Question

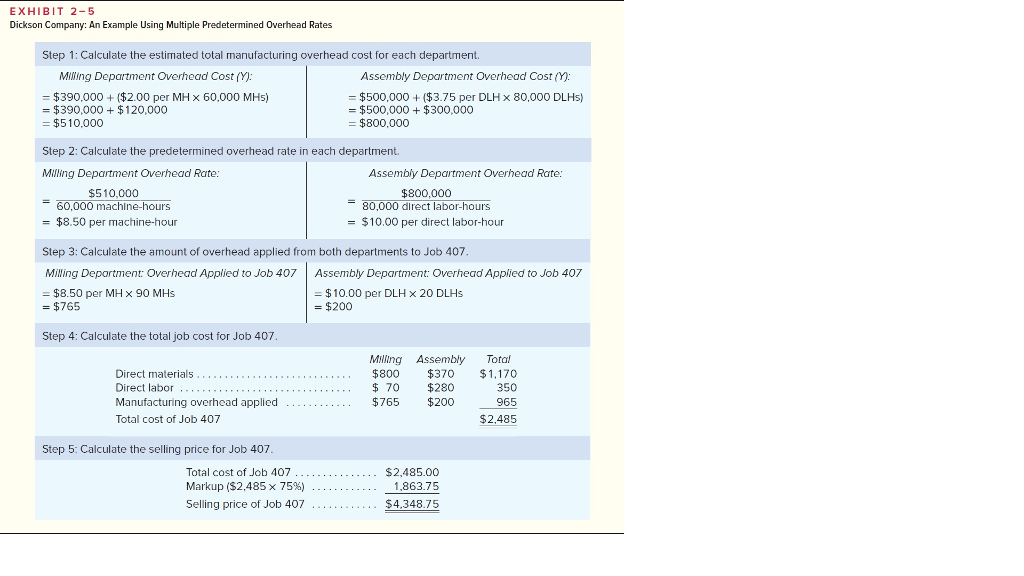

PART 1 Required Information : This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5 - Please see attachment. Download

PART 1

Required Information: This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5 - Please see attachment.

Download the applying Excel form and enter formulas in all cells thatcontain question marks.

The Chapter 2 Form worksheet is to be used to create your own worksheet version of the example in the text.

Enter formulas in the cells that contain question marks. For example, in cell B25 enter the formula "=B10".

After entering formulas in all of the cells that contained question marks, verify that the amounts match the example in the text.

Check your worksheet by changing the total fixed manufacturing overhead cost for the Milling Department in the Data area to $300,000, keeping all of other data he same as in the original example. If your worksheet is operating properly, the total cost of job 407 should now be $2,350. If you do not get his answer, find the errors in your worksheet and correct them.

You should proceed to the requirements below only after completing your worksheet.

Save your completed Applying Excel form to your computer and then upload it here by clicking " Browse". Next click "Save." You will use this worksheet to answer the questions in Part 2.

PART 2

Required information: This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5 ( Please see attachment).

2) Change the total fixed manufacturing overhead cost for the Milling Department in the area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, job 408, with the following characteristics:

| A | B | C | |

| 1 | Chapter 2: Applying excel | ||

| 2 | |||

| 3 | Cost Summary for Job 408 | Department | |

| 4 | Milling | Assembly | |

| 5 | Machine-Hours | 70 | 2 |

| 6 | Direct labor-hours | 7 | 20 |

| 7 | Direct materials cost | $760 | $390 |

| 8 | Direct labor cost | $140 | $320 |

| 9 |

In your worksheet, enter this new data in the cells for Job 407.

What is the new selling price for job 408? ( Round your final answer to 2 decimal places.)

| Selling price for Job 408 | ???? |

3) Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machine-hours in the Assembly Department increases from 3,000 machine-hours to 4,000 machine-hours? ( Round your final answer to 2 decimal places)

| Selling Price for Job 408 | ???? |

4) Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 40,000 direct labor-hours? ( Round your final answer to 2 decimal places)

| selling price for job | =? |

PART 3

"Blast it!" said David Wilson, president of Teledex Company. " We've just lost the bid on the Koopers job by $2,000. It seems we're either too high to get the job or too low to make any money on half the jobs we bid".

Teledex Company manufactures products to customers' specifications and uses a job-order costing system. The company uses a plantwide predetermined overhead rate based on direct labor cost to apply its manufacturing overhead ( assumed to be all fixed) to jobs. The following estimates were made at the beginning of the year.

| Department | ||||

| Fabricating | Machining | Assembly | Total Plant | |

| Manufacturing overhead | $369,250 | $422,000 | $94,950 | $886,200 |

| Direct labor | $211,000 | $105,500 | $316,500 | $633,000 |

Jobs require varying amounts of work in the three department. The Koopers job, for example, would have required manufacturing costs in the three departments as follows:

| Department | ||||

| Fabricating | Machining | Assembly | Total Plant | |

| Direct materials | $4,100 | $400 | $2,500 | $7,000 |

| Direct labor | $5,000 | $700 | $7,300 | $13,000 |

| Manufacturing overhead | ? | ? | ? | ? |

Required:

1. Using the company's plantwide approach:

a. Compute the plantwide predetermined rate for the current year.

b. Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job.

2. Suppose that instead of using a plantwide predetermined overhead rate, the company had used departmental predetermined overhead rates based on direct labor cost. Under these conditions:

a) Compute the predetermined overhead rate foreach department rate for each department for the current year.

b) Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job.

4. Assume that it is customary in the industry to bid jobs at 150% of total manufacturing cost ( direct mterials, direct labor, and applied overhead).

a) What was the company's bid price on the Koopers job using a plantwide predetermined overhead rate?

b. what would the bid price have been if department predetermined overhead rates had been used to apply overhead cost?

Complete this question by entering your answers in the tabs below.

Require 1A Compute the plantwide predetermined rate for the current year

| Predetermined overhead rate | ? | % | of direct labor cost |

Requiredm 1B : Determine the amount of manufacturing overhead cost that would have been to the koopers job.

| Manufacturing overhead cost applied | ? |

Required 2A : Compute the predetermined overhead rate for each department for the current year.

| Predetermined Overhead Rate | |

| Fabricating departent ? % | of direct labor cost |

| Machining department ? % | of direct labor cost |

| Assembly department ? % | of direct labor cost |

Required 2B : Determine the amount of manufacturing overhead cost that would have been applied to the Koopers job.

| Manufacturing overhead cost applied | ??? |

Required 4A : What was the company's bid price on the Koopers job using a plantwide predetermined overhead rate?

| Company's bid price | ???? |

Required 4B : What would the bid price have been if department predetermined overhead rates had been used to apply overhead cost?

| Manufacturing overhead cost applied | ???? |

| Chapter 2: Applying Excel ( I have copied here the Excel worksheet to use for this homework) | |||

| Data | |||

| Markup on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| Machine-hours | 60,000 | 3,000 | |

| Direct labor-hours | 8,000 | 80,000 | |

| Total fixed manufacturing overhead cost | $390,000 | $500,000 | |

| Variable manufacturing overhead per machine-hour | $2.00 | ||

| Variable manufacturing overhead per direct labor-hour | $3.75 | ||

| Cost summary for Job 407 | Department | ||

| Milling | Assembly | ||

| Machine-hours | 90 | 4 | |

| Direct labor-hours | 5 | 20 | |

| Direct materials | $800 | $370 | |

| Direct labor cost | $70 | $280 | |

| Enter a formula into each of the cells marked with a ? below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| Total fixed manufacturing overhead cost | ? | ? | |

| Variable manufacturing overhead per machine-hour or direct labor-hour | ? | ? | |

| Total machine-hours or direct labor-hours | ? | ? | |

| Total variable manufacturing overhead | ? | ? | |

| Total manufacturing overhead | ? | ? | |

| Step 2: Calculate the predetermined overhead rate in each department | |||

| Milling | Assembly | ||

| Total manufacturing overhead | ? | ? | |

| Total machine-hours or direct labor-hours | ? | ? | |

| Predetermined overhead rate per machine-hour or direct labor-hour | ? | ? | |

| Step 3: Calculate the amount of overhead applied from both departments to Job 407 | |||

| Milling | Assembly | ||

| Predetermined overhead rate per machine-hour or direct labor-hour | ? | ? | |

| Machine-hours or direct labor-hours for the job | ? | ? | |

| Manufacturing overhead applied | ? | ? | |

| Step 4: Calculate the total job cost for Job 407 | |||

| Milling | Assembly | Total | |

| Direct materials | ? | ? | ? |

| Direct labor cost | ? | ? | ? |

| Manufacturing overhead applied | ? | ? | ? |

| Total cost of Job 407 | ? | ||

| Step 5: Calculate the selling price for Job 407 | |||

| Total cost of Job 407 | ? | ||

| Markup | ? | ||

| Selling price of Job 407 | ? | ||

Textbook

Title: Managerial Accounting, 16th Edition (eBook with McGraw-Hill Connect)

Author: Garrison, Noreen, Brewer

ISBN-13: 9781259995378

Publisher: McGraw-Hill

Edition: 16th

Thank you

EXHIBIT 2-5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates Step 1: Calculate the estimated total manufacturing overhead cost for each department. Milling Department Overhead Cost (Y): = $390,000 + ($2.00 per MH x 60.000 M Hs) Assembly Department Overhead Cost Y): = $500,000 + ($3.75 per DLH x 80,000 DLH5) = $500,000 + $300,000 $390,000 + $120,000 $800,000 $51 0,000 Step 2: Calculate the predetermined overhead rate in each department. Milling Department Overhead Rate = 60,000 machine-hours Assembiy t Overhead Rate $510,000 $800,000 = 80,000 direct labor-hours = $10.00 per direct labor-hour $8.50 per machine-hour Step 3: Calculate the amount of overhead applied from both departments to Job 407 MiNing Deportment: Overhead Applied to Job 407 Assembly Department: Overhead Applied to Job 407 $8.50 per MH 90 MHS -$10.00 per DLH 20 DLHs = $200 = $765 Step 4: Calculate theotal job cost for Job 407 Direct materials Direct labor Manufacturing overhead applied Total cost of Job 407 Milling Assembly Tota $800 $370 1,170 $ 70 $280 $765 $200 350 965 $2,485 Step 5: Calculate the selling price for Job 407 Total cost of Job 407 Markup ($2.485 75%) Selling price of Job 407 $2,485.00 1,863.75Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started