Question

Step 1: Identify Suitable Analytical Procedures . Your audit senior has suggested that you should use the following ratios (on an overall financial statement level)

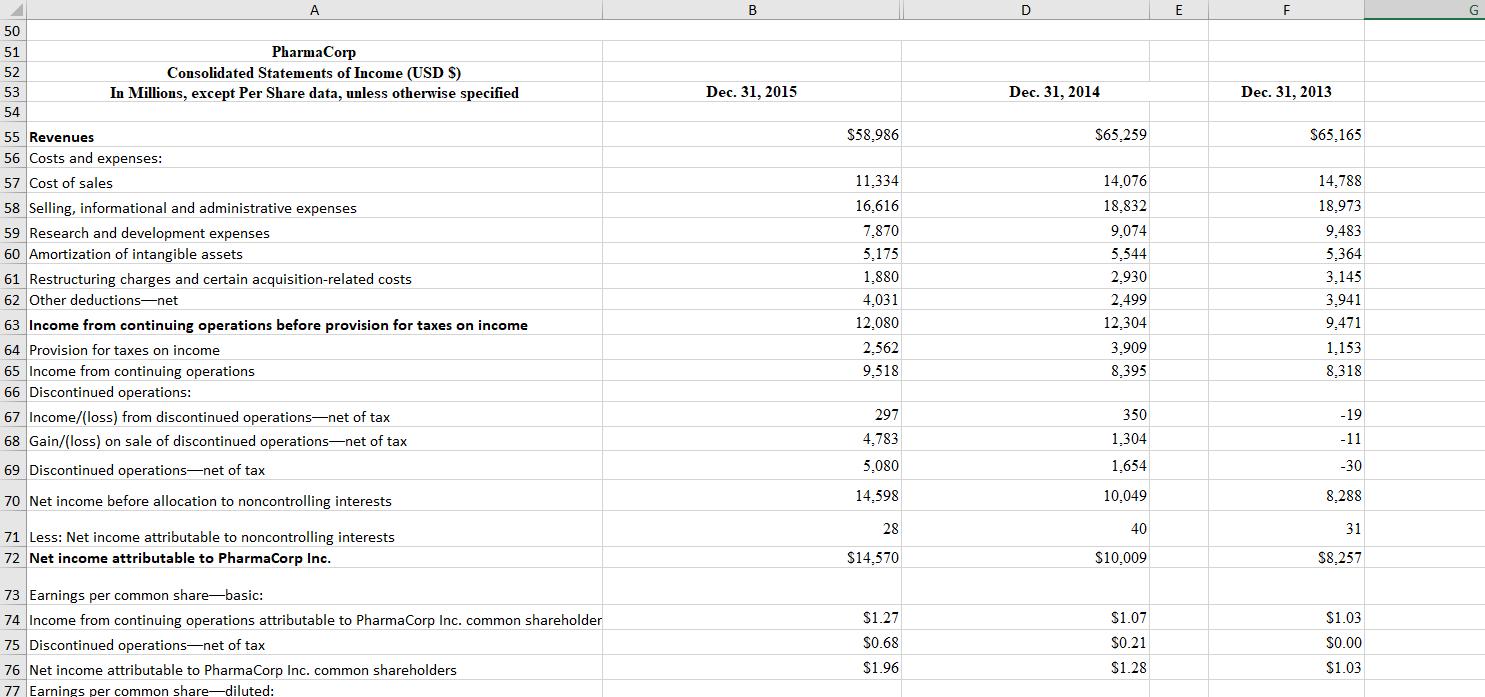

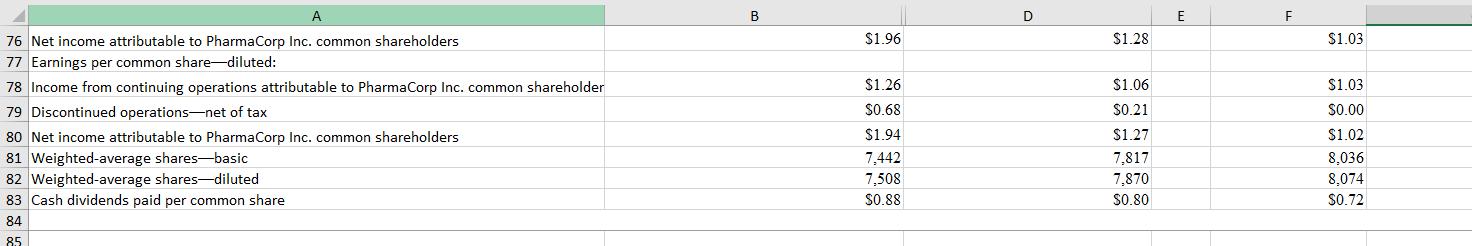

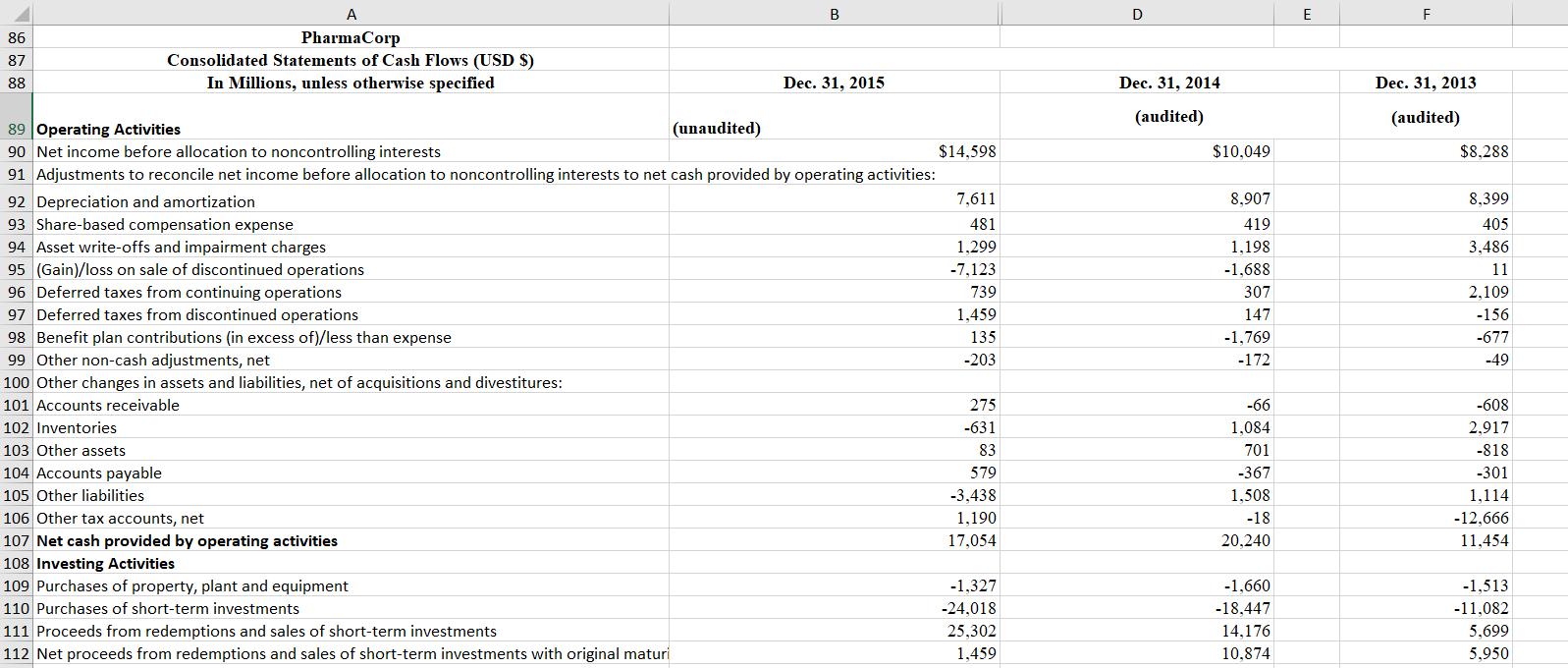

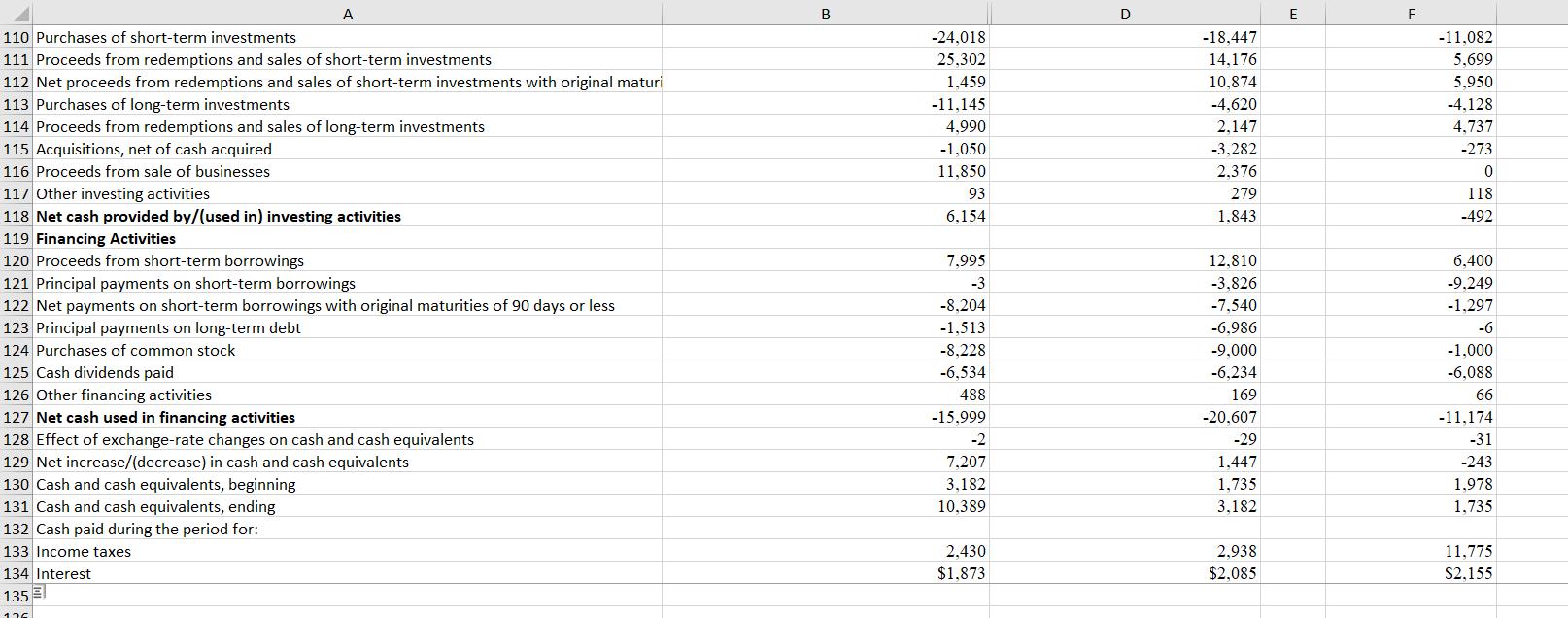

Step 1: Identify Suitable Analytical Procedures. Your audit senior has suggested that you should use the following ratios (on an overall financial statement level) for planning analytical procedures in the revenue cycle at PharmaCorp:

Turnover of receivables: (revenues/average accounts receivable); for ease of computation simply use ending accounts receivable

Receivables as a percentage of current assets and as a percentage of total assets: (accounts receivable/total current assets) and (accounts receivable/total assets)

Allowance for uncollectible accounts as a percentage of accounts receivable: (allowance/accounts receivable)

- Gross margin: (revenues-cost of sales)/revenues

- As part of Step 1, identify any other relevant relationships or trend analyses that would be useful to consider as part of planning analytics. Explain your reasoning.

Step 2: Evaluate Reliability of Data Used to Develop Expectations. The audit team has determined that the data you will be using to develop expectations in the revenue cycle are reliable. Indicate the factors that the audit team likely considered in making that determination.

Step 3: Develop Expectations. Complete Step 3 of planning analytical procedures by developing expectations for relevant accounts in the revenue cycle and for the ratios from Part (a). Develop expectations by considering both historical trends of PharmaCorp, and also by considering features of and historical trends in the industry. Given that this is a planning analytical procedure, the expectations are not expected to have a high level of precision. You might indicate that you expect a ratio to increase, decrease, or stay the same, and possibly indicate the size of any expected increases or decreases, or the range of the expected ratio. PharmaCorp’s financial information is on first tab of the Excel file, while the financial information for Novartell and AstraZoro is provided on the last two tabs of the Excel file.

Step 4 and Step 5: Define and Identify Significant Unexpected Differences. Refer to the guidance in Chapter 7 on overall materiality, performance materiality, and posting materiality. Apply those materiality guidelines to Step 4 of planning analytical procedures in the revenue cycle for PharmaCorp, to define what is meant by a significant difference. Explain your reasoning. Also, comment on qualitative materiality considerations in this context. Now that you have determined what amount of difference would be considered significant, calculate the ratios identified in Step 1 (and any additional ratios or trend analyses that you suggested), based on PharmaCorp’s recorded financial statement amounts. Identify those ratios where there is a significant unexpected difference.

Step 6 and Step 7: Investigate Significant Unexpected Differences and Ensure Proper Documentation. Complete Step 6 of planning analytical procedures by describing accounts or relationships that you would investigate further through substantive audit procedures. Explain your reasoning. To complete Step 7, describe what information should be included in the auditor’s workpapers.

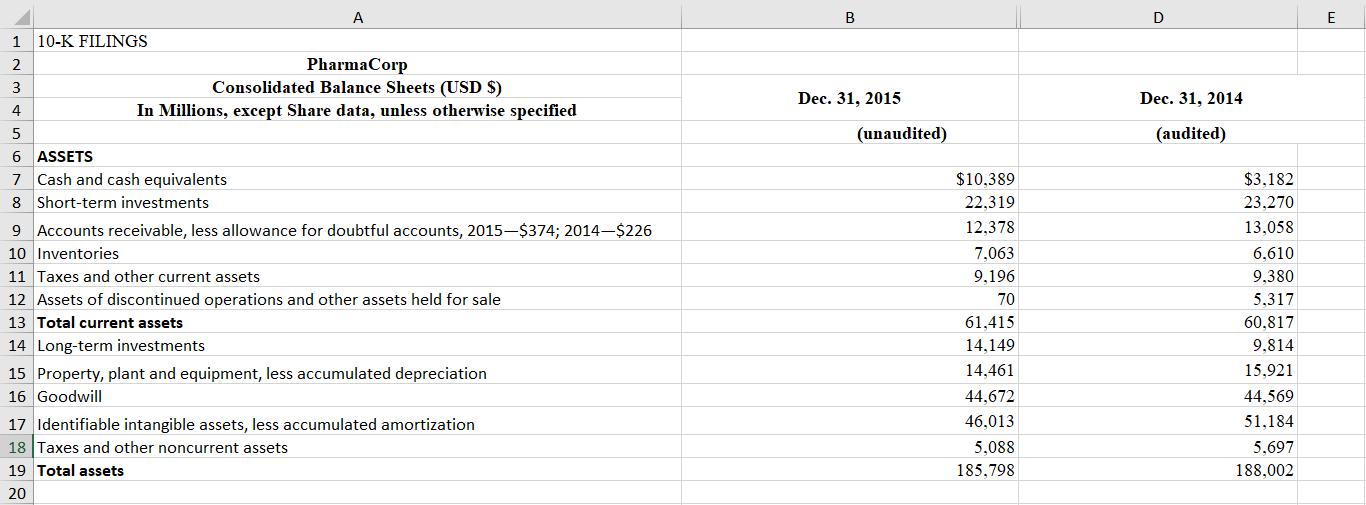

1 10-K FILINGS 2 3 4 5 6 ASSETS 7 Cash and cash equivalents 8 Short-term investments A PharmaCorp Consolidated Balance Sheets (USD $) In Millions, except Share data, unless otherwise specified 9 Accounts receivable, less allowance for doubtful accounts, 2015-$374; 2014-$226 10 Inventories 11 Taxes and other current assets 12 Assets of discontinued operations and other assets held for sale 13 Total current assets 14 Long-term investments 15 Property, plant and equipment, less accumulated depreciation 16 Goodwill 17 Identifiable intangible assets, less accumulated amortization 18 Taxes and other noncurrent assets 19 Total assets 20 B Dec. 31, 2015 (unaudited) $10,389 22,319 12,378 7,063 9,196 70 61,415 14,149 14,461 44,672 46,013 5,088 185,798 D Dec. 31, 2014 (audited) $3,182 23.270 13,058 6,610 9.380 5,317 60.817 9,814 15,921 44,569 51,184 5,697 188,002 E

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Planning Analytical Procedures 1 In addition to the ratios provided they will likely be creative in suggesting others Example a Trends in revenue growth and comparisons to industry trends b Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started