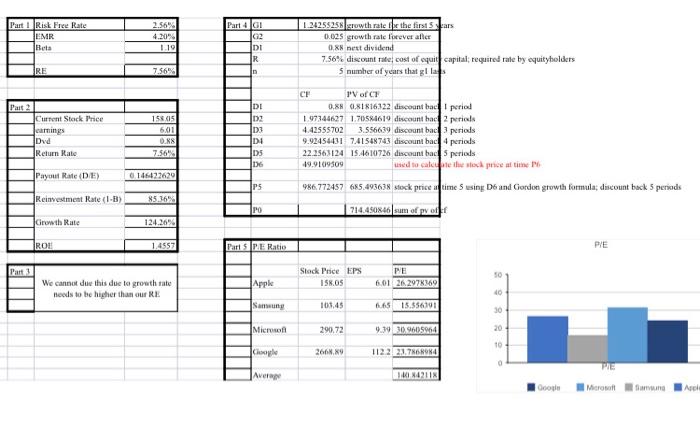

Part 1 Risk Free Rate LMR Beta 2.500 4.20" 119 Part 4 GI G2 DI R 1.24255256 growth rate is the firstars 0.025 growth rate forever alle 0,8 nest dividend 7.56% discount rate cost of equit capital, requited rate by equityholders 5 number of years that glla RE 7.56% in DI DZ Current Stock Price Jamnings Dvd Return Rate 1535 601 O.RS 7.56% BUS TV of C 0.88 081816322 discount bacl period 197344627 1.70584619 discount hac period 4.42555702 3.556639 discount bacperiods 9.92454431 741548743 discount bac periods 22.2563124 15.4610726 discount bacs periods 49.9109309 used to call to me at time 986.772457 685.493638 stock price a time 5 using De and Gordon growth formula; discount back 5 persads 714.490846 sum of pv D6 Payout Rate (DE) 6146422620 ps Reinvestment Rate (1-B) 85 16 PO Growth Rate 124.26 ROL 1.4557 Part 5 PE Ratio PIE Part 1 Stack Price EPS 15KOS PE 6.01 26.2978469 50 We cannot do this due to growth rate Hoods to be higher than our RE Apple 40 Samsung 101,45 6.65 15.556791 30 Microsoft 290,72 99 309605964 20 10 Ciale 26. 11222.1.76 0 Ave KI42118 Google Microsoft un Ah Please use yahoo finance, the U.S. Treasury's website, and other reliable sources to complete this assignment 1. (20 points) Determine today's risk-free rate (use 20-year rate) and market risk premium. Once you have decided on these values, calculate the expected cost of equity for Apple, Inc. using the CAPM. Please cite the source you used to obtain the market risk premium. 2. (15 points) Determine Apple, Inc.'s earnings growth rate by using current ROE and calculated reinvestment rate (1- the payout ratio on yahoo finance). 3. (10 points) Given your answers to (1) and (2), can you use the Gordon Growth Formula to calculate the intrinsic value of Apple, Inc.'s stock? If not, explain why. 4. (35 points) Using your answers to (1) and the dividend, determine the intrinsic value of Apple, Inc.'s stock assuming that dividends grow at the rate found in (2) for 5 years and forever after at 2.5%. How does the intrinsic value compare with the current stock price? Why the discrepancy? Based on your calculation, do you recommend buying or selling the stock? Part 1 Risk Free Rate LMR Beta 2.500 4.20" 119 Part 4 GI G2 DI R 1.24255256 growth rate is the firstars 0.025 growth rate forever alle 0,8 nest dividend 7.56% discount rate cost of equit capital, requited rate by equityholders 5 number of years that glla RE 7.56% in DI DZ Current Stock Price Jamnings Dvd Return Rate 1535 601 O.RS 7.56% BUS TV of C 0.88 081816322 discount bacl period 197344627 1.70584619 discount hac period 4.42555702 3.556639 discount bacperiods 9.92454431 741548743 discount bac periods 22.2563124 15.4610726 discount bacs periods 49.9109309 used to call to me at time 986.772457 685.493638 stock price a time 5 using De and Gordon growth formula; discount back 5 persads 714.490846 sum of pv D6 Payout Rate (DE) 6146422620 ps Reinvestment Rate (1-B) 85 16 PO Growth Rate 124.26 ROL 1.4557 Part 5 PE Ratio PIE Part 1 Stack Price EPS 15KOS PE 6.01 26.2978469 50 We cannot do this due to growth rate Hoods to be higher than our RE Apple 40 Samsung 101,45 6.65 15.556791 30 Microsoft 290,72 99 309605964 20 10 Ciale 26. 11222.1.76 0 Ave KI42118 Google Microsoft un Ah Please use yahoo finance, the U.S. Treasury's website, and other reliable sources to complete this assignment 1. (20 points) Determine today's risk-free rate (use 20-year rate) and market risk premium. Once you have decided on these values, calculate the expected cost of equity for Apple, Inc. using the CAPM. Please cite the source you used to obtain the market risk premium. 2. (15 points) Determine Apple, Inc.'s earnings growth rate by using current ROE and calculated reinvestment rate (1- the payout ratio on yahoo finance). 3. (10 points) Given your answers to (1) and (2), can you use the Gordon Growth Formula to calculate the intrinsic value of Apple, Inc.'s stock? If not, explain why. 4. (35 points) Using your answers to (1) and the dividend, determine the intrinsic value of Apple, Inc.'s stock assuming that dividends grow at the rate found in (2) for 5 years and forever after at 2.5%. How does the intrinsic value compare with the current stock price? Why the discrepancy? Based on your calculation, do you recommend buying or selling the stock