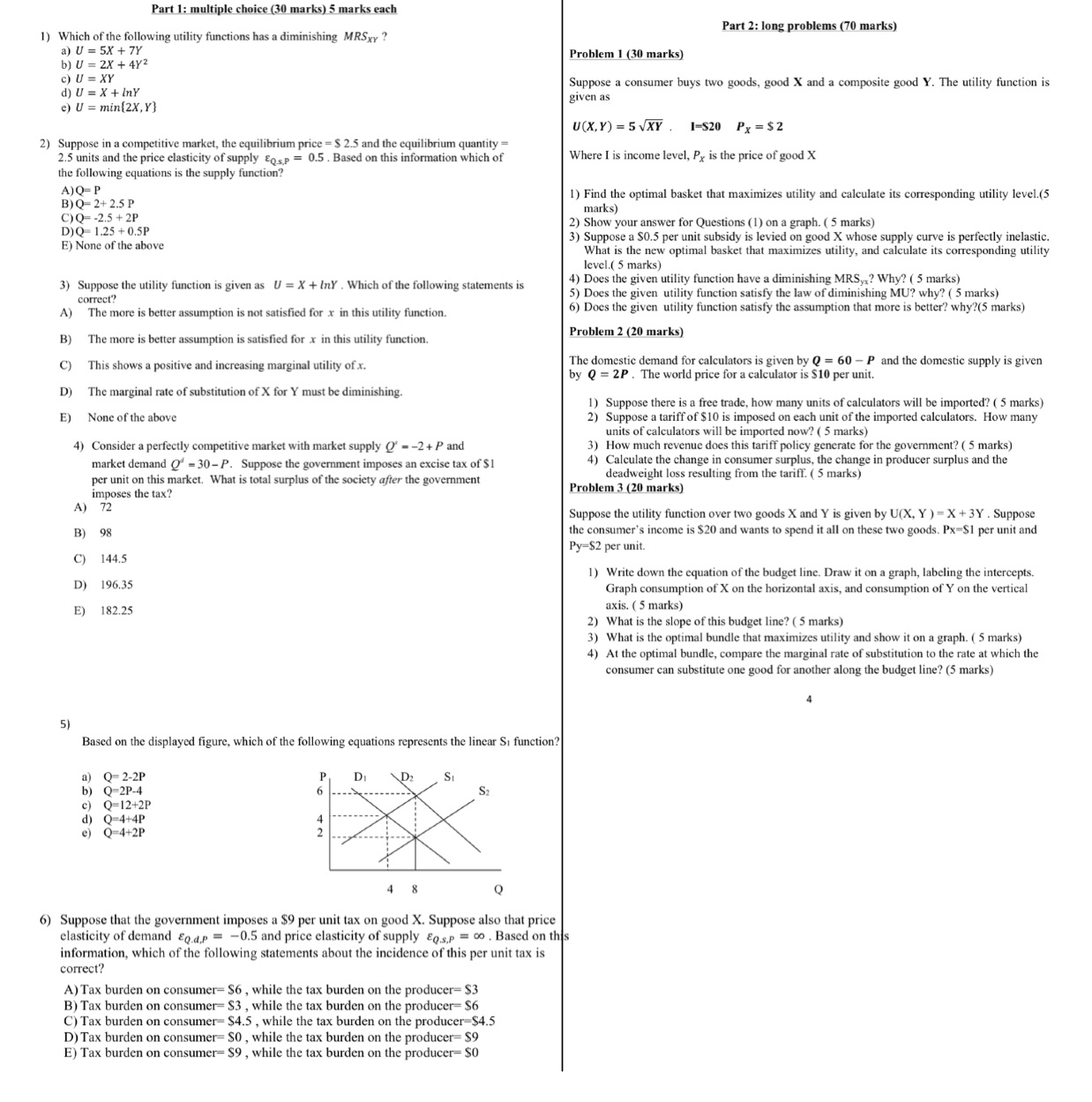

Part 1: multiple choice (30 marks) 5 marks each 1) Which of the following utility functions has a diminishing MRSxy ? Part 2: long problems (70 marks) a) U = 5X + 7Y Problem 1 (30 marks) b) U = 2X + 4Y c) U = XY d) U = X + InY Suppose a consumer buys two goods, good X and a composite good Y. The utility function is given as c) U = min(2X, Y} U(X, Y) = 5 VXY . 1=$20 Px = $2 2) Suppose in a competitive market, the equilibrium price = $ 2.5 and the equilibrium quantity = 2.5 units and the price elasticity of supply EQs,p = 0.5 . Based on this information which of Where I is income level, Px is the price of good X the following equations is the supply function? A)Q=P B) Q-2+2.5P 1) Find the optimal basket that maximizes utility and calculate its corresponding utility level.(5 C) Q= -2.5 + 2P marks) D)Q-1.25 + 0.5P 2) Show your answer for Questions (1) on a graph. ( 5 marks) E) None of the above 3) Suppose a $0.5 per unit subsidy is levied on good X whose supply curve is perfectly inelastic. What is the new optimal basket that maximizes utility, and calculate its corresponding utility level.( 5 marks) 3) Suppose the utility function is given as U = X + InY . Which of the following statements is 4) Does the given utility function have a diminishing MRS,? Why? ( 5 marks) correct? 5) Does the given utility function satisfy the law of diminishing MU? why? ( 5 marks) A) The more is better assumption is not satisfied for x in this utility function. 6) Does the given utility function satisfy the assumption that more is better? why?(5 marks) B) The more is better assumption is satisfied for x in this utility function. Problem 2 (20 marks) C) This shows a positive and increasing marginal utility of x. The domestic demand for calculators is given by Q = 60 - P and the domestic supply is given by Q = 2P . The world price for a calculator is $10 per unit. D) The marginal rate of substitution of X for Y must be diminishing. 1) Suppose there is a free trade, how many units of calculators will be imported? ( 5 marks) E) None of the above 2) Suppose a tariff of $10 is imposed on each unit of the imported calculators. How many units of calculators will be imported now? ( 5 marks) 4) Consider a perfectly competitive market with market supply Q' = -2 + P and ) How much revenue does this tariff policy generate for the government? ( 5 marks) market demand Q = 30-P. Suppose the government imposes an excise tax of $1 4) Calculate the change in consumer surplus, the change in producer surplus and the per unit on this market. What is total surplus of the society after the government deadweight loss resulting from the tariff. ( 5 marks) imposes the tax? Problem 3 (20 marks) A) 72 Suppose the utility function over two goods X and Y is given by U(X, Y ) = X + 3Y . Suppose 3) 98 the consumer's income is $20 and wants to spend it all on these two goods. Px=$1 per unit and Py=$2 per unit. C) 144.5 1) Write down the equation of the budget line. Draw it on a graph, labeling the intercepts D) 196.35 Graph consumption of X on the horizontal axis, and consumption of Y on the vertical E) 182.25 axis. ( 5 marks) 2) What is the slope of this budget line? ( 5 marks) 3) What is the optimal bundle that maximizes utility and show it on a graph. ( 5 marks) 4) At the optimal bundle, compare the marginal rate of substitution to the rate at which the consumer can substitute one good for another along the budget line? (5 marks) 5) Based on the displayed figure, which of the following equations represents the linear Si function? a) Q=2-2P DI b) c) Q=12+2P d) Q=4+4P e) Q=4+2P 6) Suppose that the government imposes a $9 per unit tax on good X. Suppose also that price elasticity of demand EQ.ap = -0.5 and price elasticity of supply EQ.s,p = co . Based on this information, which of the following statements about the incidence of this per unit tax is correct? A) Tax burden on consumer= $6 , while the tax burden on the producer= $3 B) Tax burden on consumer= $3 , while the tax burden on the producer= $6 C) Tax burden on consumer- $4.5 , while the tax burden on the producer $4.5 D) Tax burden on consumer= $0 , while the tax burden on the producer= $9 E) Tax burden on consumer= $9 , while the tax burden on the producer= $0