part 1

part 2

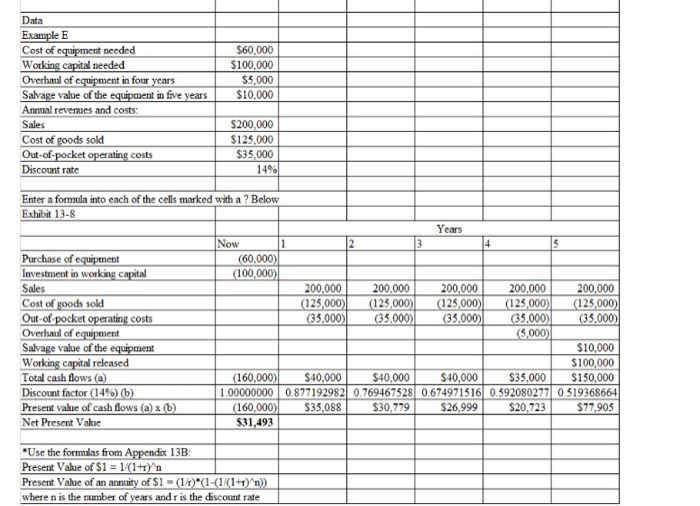

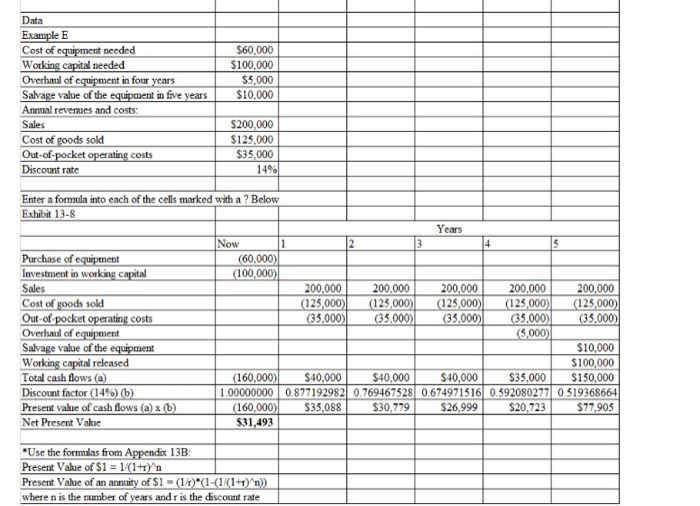

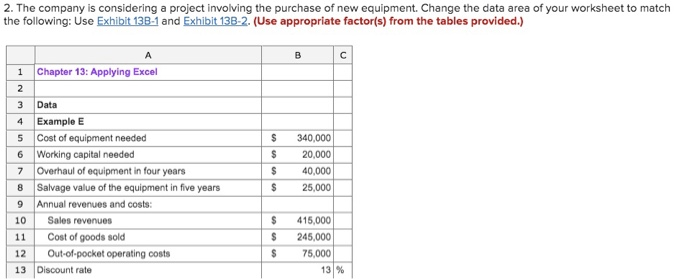

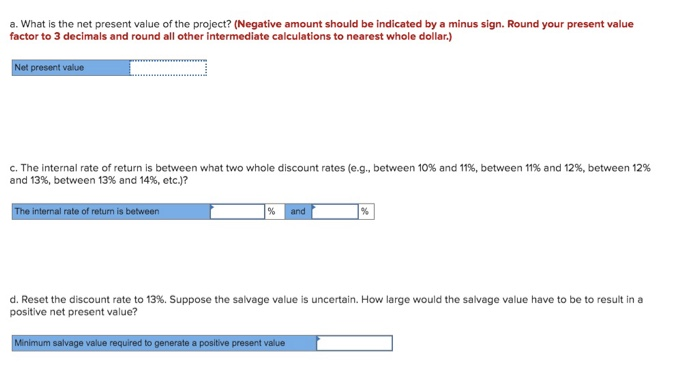

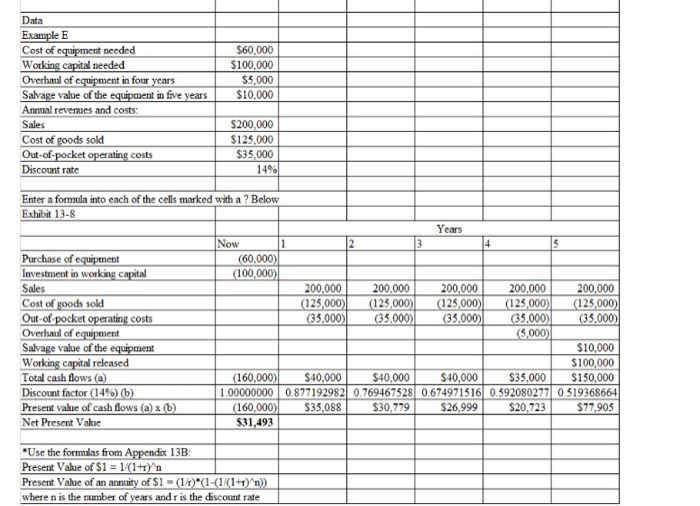

Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales Cost of goods sold Out-of-pocket operating costs Discount rate $60,000 $100.000 $5,000 $10,000 $200,000 $125,000 $35,000 14% Enter a forma into each of the cells marked with a ? Below Exhibit 13-8 Years 13 14 Now (60,000) (100,000) Purchase of equipment Investment in working capital Sales Cost of goods sold Out-of-pocket operating costs Overhaul of equipment Salvage value of the equipment Working capital released Total cash flows (a) Discount factor (14%) (b) Present value of cash flows (a) Net Present Value 200.000 200.000 200.000 200.000 200.000 (125,000) (125,000) (125,000) (125,000) (125,000) (35.000 (33.000) (35.000) (35.000) (33.000) (5,000) $10,000 $100,000 $40,000 $40,000 $40,000 $35,000 $150,000 0.877192982 0.769467528 0.674971516 0.592080277 0.519368664 $35,088 $30,779 $26,999 $20,723 $77,905 (160,000) 1.00000000 (160,000 $31,493 (b) *Use the formulas from Appendix 13B Present Value of $1 = 1/(1+1) 'n Present Value of an annuity of $1 = (1/1)*(1-(1/(1+1) 'n) where n is the number of years and r is the discount rate 2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match the following: Use Exhibit 13B-1 and Exhibit 13B-2. (Use appropriate factor(s) from the tables provided.) 1 Chapter 13: Applying Excel Data 4 $ 5 6 7 $ 340,000 20,000 40,000 25,000 $ $ Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales revenues Cost of goods sold Out-of-pocket operating costs Discount rate $ $ 415,000 245,000 75,000 13 13% a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.) Net present value c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? The internal rate of return is between % and % d. Reset the discount rate to 13%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? Minimum salvage value required to generate a positive present value Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales Cost of goods sold Out-of-pocket operating costs Discount rate $60,000 $100.000 $5,000 $10,000 $200,000 $125,000 $35,000 14% Enter a forma into each of the cells marked with a ? Below Exhibit 13-8 Years 13 14 Now (60,000) (100,000) Purchase of equipment Investment in working capital Sales Cost of goods sold Out-of-pocket operating costs Overhaul of equipment Salvage value of the equipment Working capital released Total cash flows (a) Discount factor (14%) (b) Present value of cash flows (a) Net Present Value 200.000 200.000 200.000 200.000 200.000 (125,000) (125,000) (125,000) (125,000) (125,000) (35.000 (33.000) (35.000) (35.000) (33.000) (5,000) $10,000 $100,000 $40,000 $40,000 $40,000 $35,000 $150,000 0.877192982 0.769467528 0.674971516 0.592080277 0.519368664 $35,088 $30,779 $26,999 $20,723 $77,905 (160,000) 1.00000000 (160,000 $31,493 (b) *Use the formulas from Appendix 13B Present Value of $1 = 1/(1+1) 'n Present Value of an annuity of $1 = (1/1)*(1-(1/(1+1) 'n) where n is the number of years and r is the discount rate 2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match the following: Use Exhibit 13B-1 and Exhibit 13B-2. (Use appropriate factor(s) from the tables provided.) 1 Chapter 13: Applying Excel Data 4 $ 5 6 7 $ 340,000 20,000 40,000 25,000 $ $ Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales revenues Cost of goods sold Out-of-pocket operating costs Discount rate $ $ 415,000 245,000 75,000 13 13% a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.) Net present value c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? The internal rate of return is between % and % d. Reset the discount rate to 13%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? Minimum salvage value required to generate a positive present value