Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31, 2011. Parrot borrowed $2.000,000 to

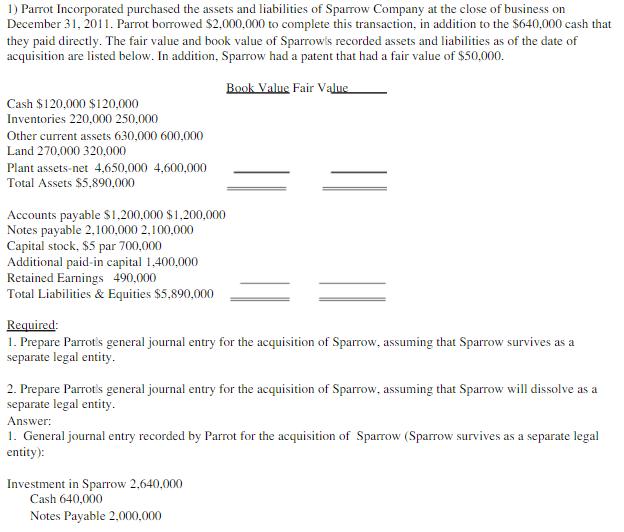

1) Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31, 2011. Parrot borrowed $2.000,000 to complete this transaction, in addition to the $640,000 cash that they paid directly. The fair value and book value of Sparrowis recorded assets and liabilities as of the date of acquisition are listed below. In addition, Sparrow had a patent that had a fair value of $50,000. Book Value Fair Value Cash $120,000 $120,000 Inventories 220,000 250,000 Other current assets 630,000 600,000 Land 270,000 320,000 Plant assets-net 4,650,000 4,600,000 Total Assets $5,890,000 Accounts payable $1.200,000 $1,200,000 Notes payable 2,100,000 2,100,000 Capital stock, $5 par 700,000 Additional paid-in capital 1,400,000 Retained Earnings 490,000 Total Liabilities & Equities $5,890,000 Required: 1. Prepare Parrotis general journal entry for the acquisition of Sparrow, assuming that Sparrow survives as a separate legal entity. 2. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow will dissolve as a separate legal entity. Answer: 1. General journal entry recorded by Parrot for the acquisition of Sparrow (Sparrow survives as a separate legal entity): Investment in Sparrow 2,640,000 Cash 640,000 Notes Payable 2,000,000

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Date account titles debit credit Dec 312013 Investment in sparrow 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started