Answered step by step

Verified Expert Solution

Question

1 Approved Answer

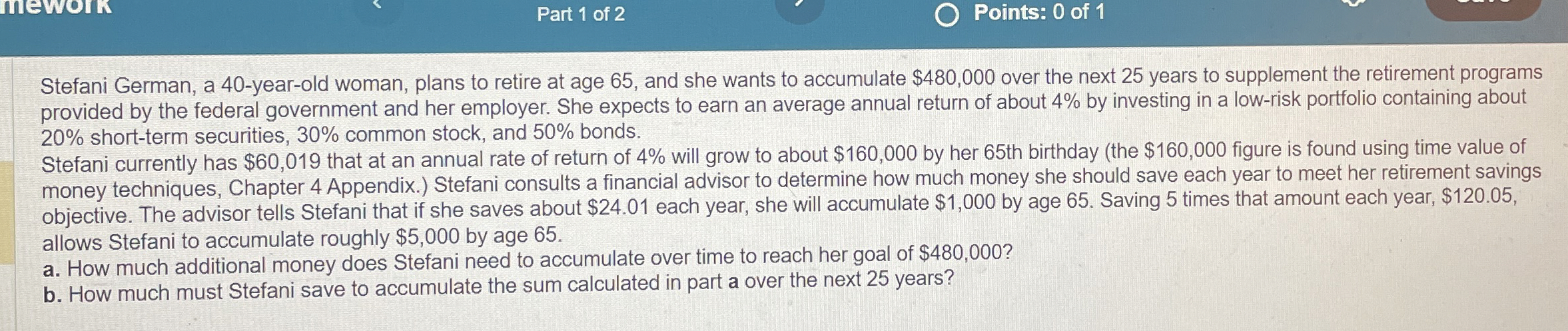

Part 1 of 2 Points: 0 of 1 Stefani German, a 4 0 - year - old woman, plans to retire at age 6 5

Part of

Points: of

Stefani German, a yearold woman, plans to retire at age and she wants to accumulate $ over the next years to supplement the retirement programs provided by the federal government and her employer. She expects to earn an average annual return of about by investing in a lowrisk portfolio containing about shortterm securities common stock, and bonds.

Stefani currently has $ that at an annual rate of return of will grow to about $ by her th birthday the $ figure is found using time value of money techniques, Chapter Appendix. Stefani consults a financial advisor to determine how much money she should save each year to meet her retirement savings objective. The advisor tells Stefani that if she saves about $ each year, she will accumulate $ by age Saving times that amount each year, $ allows Stefani to accumulate roughly $ by age

a How much additional money does Stefani need to accumulate over time to reach her goal of $

b How much must Stefani save to accumulate the sum calculated in part a over the next years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started