Part 1

Part 2

Part 3

Part 4

Part 5

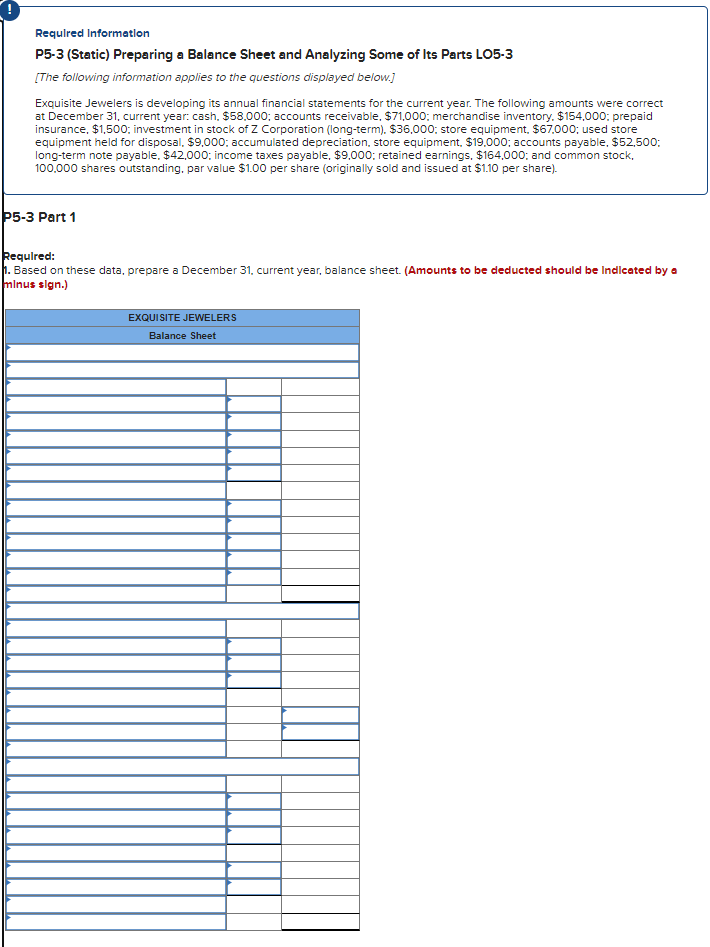

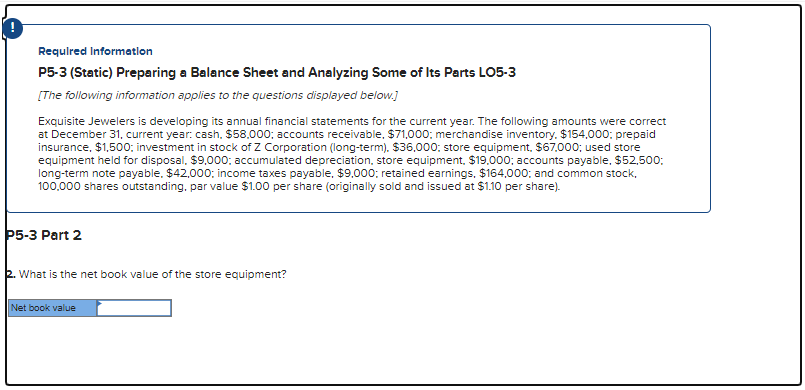

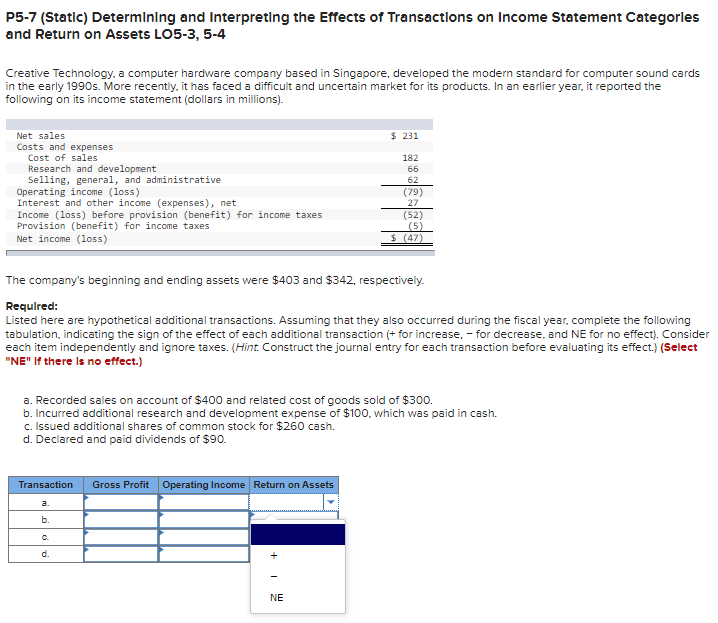

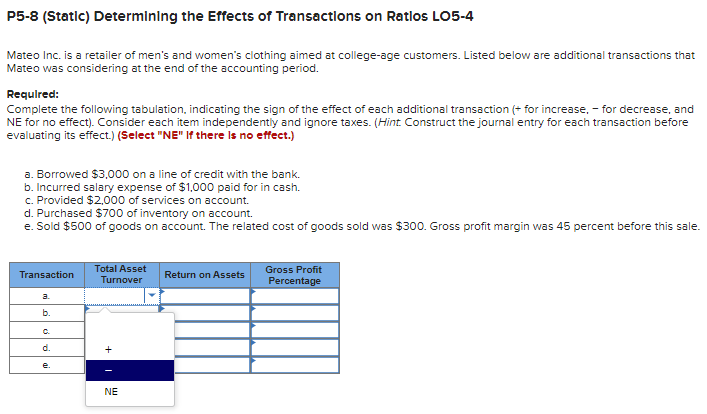

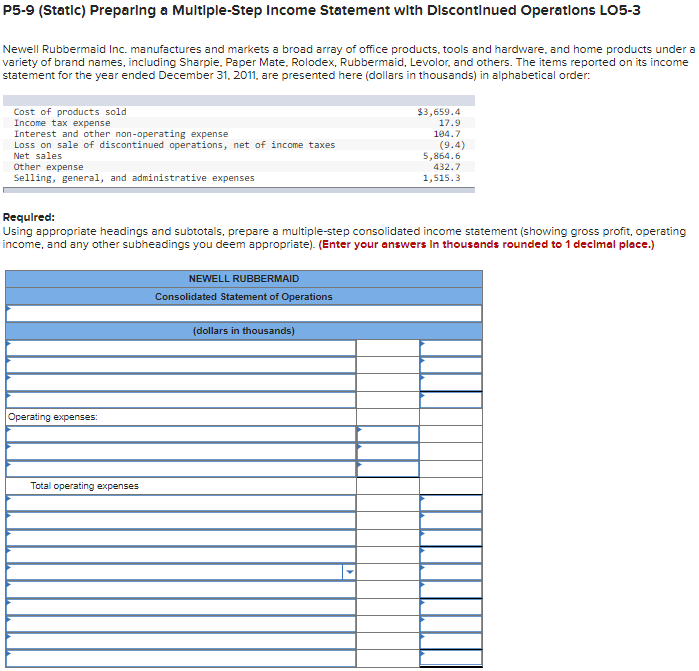

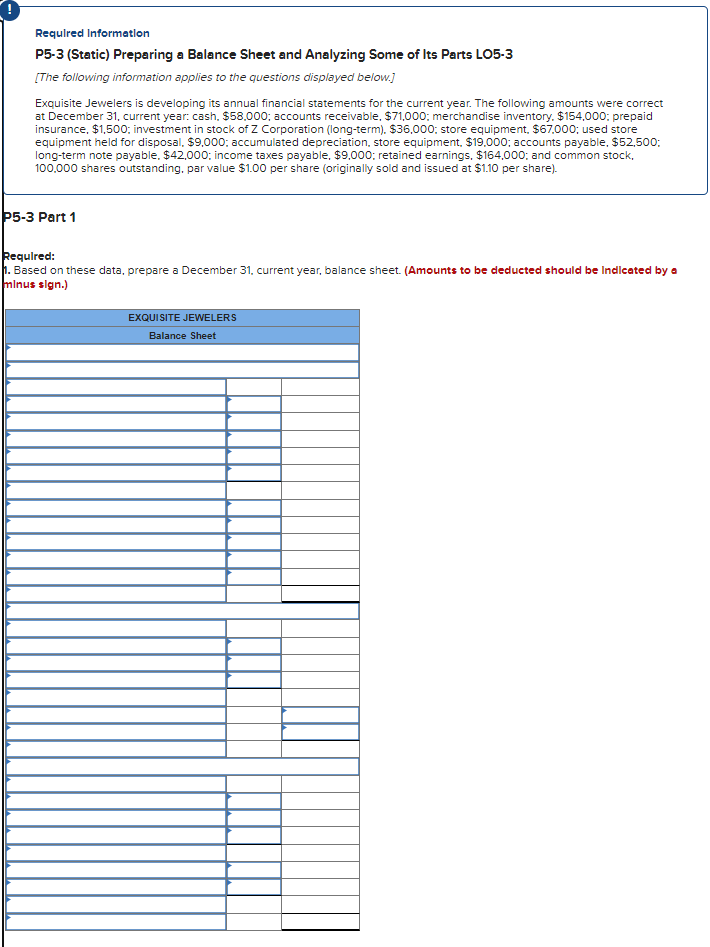

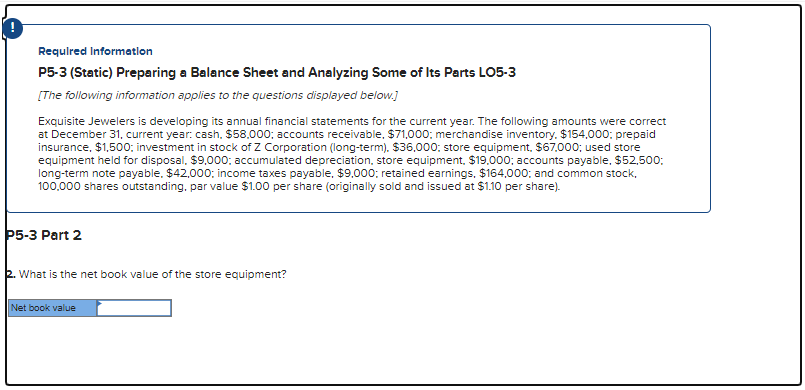

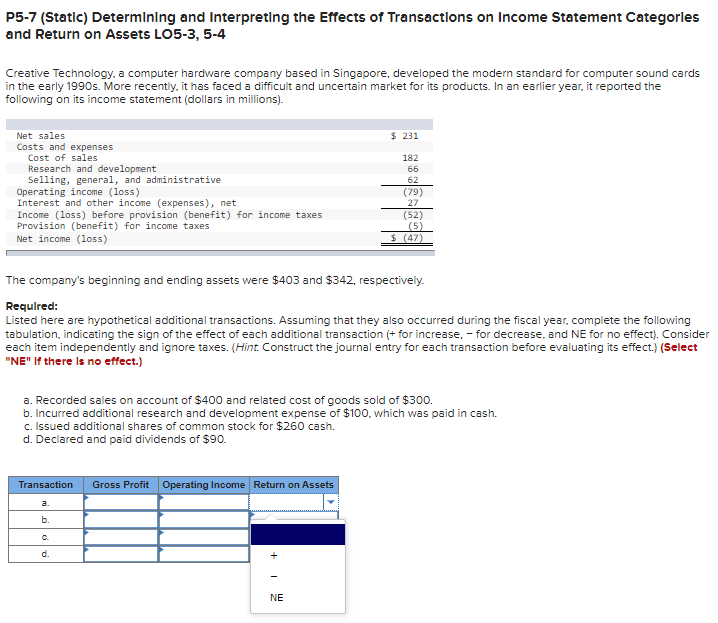

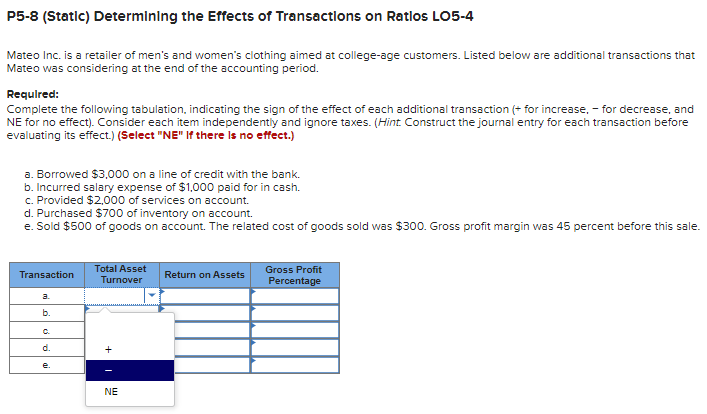

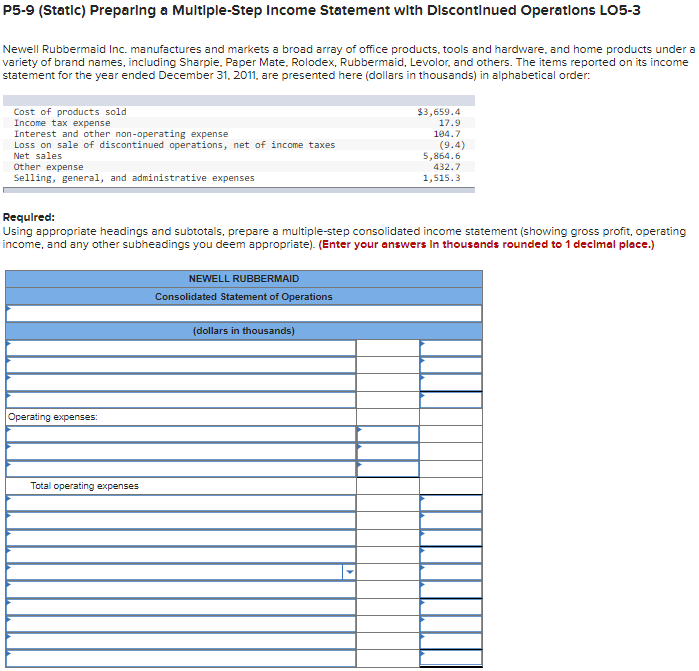

Requlred Informetlon P5-3 (Static) Preparing a Balance Sheet and Analyzing Some of Its Parts LO5-3 [The following information applies to the questions displayed below.] Exquisite Jewelers is developing its annual financial statements for the current year. The following amounts were correct at December 31, current year: cash, $58,000; accounts receivable, $71,000; merchandise inventory, \$154,000; prepaid insurance, $1,500; investment in stock of Z Corporation (long-term). $36,000; store equipment, $67,000; used store equipment held for disposal, \$9,000; accumulated depreciation, store equipment, $19,000; accounts payable, $52,500; long-term note payable, $42,000; income taxes payable, $9,000; retained earnings, $164,000; and common stock, 100,000 shares outstanding. par value $1.00 per share (originally sold and issued at $1.10 per share). 55-3 Part 1 Requlred: . Based on these data, prepare a December 31, current year, balance sheet. (Amounts to be deducted should be Indleated by a minus slgn.) Requlred Information P5-3 (Static) Preparing a Balance Sheet and Analyzing Some of Its Parts LO5-3 [The following information applies to the questions displayed below.] Exquisite Jewelers is developing its annual financial statements for the current year. The following amounts were correct at December 31, current year: cash, $58,000; accounts receivable, \$71,000; merchandise inventory. \$154,000; prepaid insurance, $1,500; investment in stock of Z Corporation (long-term). $36,000; store equipment, $67,000; used store equipment held for disposal, $9,000; accumulated depreciation, store equipment, $19,000; accounts payable, $52,500; long-term note payable, $42,000; income taxes payable, $9,000; retained earnings, $164,000; and common stock, 100,000 shares outstanding. par value $1.00 per share (originally sold and issued at $1.10 per share). P5-3 Part 2 2. What is the net book value of the store equipment? P5-7 (Static) Determining and Interpreting the Effects of Transactions on Income Statement Categorles and Return on Assets LO5-3, 5-4 Creative Technology, a computer hardware company based in Singapore, developed the modern standard for computer sound cards in the early 1990s. More recently, it has faced a difficult and uncertain market for its products. In an earlier year, it reported the following on its income statement (dollars in millions). The company's beginning and ending assets were $403 and $342, respectively. Requlred: Listed here are hypothetical additional transactions. Assuming that they also occurred during the fiscal year, complete the following tabulation, indicating the sign of the effect of each additional transaction (+ for increase, - for decrease, and NE for no effect). Consider each item independently and ignore taxes. (Hint. Construct the journal entry for each transaction before evaluating its effect.) (Select "NE" If there is no effect.) a. Recorded sales on account of $400 and related cost of goods sold of $300. b. Incurred additional research and development expense of $100, which was paid in cash. c. Issued additional shares of common stock for $260 cash. d. Declared and paid dividends of $90. P5-8 (Static) Determining the Effects of Transactions on Ratlos LO5-4 Mateo Inc. is a retailer of men's and women's clothing aimed at college-age customers. Listed below are additional transactions that Mateo was considering at the end of the accounting period. Requlred: Complete the following tabulation, indicating the sign of the effect of each additional transaction (+ for increase, - for decrease, and NE for no effect). Consider each item independently and ignore taxes. (Hint. Construct the journal entry for each transaction before evaluating its effect.) (Select "NE" If there ls no effect.) a. Borrowed $3,000 on a line of credit with the bank. b. Incurred salary expense of $1,000 paid for in cash. c. Provided $2,000 of services on account. d. Purchased $700 of inventory on account. e. Sold $500 of goods on account. The related cost of goods sold was $300. Gross profit margin was 45 percent before this sale. P5-9 (Statlc) PreparIng a Multiple-Step Income Statement with Dlscontinued Operations LO5-3 Newell Rubbermaid Inc. manufactures and markets a broad array of office products, tools and hardware, and home products under a variety of brand names, including Sharpie, Paper Mate, Rolodex, Rubbermaid, Levolor, and others. The items reported on its income statement for the year ended December 31, 2011, are presented here (dollars in thousands) in alphabetical order: Requlred: Using appropriate headings and subtotals, prepare a multiple-step consolidated income statement (showing gross profit, operating income, and any other subheadings you deem appropriate). (Enter your answers In thousands rounded to 1 declmal plece.)